Russian Exit Fallout: Nearly One-Third of U.S. Firms Lose Buyback Lifeline

Companies

2025-04-14 12:31:24Content

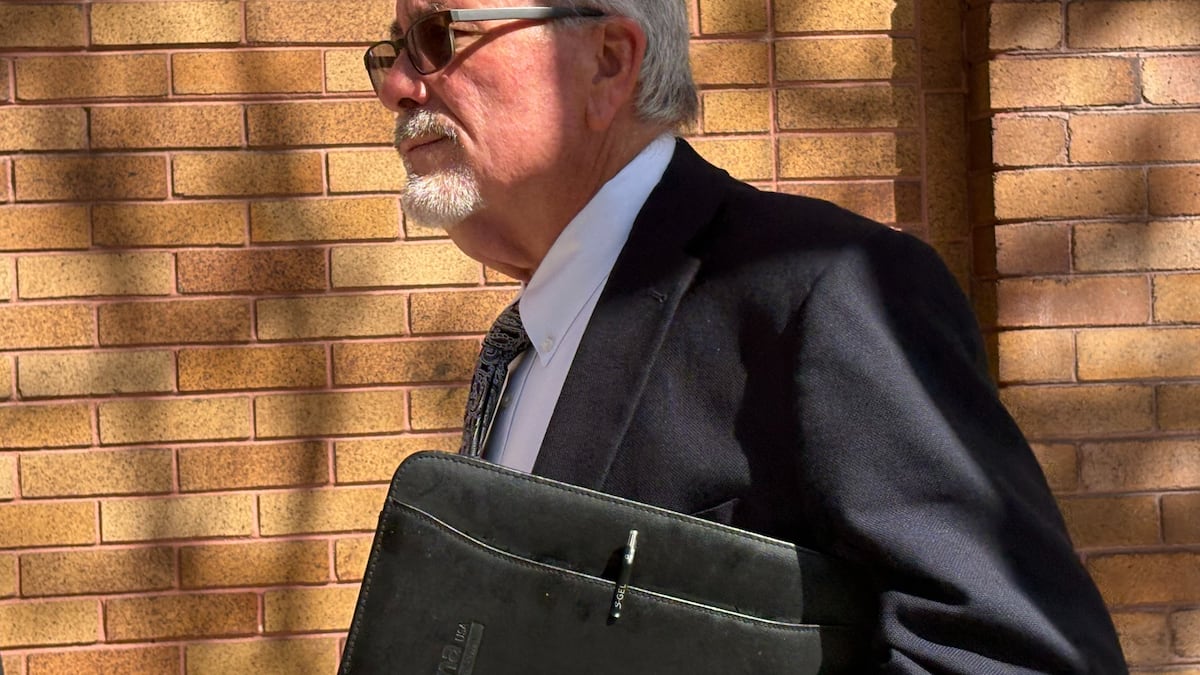

Nearly one-third of American companies that withdrew from Russia following its invasion of Ukraine have encountered expired buyback options, according to a revealing interview with Robert Agee, President of the American Chamber of Commerce in Russia (AmCham).

Speaking with the Russian business publication Expert, Agee disclosed that approximately 30% of corporate exit strategies have now reached their time limits. While some buyback opportunities remain active, the window for potential corporate re-entry is rapidly narrowing for many U.S. businesses.

The statement provides a nuanced glimpse into the ongoing economic fallout from the conflict, highlighting the complex challenges faced by international corporations navigating the geopolitical landscape. As sanctions and corporate exodus continue to reshape business relations, companies are carefully evaluating their long-term strategies in the region.

Agee's comments underscore the significant economic disruption caused by the ongoing tensions, with many U.S. companies forced to make difficult decisions about their Russian operations in the wake of the full-scale invasion of Ukraine.

Corporate Exodus: The Unfolding Economic Aftermath of Russia's Ukrainian Invasion

In the complex geopolitical landscape following Russia's full-scale invasion of Ukraine, multinational corporations have been navigating unprecedented economic challenges, with strategic withdrawals and complex financial negotiations becoming the new norm for international business operations.Navigating Unprecedented Corporate Disruption

The Landscape of Corporate Withdrawal

The global business ecosystem has witnessed a remarkable transformation in the wake of geopolitical tensions, with numerous American companies strategically reassessing their investments and operational footprints in the Russian market. The unprecedented economic sanctions and ethical considerations have prompted a significant corporate migration, fundamentally reshaping international business relationships and economic interdependencies. Corporations have been confronting complex divestment strategies, balancing financial considerations with ethical imperatives. The process of withdrawal involves intricate legal negotiations, financial restructuring, and strategic realignment of global business portfolios. Many organizations have found themselves navigating uncharted territories, seeking viable exit strategies that minimize financial losses while maintaining corporate integrity.Financial Implications of Corporate Departures

The economic ramifications of corporate withdrawals extend far beyond immediate financial transactions. Companies have been exploring sophisticated buyback mechanisms, contractual provisions, and strategic exit routes that protect their long-term economic interests. The American Chamber of Commerce in Russia has been closely monitoring these transitions, providing critical insights into the evolving corporate landscape. Statistical analyses reveal that approximately one-third of U.S. companies have encountered expired buyback options, signaling the complexity of divestment processes. These expired options represent more than mere financial transactions; they symbolize the profound economic recalibration occurring in response to geopolitical tensions.Strategic Considerations in Corporate Decision-Making

Corporate leaders are confronting multifaceted challenges that transcend traditional business calculations. The decision to withdraw from the Russian market involves nuanced considerations of ethical standards, potential reputational risks, and long-term strategic positioning. Companies must balance immediate financial concerns with broader geopolitical implications. Risk management has become paramount, with organizations developing sophisticated frameworks to assess potential economic and reputational consequences. The ability to adapt quickly, maintain flexibility, and make principled decisions has emerged as a critical competitive advantage in this volatile global environment.Global Economic Ripple Effects

The corporate exodus from Russia represents more than an isolated economic phenomenon. It signals a broader recalibration of international business relationships, challenging established paradigms of global economic integration. Multinational corporations are reassessing their global strategies, emphasizing resilience, ethical considerations, and adaptability. These transformative shifts are reshaping economic landscapes, creating new opportunities and challenges for businesses worldwide. The ability to navigate complex geopolitical environments while maintaining economic sustainability has become a critical competency for modern corporations.RELATED NEWS

Companies

Lone Star Lunar Leap: Firefly Aerospace Clinches Historic Private Moon Landing

2025-03-03 04:13:03

Companies

Govoni Empire Crumbles: Bankruptcy Court Sets Stage for Massive 7-Company Liquidation Auction

2025-04-10 16:58:17