Powell's Power Play: Trump Accuses Fed Chair of Political Maneuvering

Politics

2025-04-17 18:30:16Content

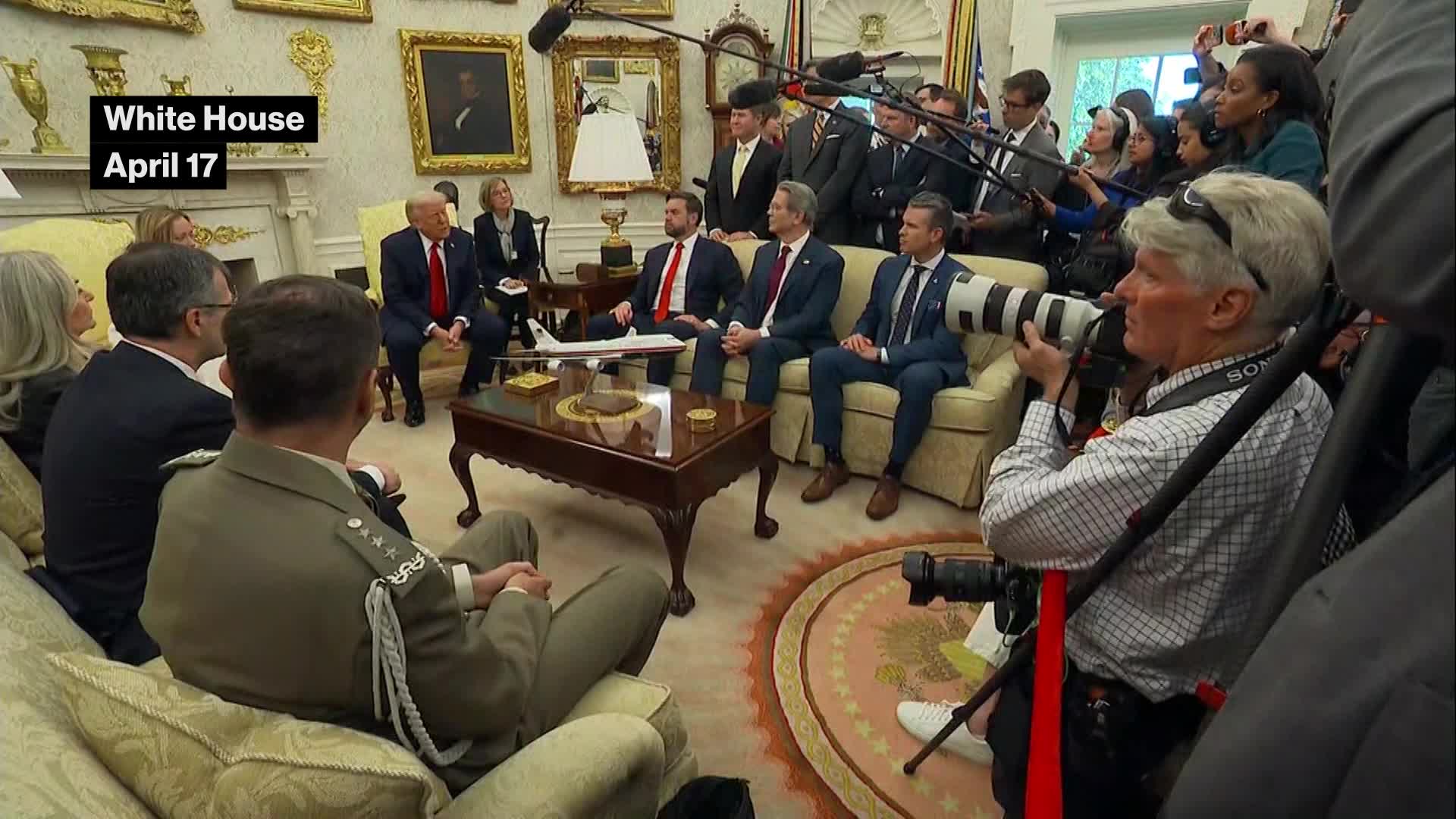

President Donald Trump launched a fresh critique of Federal Reserve Chair Jerome Powell, expressing his frustration with the central bank's leadership. In a pointed statement to reporters at the Oval Office, Trump accused Powell of "playing politics" and argued that interest rates should be significantly lowered.

The president's latest broadside against Powell underscores the ongoing tension between the White House and the independent Federal Reserve. Trump has repeatedly criticized the central bank's monetary policy, believing that lower interest rates would stimulate economic growth and boost market performance.

By publicly challenging Powell's approach, Trump continues to break with traditional presidential norms of maintaining distance from monetary policy decisions. His comments reflect a persistent belief that the Fed's current strategy is not sufficiently supportive of his administration's economic objectives.

Presidential Pressure: Trump's Controversial Critique of Federal Reserve Leadership

In the volatile landscape of economic policy and political maneuvering, the relationship between the White House and the Federal Reserve has once again become a focal point of national discourse, highlighting the complex dynamics between presidential influence and monetary independence.Unraveling the High-Stakes Economic Power Struggle in Washington

The Presidential Perspective on Monetary Policy

President Donald Trump's ongoing criticism of Federal Reserve Chair Jerome Powell represents a unprecedented moment of public confrontation between executive leadership and central banking governance. The tension reveals deeper systemic challenges within America's economic decision-making framework, where presidential expectations clash with institutional monetary autonomy. Trump's vocalized dissatisfaction stems from a fundamental disagreement about interest rate strategies. By publicly challenging Powell's leadership, the president signals a desire for more aggressive monetary intervention that could potentially stimulate economic growth. This approach challenges traditional boundaries of presidential engagement with independent financial institutions.Institutional Independence and Political Pressure

The Federal Reserve's constitutional mandate requires maintaining economic stability through carefully calibrated monetary policies. Powell's leadership has consistently emphasized maintaining institutional neutrality, a principle directly challenged by Trump's public criticisms. Such confrontations raise critical questions about the delicate balance between political influence and economic stewardship. Economic experts argue that presidential interference in Federal Reserve decisions could potentially undermine market confidence and create unpredictable financial uncertainties. The public nature of Trump's critique represents an unusual departure from historical presidential protocols of maintaining diplomatic distance from central banking operations.Economic Implications of Presidential Critique

Trump's assertion that Powell is "playing politics" introduces a provocative narrative challenging the Federal Reserve's perceived objectivity. By suggesting that interest rates should be reduced, the president implies a belief that monetary policy can be manipulated to serve immediate political and economic objectives. Financial analysts suggest that such public statements could create market volatility and potentially impact investor confidence. The complex interplay between presidential rhetoric and monetary policy demonstrates the intricate relationship between political leadership and economic management.Historical Context of Executive-Federal Reserve Relations

Historically, presidents have maintained a diplomatic distance from Federal Reserve operations, respecting the institution's independence. Trump's approach represents a significant departure from established norms, potentially setting a precedent for future executive-banking interactions. The confrontational stance highlights broader questions about institutional governance, the limits of presidential influence, and the fundamental principles of economic policymaking. By challenging Powell publicly, Trump exposes underlying tensions in America's financial decision-making ecosystem.Broader Systemic Implications

Beyond immediate political dynamics, this conflict illuminates deeper structural challenges within America's economic governance. The interaction between presidential expectations and institutional independence represents a critical moment of potential transformation in financial policymaking. Economists and political scientists continue to analyze the long-term ramifications of such public confrontations, recognizing that they could potentially reshape future relationships between executive leadership and independent financial institutions.RELATED NEWS

Politics

CBS Bends: '60 Minutes' Faces Criticism Over Alleged Trump Accommodation

2025-04-23 00:03:58