Behind the Shine: Why Lowe's Investors Are Winning Despite Sluggish Earnings Growth

Companies

2025-04-15 11:00:16Content

Investors in Lowe's Companies, Inc. (NYSE:LOW) may be experiencing a moment of concern as the company's stock takes an unexpected tumble. Recent market activity has seen the share price decline by a notable 11%, sending ripples of uncertainty through the investment community.

While such a significant drop might initially spark alarm, savvy investors understand that market fluctuations are a natural part of the investment landscape. The key is to look beyond short-term volatility and examine the underlying fundamentals of the company.

Lowe's, a major player in the home improvement retail sector, has historically demonstrated resilience and strategic adaptability. The current price movement could be attributed to various factors, including broader market trends, sector-specific challenges, or company-specific developments.

For shareholders, this moment presents an opportunity for careful analysis. It's crucial to consider the company's long-term growth potential, recent performance metrics, and strategic initiatives before making any hasty investment decisions.

Experienced investors know that temporary setbacks can often create attractive entry points for those with a forward-looking perspective. The current price adjustment might be worth investigating as a potential investment opportunity for those who believe in Lowe's fundamental strength and market position.

Navigating Turbulent Waters: Lowe's Shareholders Brace for Unexpected Market Shifts

In the dynamic landscape of retail and home improvement, Lowe's Companies, Inc. finds itself at a critical juncture, facing unprecedented challenges that are testing the resilience of its market position and investor confidence. The recent stock performance has sparked intense speculation about the company's strategic direction and ability to weather current economic uncertainties.Unraveling the Complex Dynamics of Retail Transformation

Market Volatility and Investor Sentiment

The home improvement retail sector is experiencing seismic shifts that are reshaping investor expectations and corporate strategies. Lowe's recent stock performance reflects a broader narrative of adaptation and survival in an increasingly competitive marketplace. Sophisticated investors are closely analyzing the company's ability to navigate complex economic headwinds, including supply chain disruptions, changing consumer behaviors, and technological innovations that are rapidly transforming the retail landscape. Financial analysts are diving deep into the nuanced factors contributing to the stock's recent volatility. The 11% decline is not merely a numerical representation but a complex interplay of market sentiments, operational challenges, and macroeconomic trends that are testing the company's strategic resilience.Strategic Implications of Market Challenges

Lowe's is confronting a multifaceted challenge that extends beyond simple market fluctuations. The company must simultaneously address technological integration, evolving consumer expectations, and the ongoing digital transformation of the retail sector. Investors are keenly observing the company's ability to implement innovative strategies that can counteract the downward pressure on its stock performance. The home improvement giant is not just facing a temporary setback but is potentially at a critical inflection point that will determine its long-term market positioning. Strategic pivots, technological investments, and adaptive business models will be crucial in restoring investor confidence and stabilizing stock performance.Economic Context and Future Outlook

Understanding the broader economic context is paramount in interpreting Lowe's current market challenges. The retail sector is experiencing unprecedented disruption, driven by technological advancements, changing consumer preferences, and global economic uncertainties. Lowe's must demonstrate exceptional adaptability to maintain its competitive edge. The company's response to these challenges will likely involve comprehensive strategic realignments, including potential digital transformation initiatives, supply chain optimization, and innovative customer engagement strategies. Investors are looking for clear signals of the company's ability to transform challenges into opportunities.Technological Innovation and Market Adaptation

In an era of rapid technological advancement, Lowe's must position itself as a forward-thinking organization capable of leveraging cutting-edge technologies to enhance customer experience and operational efficiency. This includes potential investments in artificial intelligence, augmented reality shopping experiences, and advanced inventory management systems. The integration of digital platforms with traditional retail models represents a critical strategy for maintaining relevance in an increasingly competitive marketplace. Lowe's has the opportunity to reimagine its approach to customer engagement, potentially creating hybrid shopping experiences that blend online convenience with in-store expertise.Investor Strategies and Risk Management

For shareholders and potential investors, the current market scenario demands a nuanced approach to risk assessment and investment strategy. Understanding the complex dynamics affecting Lowe's performance requires a comprehensive analysis that goes beyond surface-level stock movements. Sophisticated investors are likely to conduct deep-dive research, examining the company's long-term strategic vision, management capabilities, and potential for innovation. The ability to adapt and transform will be key determinants of future investment potential.RELATED NEWS

Companies

Subscription Scam Alert: BBB Exposes Cunning Renewal Traps Targeting Unsuspecting Consumers

2025-03-08 17:00:01

Companies

Breaking: STACKT Revolutionizes Economic Development, Clinches Top 5 Spot in Global Innovation Rankings

2025-03-18 14:52:00

Companies

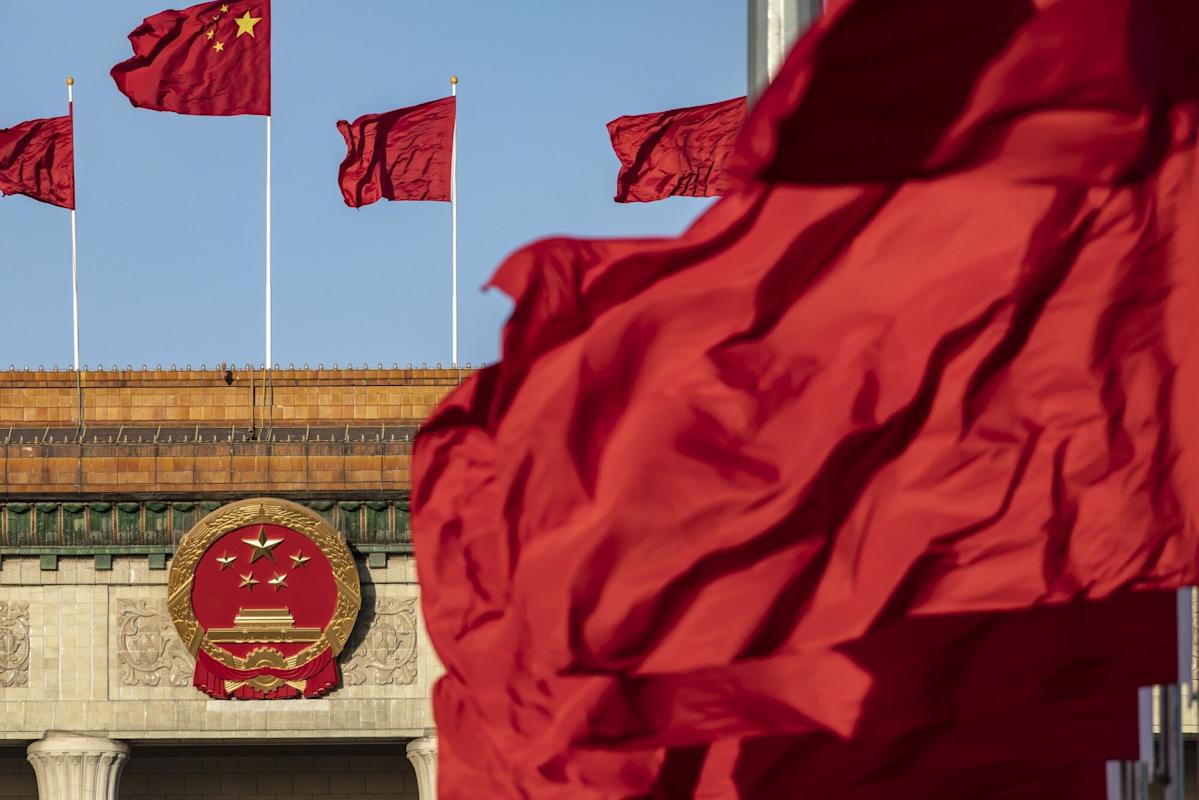

Beijing's Bold Promise: Foreign Firms Will Always Find Safe Harbor in China

2025-04-07 05:44:15