Economic Storm Clouds: 5 Warning Signs Experts Are Tracking Right Now

Finance

2025-04-17 13:20:24Content

In a stark warning that sent ripples through financial markets, Federal Reserve Chairman Jerome Powell highlighted the potential inflationary risks posed by tariffs, creating additional challenges for the central bank's economic strategy. The comments have sparked intense speculation among investors about the possibility of an impending recession.

Wall Street strategists are closely monitoring the situation, analyzing the potential economic implications of Powell's statements. The intersection of trade policies and monetary policy has become a critical focal point for market analysts, who are assessing how these factors might impact future economic growth and stability.

Josh Schafer, Markets Reporter for Yahoo Finance, suggests that the current economic landscape remains complex and uncertain. Investors are advised to stay informed and watch for further developments that could signal significant shifts in the economic environment.

For those seeking deeper insights and expert analysis on the latest market movements, Yahoo Finance's Morning Brief continues to provide comprehensive coverage of these critical economic trends.

Economic Tremors: Powell's Warning and the Looming Recession Specter

In the intricate landscape of global economic dynamics, the Federal Reserve's latest signals are sending ripples of uncertainty through financial markets. As economic indicators become increasingly complex, investors and policymakers find themselves navigating a treacherous terrain of potential economic disruption and strategic uncertainty.Unraveling the Economic Puzzle: Tariffs, Inflation, and Market Volatility

The Tariff Tightrope: Navigating Inflationary Pressures

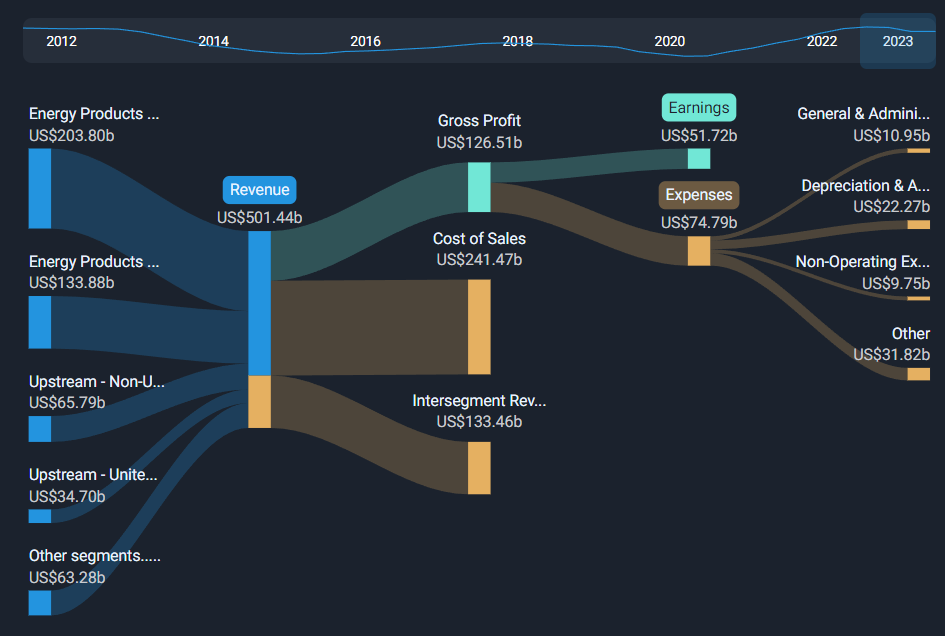

The economic landscape is currently experiencing a profound transformation, with tariff policies emerging as a critical fulcrum of potential inflationary momentum. Jerome Powell's recent commentary highlights the delicate balance between trade policies and economic stability. Economists are closely examining the intricate relationship between international trade mechanisms and domestic price structures, recognizing that seemingly isolated policy decisions can trigger cascading economic consequences. Financial analysts are meticulously dissecting the potential ramifications of these tariff-induced inflationary pressures. The complex interplay between global trade dynamics, monetary policy, and market sentiment creates a multifaceted challenge for economic policymakers. Each tariff implementation potentially introduces new variables that can destabilize carefully constructed economic equilibriums.Recession Speculation: Reading Between the Economic Lines

Wall Street strategists are engaged in intense deliberation about the potential onset of an economic recession. The warning signals emanating from the Federal Reserve suggest a nuanced and potentially volatile economic environment. Investors are scrutinizing multiple economic indicators, attempting to decipher the subtle signals that might presage a significant economic downturn. The speculation surrounding a potential recession is not merely academic but carries profound implications for businesses, investors, and everyday citizens. Economic forecasting has become increasingly sophisticated, with advanced predictive models attempting to anticipate market movements and potential systemic risks. The uncertainty surrounding these predictions adds an additional layer of complexity to economic decision-making.Market Dynamics: Interpreting Powell's Strategic Signals

Jerome Powell's communication strategy represents a critical mechanism for managing market expectations and investor sentiment. By carefully articulating potential economic challenges, the Federal Reserve Chairman provides a nuanced perspective on the intricate economic landscape. His warnings about tariffs and potential inflationary trends serve as a strategic communication tool designed to prepare market participants for potential economic shifts. Financial experts are closely analyzing every nuance of Powell's statements, recognizing that his words can significantly influence market psychology. The delicate art of central bank communication requires a balanced approach that provides transparency while avoiding unnecessary market panic. This strategic communication becomes especially crucial during periods of economic uncertainty.Global Economic Interconnectedness: Beyond Domestic Considerations

The current economic scenario transcends national boundaries, highlighting the deeply interconnected nature of global financial systems. Tariff policies and potential inflationary trends do not exist in isolation but represent complex interactions between international economic actors. The ripple effects of economic decisions can rapidly propagate across different markets and economic zones. Multinational corporations and international investors are continuously adapting their strategies to navigate this complex economic environment. The ability to anticipate and respond to potential economic shifts has become a critical competitive advantage in an increasingly volatile global marketplace.Technological and Strategic Adaptations

As economic uncertainties persist, businesses and investors are increasingly leveraging advanced technological tools and predictive analytics to navigate potential challenges. Machine learning algorithms and sophisticated economic models are being deployed to provide more nuanced insights into potential market movements and economic trends. The integration of artificial intelligence and big data analytics is transforming economic forecasting, offering unprecedented levels of granularity and predictive capability. These technological innovations are reshaping how economic risks are assessed and managed in an increasingly complex global environment.RELATED NEWS

Finance

TechnoMile Bolsters Financial Leadership: Graham Hawkes Steps into VP Role

2025-04-28 08:42:03

Finance

Dollars and Sense: How CASH Campaign Has Transformed Baltimore's Financial Landscape for 18 Years

2025-03-29 21:08:02