Money Matters: Why Most Teens Are Failing the Financial Literacy Test

Finance

2025-04-15 11:00:00Content

Tax Day Sparks Call for Enhanced Financial Education

As Americans across the nation prepare to meet their annual tax filing deadline, a growing movement is advocating for improved financial literacy to help citizens better understand their fiscal responsibilities and opportunities.

This Tax Day serves as a critical reminder that many individuals struggle with complex financial concepts and tax regulations. Proponents argue that comprehensive financial education could empower taxpayers to make more informed decisions about their personal finances, tax planning, and long-term economic strategies.

By promoting financial literacy programs in schools, workplaces, and communities, advocates hope to equip individuals with the knowledge and skills needed to navigate the intricate world of personal finance and taxation more confidently.

The push for better financial education comes at a time when tax laws continue to evolve and become increasingly complex, making it more important than ever for citizens to understand their financial landscape.

Financial Literacy Revolution: Empowering Americans Beyond Tax Day Challenges

In the complex landscape of personal finance, Americans face an annual ritual that tests their economic understanding and preparedness: tax filing. As the deadline approaches, a critical conversation emerges about the fundamental need for comprehensive financial education that extends far beyond mere tax compliance.Transforming Financial Knowledge into Economic Empowerment

The Critical Gap in Financial Understanding

Modern financial landscapes present unprecedented challenges for everyday Americans. Despite technological advancements and increased access to information, many individuals struggle with fundamental financial concepts that could dramatically improve their economic well-being. The intricate world of taxation, investment strategies, and personal budgeting remains a mysterious terrain for millions, creating systemic vulnerabilities in personal economic planning. Financial literacy is not merely about understanding tax forms or calculating deductions. It represents a holistic approach to comprehending money management, investment strategies, risk assessment, and long-term financial planning. Research consistently demonstrates that individuals with robust financial knowledge make more informed decisions, build stronger savings, and navigate economic uncertainties with greater confidence.Educational Strategies for Financial Empowerment

Innovative approaches are emerging to address the financial education deficit. Schools, community organizations, and forward-thinking institutions are developing comprehensive programs designed to equip individuals with practical financial skills. These initiatives go beyond traditional classroom learning, incorporating interactive workshops, digital learning platforms, and personalized financial coaching. Technology plays a transformative role in democratizing financial education. Mobile applications, online courses, and interactive platforms are making complex financial concepts more accessible and engaging. Artificial intelligence-driven tools now offer personalized financial advice, helping individuals understand their unique economic profiles and develop tailored strategies for wealth accumulation and management.Systemic Challenges in Financial Education

Despite growing awareness, significant barriers persist in widespread financial literacy implementation. Socioeconomic disparities, limited educational resources, and complex financial systems continue to challenge comprehensive financial education efforts. Policymakers, educators, and financial institutions must collaborate to develop inclusive strategies that address these systemic limitations. The economic implications of financial illiteracy extend far beyond individual challenges. Entire communities and national economic stability are impacted by widespread financial misconceptions. By investing in robust financial education programs, societies can potentially reduce economic inequalities, improve individual financial resilience, and foster more sustainable economic growth.Emerging Trends in Financial Learning

The future of financial education is increasingly personalized and technology-driven. Adaptive learning platforms, machine learning algorithms, and immersive educational experiences are revolutionizing how individuals engage with financial concepts. These innovative approaches promise to make financial learning more accessible, engaging, and directly applicable to real-world scenarios. Emerging generations demonstrate a growing appetite for comprehensive financial knowledge. Millennials and Generation Z are actively seeking resources that provide practical, actionable financial insights. This generational shift represents a promising trend towards more proactive and informed financial decision-making.Practical Steps Towards Financial Literacy

Individuals can take immediate steps to enhance their financial understanding. Engaging with reputable online resources, participating in community workshops, and seeking personalized financial counseling can provide foundational knowledge. The key lies in maintaining a curious, open mindset and recognizing financial education as a continuous, lifelong journey. Professional financial advisors increasingly emphasize the importance of holistic financial learning. Beyond traditional investment advice, modern financial guidance focuses on developing comprehensive economic skills that empower individuals to make informed, strategic decisions across various aspects of their financial lives.RELATED NEWS

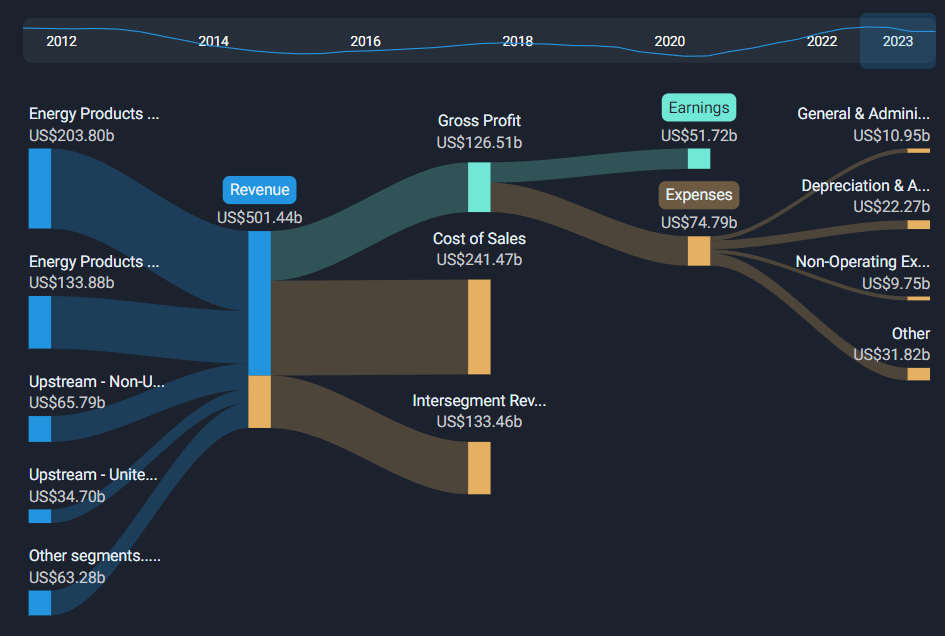

Oil Production Stumbles: Mexico Falls Short of Crude Output Targets by Massive 129,000 Barrels Daily