Wall Street Insiders Reveal: 7 Deadly Investment Sins That Could Crush Your Financial Dreams

Finance

2025-04-13 10:02:14Content

Financial Wisdom: Smart Money Moves for Every Budget

Whether you're just starting to save or have built a substantial nest egg, navigating the financial landscape can be tricky. The good news? By avoiding a few critical money pitfalls, you can protect your hard-earned cash and set yourself up for long-term financial success.

First and foremost, don't fall into the comparison trap. Your financial journey is unique, and what works for others may not work for you. Whether you have $5 or $500,000 in the bank, the key is making strategic decisions that align with your personal goals and circumstances.

Common financial mistakes can derail even the most well-intentioned plans. Impulse spending, neglecting emergency funds, and failing to invest wisely are just a few of the pitfalls that can cost you dearly. The secret is to develop a proactive approach to managing your money.

Start by creating a realistic budget that reflects your income and priorities. Build an emergency fund that can cushion unexpected expenses. Be mindful of lifestyle inflation – just because you earn more doesn't mean you should spend more. Invest consistently, even if it's a small amount, and focus on long-term growth rather than short-term gains.

Remember, financial success isn't about how much money you have, but how smartly you manage what you've got. By staying informed, making deliberate choices, and avoiding common money traps, you can build a more secure and prosperous financial future.

Mastering Your Financial Future: Insider Secrets to Avoiding Costly Investment Pitfalls

In the complex world of personal finance, navigating investment landscapes can feel like traversing a minefield of potential financial disasters. Every dollar you earn represents hours of hard work, making it crucial to protect and grow your wealth with strategic precision and informed decision-making.Transform Your Financial Destiny: Smart Investing Starts Here

Understanding the Psychology of Investment Decisions

Successful investing transcends mere number crunching; it's a profound psychological journey that demands emotional intelligence and self-awareness. Many investors unknowingly sabotage their financial potential through cognitive biases that cloud rational judgment. Emotional reactions to market fluctuations can trigger impulsive decisions that derail long-term wealth accumulation strategies. Recognizing these psychological traps requires developing a disciplined mindset. Investors must learn to detach personal emotions from financial choices, viewing investments through an objective lens. This means cultivating patience, embracing calculated risks, and maintaining a strategic perspective even during market volatility.Risk Management: The Cornerstone of Intelligent Investing

Effective risk management is not about eliminating risk entirely but understanding and strategically navigating potential financial challenges. Diversification emerges as a critical strategy, spreading investments across multiple asset classes to mitigate potential losses. This approach creates a financial safety net that protects your portfolio from catastrophic downturns. Sophisticated investors understand that risk is not a binary concept but a nuanced spectrum. They meticulously analyze potential investments, considering factors like market trends, economic indicators, and individual asset performance. By developing a comprehensive risk assessment framework, investors can make informed decisions that balance potential returns with acceptable risk levels.Technology and Investment: Leveraging Modern Financial Tools

The digital revolution has democratized investment opportunities, providing unprecedented access to sophisticated financial tools and resources. Cutting-edge platforms offer real-time market analysis, algorithmic trading capabilities, and personalized investment recommendations that were once exclusive to institutional investors. However, technology is a double-edged sword. While these tools provide valuable insights, they cannot replace fundamental financial knowledge and strategic thinking. Successful investors combine technological resources with critical thinking, using digital platforms as enhancement tools rather than sole decision-making mechanisms.Building Sustainable Wealth: Beyond Short-Term Gains

True financial success extends far beyond momentary market victories. Sustainable wealth creation requires a holistic approach that integrates long-term planning, continuous learning, and adaptable strategies. Investors must view their financial journey as an evolving process, consistently refining their approach based on changing market dynamics and personal circumstances. This perspective demands ongoing education and a commitment to personal financial growth. Successful investors invest not just money, but time and energy into understanding complex financial ecosystems, emerging market trends, and innovative investment strategies.Navigating Economic Uncertainties with Confidence

Economic landscapes are inherently unpredictable, characterized by constant flux and unexpected disruptions. Resilient investors develop a flexible mindset that allows them to pivot strategies quickly while maintaining core financial principles. This adaptability becomes a crucial competitive advantage in turbulent economic environments. Developing economic resilience involves maintaining robust emergency funds, creating multiple income streams, and maintaining a balanced investment portfolio that can withstand various market conditions. It's about building financial fortitude that transcends temporary market fluctuations.Ethical and Sustainable Investment Strategies

Modern investors increasingly recognize the importance of aligning financial goals with broader societal and environmental considerations. Sustainable investing represents a powerful approach that generates financial returns while contributing to positive global impact. By integrating environmental, social, and governance (ESG) criteria into investment decisions, individuals can support innovative companies driving meaningful change while potentially accessing emerging market opportunities. This approach transforms investing from a purely financial activity into a mechanism for broader societal transformation.RELATED NEWS

Finance

Wall Street Pulse: Spero Therapeutics Confronts Financial Headwinds in Q4 Earnings Reveal

2025-03-28 07:03:38

Finance

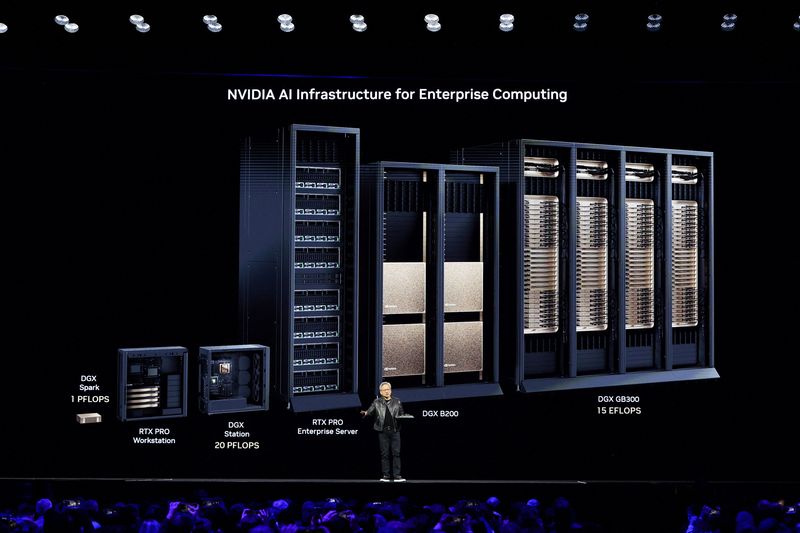

Chip Revolution: Nvidia Pledges Massive US Manufacturing Boost in Multi-Billion Dollar Expansion

2025-03-20 03:22:32

Finance

Swiss Financial Watchdog Promises Bolder Oversight: FINMA Signals Aggressive Regulatory Stance

2025-04-08 07:42:57