Green Energy Giant: Why Southern Company Is Poised to Dominate Renewable Markets in 2025

Companies

2025-04-16 20:12:47Content

Renewable Energy's Bright Future: Southern Company's Strategic Position in 2025

As the global energy landscape continues to transform, investors are increasingly turning their attention to renewable energy stocks with promising potential. Our recent comprehensive analysis highlighted 12 top renewable energy stocks to watch in 2025, and today we're diving deep into The Southern Company's (NYSE:SO) remarkable position in this dynamic market.

With governments worldwide intensifying their commitment to clean energy, 2024 is poised to be a landmark year for sustainable power generation. The Southern Company stands out as a compelling player in this green revolution, demonstrating strategic investments and innovative approaches to renewable energy development.

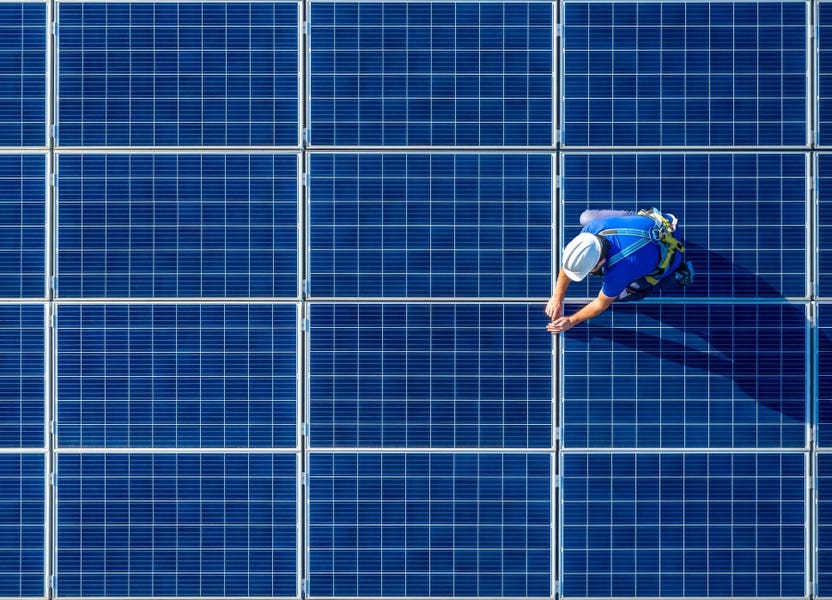

Our in-depth examination reveals how Southern Company is navigating the complex terrain of sustainable energy, positioning itself as a potential powerhouse in the renewable sector. From solar and wind initiatives to cutting-edge grid modernization efforts, the company is actively shaping the future of clean energy infrastructure.

Investors seeking robust and forward-thinking renewable energy stocks will find Southern Company's strategic vision and commitment to sustainability particularly intriguing. As global markets increasingly prioritize environmental responsibility, companies like Southern Company are not just adapting—they're leading the charge towards a cleaner, more sustainable energy future.

Stay tuned as we unpack the details of Southern Company's renewable energy strategy and its potential to deliver significant value in the evolving green energy marketplace.

Green Energy Revolution: Southern Company's Strategic Leap into Sustainable Power Landscape

In the rapidly evolving world of renewable energy, corporations are increasingly positioning themselves at the forefront of sustainable transformation. As global governments intensify their commitment to clean energy solutions, strategic investments and technological innovations are reshaping the power generation ecosystem, with companies like Southern Company emerging as pivotal players in this critical environmental and economic transition.Powering Tomorrow: Navigating the Renewable Energy Frontier

The Global Clean Energy Imperative

The contemporary energy landscape is undergoing a profound metamorphosis, driven by urgent environmental concerns and technological advancements. Governments worldwide are implementing aggressive decarbonization strategies, creating unprecedented opportunities for forward-thinking energy corporations. Southern Company stands at this critical intersection, leveraging its extensive infrastructure and strategic vision to redefine power generation paradigms. Renewable energy investments are no longer peripheral strategies but central to corporate survival and growth. The escalating climate crisis demands radical transformations in how we conceptualize and implement energy production. Southern Company's approach demonstrates a nuanced understanding of this complex challenge, integrating sophisticated technological solutions with long-term sustainability goals.Technological Innovation and Infrastructure Transformation

Southern Company's renewable energy strategy transcends traditional utility models, embracing cutting-edge technologies that promise enhanced efficiency and reduced environmental impact. By diversifying its energy portfolio, the company is not merely adapting to market changes but actively shaping future energy ecosystems. Advanced solar and wind technologies represent critical components of this transformative approach. Sophisticated grid integration techniques, energy storage solutions, and smart infrastructure investments position Southern Company as a leader in the renewable energy revolution. These strategic investments reflect a comprehensive understanding of the intricate challenges facing modern energy providers.Economic and Environmental Synergies

The economic potential of renewable energy extends far beyond environmental considerations. Southern Company's strategic investments create substantial job opportunities, stimulate regional economic development, and generate long-term value for shareholders. By aligning environmental stewardship with economic pragmatism, the company demonstrates a holistic approach to sustainable development. Emerging markets and technological innovations present unprecedented opportunities for renewable energy expansion. Southern Company's proactive stance enables it to capitalize on these dynamic market conditions, developing resilient and adaptable energy solutions that meet evolving global demands.Regulatory Landscape and Future Projections

Navigating the complex regulatory environment surrounding renewable energy requires sophisticated strategic planning. Southern Company's comprehensive approach involves active engagement with policymakers, continuous technological research, and adaptive investment strategies. The regulatory framework supporting renewable energy continues to evolve, creating both challenges and opportunities. By maintaining flexibility and demonstrating technological leadership, Southern Company positions itself to thrive in this dynamic ecosystem. Anticipated policy shifts and increasing governmental support for clean energy further enhance the company's strategic positioning.Investor Perspectives and Market Dynamics

For investors seeking exposure to the renewable energy sector, Southern Company represents a compelling opportunity. The company's balanced approach, combining established utility infrastructure with forward-looking renewable investments, offers a unique value proposition in an increasingly competitive market. Comprehensive risk management, diversified energy portfolios, and a commitment to technological innovation distinguish Southern Company from more traditional utility providers. These strategic differentiators attract sophisticated investors seeking sustainable and financially robust energy investments.RELATED NEWS

Companies

Building Success: Inside the Vision of Crista Glucksman at GH Phipps Construction

2025-03-25 18:23:45

Companies

Green Commitment Holds Strong: Businesses Refuse to Abandon Sustainability Promises

2025-03-24 11:00:00