Safe Haven Shakeup: EU Regulators Cast Doubt on U.S. Treasury Sanctuary

Finance

2025-04-17 13:10:29Content

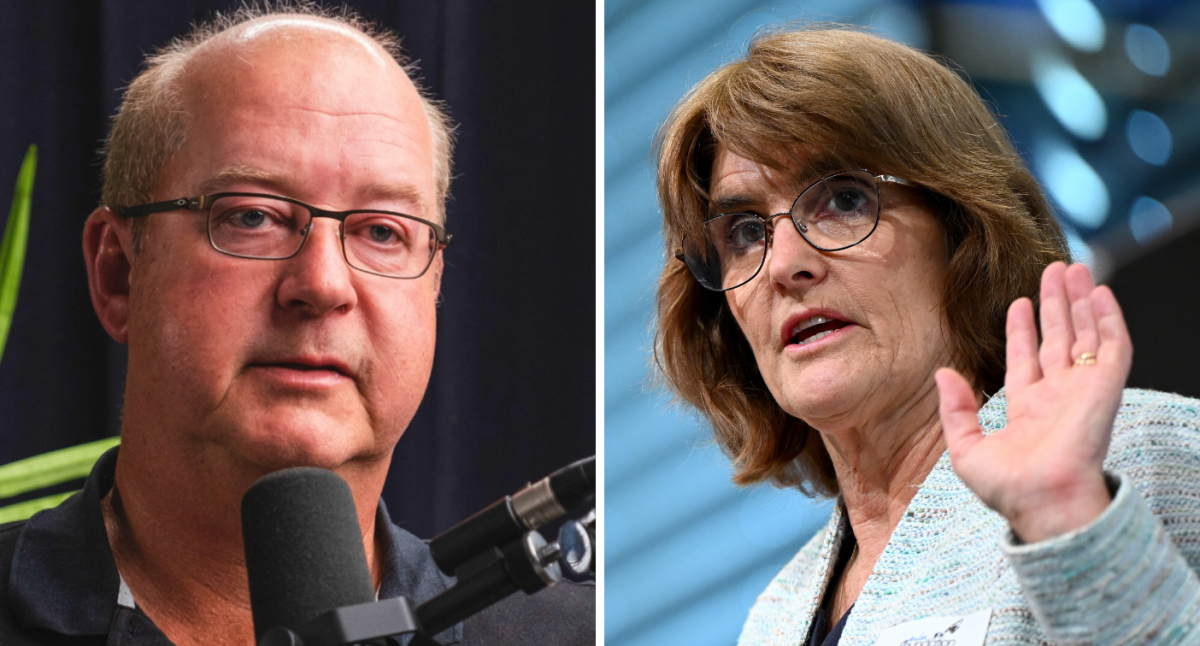

The stability of the U.S. Treasury market is under intense scrutiny as Europe's top insurance regulator raises concerns about its long-standing reputation as a financial safe haven. Recent market turbulence has prompted serious questions about the traditional perception of Treasury securities as the ultimate low-risk investment.

The unprecedented volatility in the Treasury market has caught the attention of financial experts, challenging the fundamental assumptions about its reliability and security. As investors and regulators closely monitor the situation, the potential implications for global financial markets are becoming increasingly significant.

This development signals a potential shift in how institutional investors and financial watchdogs view the once-unassailable U.S. Treasury market, suggesting that even the most trusted financial instruments are not immune to uncertainty and market pressures.

Tremors in the Financial Fortress: How US Treasury Market Volatility Challenges Global Economic Stability

In the intricate landscape of global financial markets, a seismic shift is emerging that threatens to redefine our understanding of economic safe havens. The recent turbulence in the US Treasury market has caught the attention of top financial regulators, signaling potential systemic risks that could reshape international investment strategies and economic perceptions.Unraveling the Foundations of Financial Security

The Changing Dynamics of Global Financial Markets

The US Treasury market, long considered an impenetrable bastion of financial stability, is experiencing unprecedented volatility that challenges its long-standing reputation. European insurance regulators are sounding alarm bells, suggesting that the traditional narrative of absolute safety might be fundamentally flawed. This volatility isn't merely a temporary fluctuation but potentially represents a deeper structural transformation in global financial ecosystems. Financial experts are closely examining the intricate mechanisms that underpin market stability. The interconnected nature of global financial systems means that even subtle disruptions can create cascading effects across international markets. Institutional investors, pension funds, and insurance companies are reassessing their risk management strategies, recognizing that historical assumptions about market behavior may no longer hold true.Regulatory Perspectives and Market Implications

The European insurance watchdog's commentary represents more than a casual observation—it's a strategic assessment of systemic financial risks. By questioning the US Treasury market's safe-haven status, regulators are signaling a potential paradigm shift in how financial instruments are evaluated and perceived on the global stage. This uncertainty stems from multiple complex factors, including unprecedented monetary policies, global economic uncertainties, and evolving geopolitical landscapes. Central banks worldwide are navigating uncharted territories, implementing innovative monetary strategies that challenge traditional economic models. The ripple effects of these decisions are profoundly impacting market perceptions and investment strategies.Economic Resilience in a Volatile Landscape

The current market dynamics demand a nuanced understanding of economic resilience. Investors and financial institutions must develop more sophisticated risk assessment frameworks that can adapt to rapidly changing global conditions. Traditional hedging strategies may no longer provide the same level of protection they once did. Technological advancements and algorithmic trading have further complicated market behaviors, introducing unprecedented levels of complexity and speed into financial transactions. These technological interventions create both opportunities and challenges, making market prediction increasingly difficult for even the most experienced financial professionals.Global Investment Strategy Recalibration

As the US Treasury market's stability comes under scrutiny, global investors are compelled to diversify their portfolios more strategically. This means exploring alternative investment vehicles, considering emerging markets, and developing more robust risk management protocols. The potential repositioning of the US Treasury market from an absolute safe haven to a more nuanced financial instrument could trigger significant global investment realignments. Institutional investors, sovereign wealth funds, and individual investors alike must remain vigilant and adaptable in this evolving economic landscape.Future Outlook and Strategic Considerations

While the current market volatility presents challenges, it also offers unprecedented opportunities for innovative financial strategies. Forward-thinking institutions that can quickly adapt and develop flexible investment approaches will be best positioned to navigate these complex economic terrains. The ongoing transformation suggests that financial markets are entering a new era of complexity and interconnectedness. Successful navigation will require a combination of technological sophistication, deep economic understanding, and strategic foresight.RELATED NEWS

Finance

RBA Rate Cut Bombshell: The Hidden Economic Nightmare Millions of Australians Fear

2025-02-17 19:00:45

Finance

Beyond Private Equity: Carlyle's COO Reveals the Next Big Wave in Finance

2025-02-21 14:06:53

Finance

Nvidia's Market Rollercoaster: Earnings Anxiety Meets Tech Trade Tensions

2025-02-25 17:11:10