Behind the Shares: Institutional Investors and Private Powerhouses Clash in Prolintas Infra Battle

Companies

2025-02-17 07:02:24Content

Prolintas Infra Business Trust: A Deep Dive into Ownership Dynamics

Key Insights

The ownership landscape of Prolintas Infra Business Trust reveals a fascinating pattern of private company involvement. With a significant stake held by private entities, the trust demonstrates a robust and strategic approach to infrastructure investment.

This substantial private sector participation suggests a strong confidence in the trust's potential for growth and financial performance. The concentrated ownership structure indicates a focused and potentially more agile management approach, which could translate into more efficient decision-making and strategic planning.

Investors and market analysts are likely to view this ownership composition as a positive signal, reflecting the trust's potential for delivering value and maintaining a competitive edge in the infrastructure investment sector.

The prevalence of private company ownership also hints at a sophisticated investment strategy, where experienced stakeholders are actively involved in shaping the trust's direction and operational framework.

Unveiling the Strategic Landscape of Prolintas Infra Business Trust: A Deep Dive into Corporate Ownership Dynamics

In the intricate world of infrastructure investment, Prolintas Infra Business Trust emerges as a fascinating case study of corporate ownership and strategic positioning. The complex interplay of private and institutional stakeholders reveals a nuanced narrative of financial strategy and market influence that demands closer examination.Decoding the Hidden Potential of Infrastructure Investment Strategies

The Ownership Ecosystem: Beyond Traditional Investment Paradigms

The landscape of corporate ownership represents far more than a simple numerical representation of shareholders. For Prolintas Infra Business Trust, the substantial private company involvement signals a profound strategic narrative that transcends conventional investment models. These private entities are not merely passive investors but active architects of the trust's financial ecosystem, wielding significant influence through their strategic positioning. Delving deeper, the ownership structure reveals a sophisticated network of interconnected corporate interests. Private companies demonstrate an unprecedented level of commitment, suggesting they perceive substantial long-term value in the infrastructure sector. Their concentrated investment implies a deep understanding of market dynamics, potential growth trajectories, and the strategic importance of infrastructure development.Strategic Implications of Concentrated Private Ownership

The concentrated ownership by private entities introduces a compelling dimension to Prolintas Infra Business Trust's operational framework. Unlike traditional publicly traded entities, this ownership model enables more agile decision-making processes, potentially accelerating strategic initiatives and minimizing bureaucratic constraints. Such concentrated ownership also implies a higher degree of alignment between corporate objectives and investment strategies. Private companies typically bring specialized industry knowledge, extensive networks, and a more patient approach to capital deployment. This approach contrasts sharply with the short-term, performance-driven mindset often associated with public market investments.Financial Performance and Market Positioning

The intricate ownership structure directly influences the trust's financial performance and market positioning. Private companies' substantial stake suggests a long-term commitment to value creation, potentially translating into more stable investment strategies and reduced market volatility. Moreover, this ownership model enables more sophisticated risk management techniques. By maintaining significant control, private entities can implement more nuanced hedging strategies, adapt quickly to market changes, and leverage their collective expertise to navigate complex infrastructure investment landscapes.Technological and Innovation Potential

Private company involvement often correlates with enhanced innovation potential. These entities typically possess robust research and development capabilities, technological insights, and a more experimental approach to infrastructure investment. Their involvement with Prolintas Infra Business Trust could signal potential technological advancements and innovative investment methodologies. The convergence of private sector dynamism with infrastructure investment creates a fertile ground for transformative strategies. By combining industry expertise, technological prowess, and strategic capital allocation, these private companies position themselves at the forefront of infrastructure development.Future Outlook and Market Expectations

The current ownership configuration of Prolintas Infra Business Trust suggests a promising trajectory. Private companies' continued engagement indicates confidence in the infrastructure sector's potential, anticipating substantial growth and value creation in the coming years. Investors and market analysts should closely monitor this unique ownership dynamic, recognizing it as a potential bellwether for emerging investment trends in infrastructure-related financial instruments. The trust's ability to attract and retain significant private company involvement speaks volumes about its strategic positioning and future potential.RELATED NEWS

Red Sea Exodus: Chevron Leads Energy Giants in Strategic Retreat from Egyptian Concessions

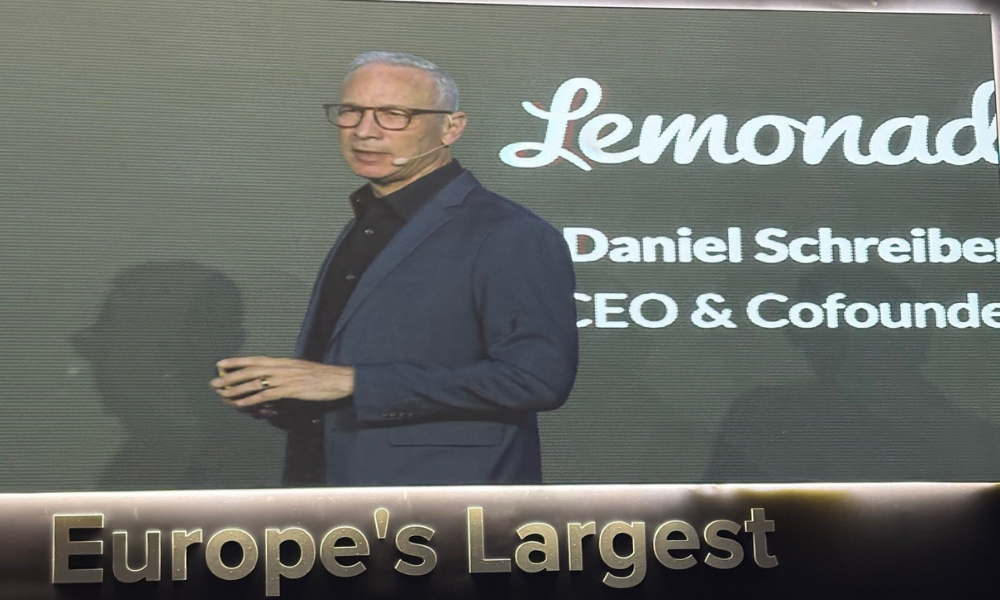

AI Revolution: Lemonade CEO Predicts Massive Insurance Industry Meltdown