Wall Street's Rollercoaster: 7 Days That Shook Global Markets

Business

2025-04-11 20:03:10Content

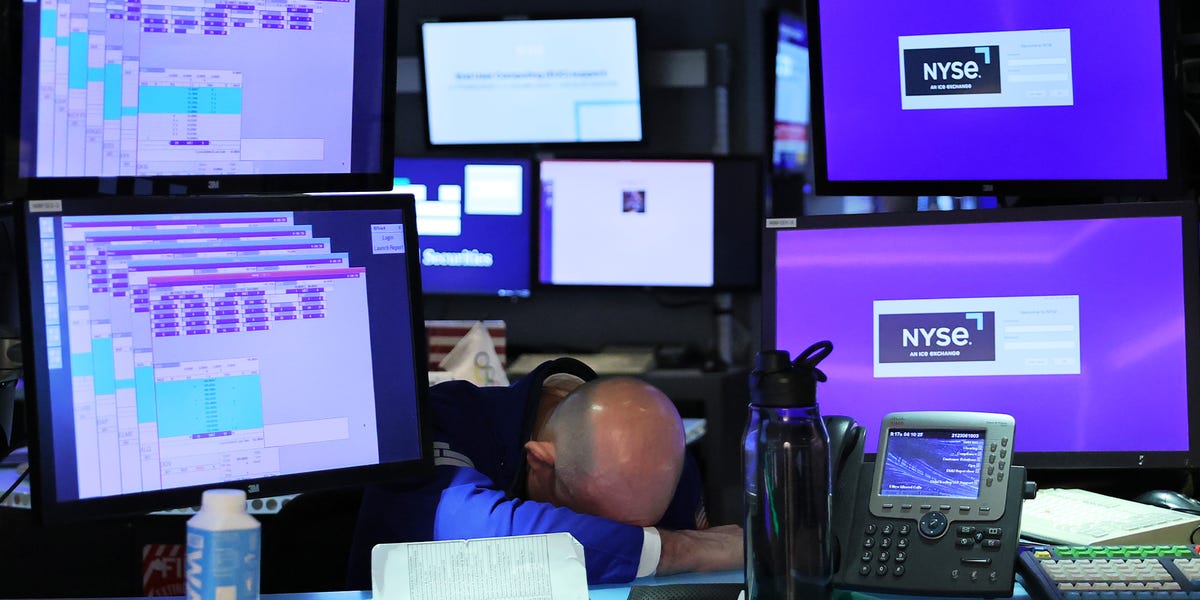

Financial markets are experiencing a rollercoaster of emotions, with investors whipsawed between extreme states of anxiety and exhilaration. "We're witnessing an unprecedented cycle of market volatility," remarked a seasoned financial analyst to Business Insider, capturing the dramatic sentiment sweeping through investment circles.

The current economic landscape is characterized by wild fluctuations, with stocks and bonds dancing to an unpredictable rhythm. The dollar, meanwhile, has taken a significant tumble, adding another layer of complexity to an already turbulent financial environment.

Investors are finding themselves caught in a perfect storm of uncertainty, where panic gives way to momentary euphoria, only to be quickly replaced by a sense of impending terror. This emotional and financial whirlwind reflects the profound uncertainty gripping global markets in these unprecedented times.

Market Mayhem: The Rollercoaster Ride of Financial Volatility Unveiled

In the ever-shifting landscape of global financial markets, investors find themselves navigating treacherous waters of unprecedented uncertainty. The recent economic turbulence has sent shockwaves through investment circles, challenging even the most seasoned financial experts to maintain their composure amid rapid and unpredictable market transformations.Buckle Up: Financial Markets on the Edge of Chaos

The Emotional Rollercoaster of Market Dynamics

Financial markets have transformed into an emotional battleground where rationality seems to have taken a backseat. Sophisticated investors and casual market participants alike are experiencing a psychological whirlwind that defies traditional economic models. The rapid oscillation between panic, euphoria, and terror has become the new normal, creating an environment where predictability has become a distant memory. The psychological impact of these market fluctuations cannot be overstated. Traders and investors are constantly recalibrating their strategies, attempting to navigate a landscape that seems to change by the minute. The traditional tools of market analysis are being stress-tested like never before, revealing the fragility of established economic paradigms.Volatility: The New Market Ecosystem

The current market environment represents a fundamental shift in how financial systems operate. Stocks and bonds are no longer behaving according to historical patterns, creating a complex ecosystem of unpredictability. The dollar's dramatic plunge serves as a stark indicator of the profound transformations occurring beneath the surface of global financial markets. Analysts are struggling to develop comprehensive frameworks that can adequately explain the current market behavior. The traditional metrics of economic analysis seem increasingly inadequate in capturing the nuanced and rapidly evolving financial landscape. This unprecedented volatility challenges long-held assumptions about market mechanics and investor behavior.Decoding the Financial Turbulence

Behind the scenes, a complex interplay of global economic factors is driving these dramatic market movements. Geopolitical tensions, technological disruptions, and macroeconomic shifts are converging to create a perfect storm of financial uncertainty. Investors are being forced to develop more adaptive and resilient strategies that can withstand rapid and unexpected market transformations. The current market conditions demand a new approach to investment and risk management. Traditional diversification strategies are being reevaluated, with investors seeking more dynamic and flexible methods of protecting their financial interests. The ability to quickly adapt and respond to market changes has become a critical competitive advantage.The Human Element in Market Dynamics

Beyond the numbers and charts, there's a profound human story unfolding. The emotional toll of constant market uncertainty is significant, affecting not just professional investors but entire economic ecosystems. The psychological resilience required to navigate these turbulent times is becoming an increasingly valuable skill. Financial institutions and individual investors are being challenged to develop more sophisticated emotional intelligence and adaptability. The ability to maintain composure and make rational decisions in the face of extreme market volatility has become a critical differentiator between success and failure in the current economic landscape.Looking Beyond the Horizon

As markets continue to evolve at an unprecedented pace, the only certainty is uncertainty itself. The financial world is undergoing a fundamental transformation that promises to reshape our understanding of economic systems, investment strategies, and global financial interactions. Investors and analysts must remain vigilant, adaptable, and prepared for anything. The future of financial markets will belong to those who can embrace complexity, manage emotional responses, and develop innovative approaches to understanding and navigating economic uncertainty.RELATED NEWS

Business

Trade War Tactics: Goldman Sachs Chief Reveals Business World's Secret Trump Strategy

2025-03-12 20:54:51

Business

Armed Confrontation Turns Fatal: Robbery Attempt Backfires at Local Jackson Establishment

2025-02-22 01:50:00

Business

Royal Retreat: Prince Andrew's Startup Venture Hits Unexpected Roadblock

2025-03-03 15:28:40