Wall Street Trembles: Trump's Tariff Timeout Falls Short as Market Bloodbath Continues

Business

2025-04-11 12:50:41Content

Wall Street plunged into another wave of selling as escalating trade tensions between the United States and China reignited investor fears. The market sentiment took a sharp turn downward after China unveiled new retaliatory tariffs, further intensifying the ongoing economic standoff between the world's two largest economies.

Investors are growing increasingly anxious as the trade war shows no signs of de-escalation. The latest round of Chinese tariffs has sent shockwaves through financial markets, triggering a widespread sell-off across major U.S. stock indexes. The uncertainty surrounding international trade relations continues to create significant volatility and unnerve market participants.

The mounting trade tensions are not just numbers on a chart—they represent real economic consequences that could potentially slow global economic growth and disrupt international supply chains. As both nations dig in their heels, the financial markets are bracing for potential further turbulence in the coming weeks.

Global Markets in Turmoil: The Escalating Trade War and Its Economic Ripple Effects

In the complex landscape of international commerce, tensions between global economic powerhouses are reaching a critical breaking point. The intricate dance of international trade has once again taken a dramatic turn, with market dynamics shifting rapidly and investors holding their collective breath in anticipation of potential economic fallout.Navigating Uncertain Economic Waters: A Critical Market Analysis

The Unfolding Trade Conflict Landscape

The current economic environment represents a powder keg of geopolitical tensions and strategic economic maneuvers. Recent developments have exposed the fragile interconnectedness of global financial systems, with major economic players engaging in a high-stakes game of strategic positioning. The escalating trade confrontation between global superpowers has sent shockwaves through international markets, creating unprecedented levels of uncertainty and volatility. Financial analysts are closely monitoring the intricate web of tariffs, retaliatory measures, and economic strategies that are reshaping global trade dynamics. The complex interplay between national economic interests and international diplomatic relations has created a volatile environment where traditional economic models are being fundamentally challenged.Market Volatility and Investor Sentiment

Investor confidence has been dramatically impacted by the ongoing trade tensions, with stock markets experiencing significant fluctuations. The uncertainty surrounding international trade policies has triggered a cascade of market reactions, causing investors to reassess their strategic portfolios and risk management approaches. Major financial indexes have demonstrated remarkable sensitivity to geopolitical developments, with rapid sell-offs reflecting the market's heightened state of anxiety. Institutional investors and individual traders alike are navigating an increasingly complex landscape, where traditional investment strategies are being tested by unprecedented economic conditions.Geopolitical Strategies and Economic Implications

The current trade confrontation represents more than a mere economic dispute; it is a sophisticated strategic engagement with far-reaching consequences. Each retaliatory measure and tariff implementation is carefully calculated to maximize economic leverage while minimizing potential domestic economic disruption. Economists are closely analyzing the potential long-term implications of these trade tensions. The intricate balance of global economic power is being fundamentally recalibrated, with potential shifts in manufacturing, supply chains, and international economic relationships that could reshape global commerce for decades to come.Technological and Supply Chain Disruptions

Beyond immediate financial implications, the ongoing trade tensions are creating significant disruptions in global supply chains and technological ecosystems. Companies are being forced to reevaluate their international manufacturing and sourcing strategies, leading to complex restructuring efforts that could have profound long-term economic consequences. The technological sector, in particular, is experiencing unprecedented challenges. Critical components and advanced manufacturing capabilities are becoming strategic assets in this economic confrontation, with nations seeking to protect and advance their technological sovereignty.Global Economic Resilience and Adaptation

Despite the challenging economic landscape, there are emerging signs of remarkable resilience and adaptive capacity within global markets. Innovative companies and forward-thinking economic strategies are finding opportunities within the complexity, demonstrating the dynamic nature of international commerce. Emerging markets and alternative economic partnerships are gaining prominence, suggesting that the current trade tensions might ultimately accelerate economic diversification and create new pathways for international collaboration.RELATED NEWS

Business

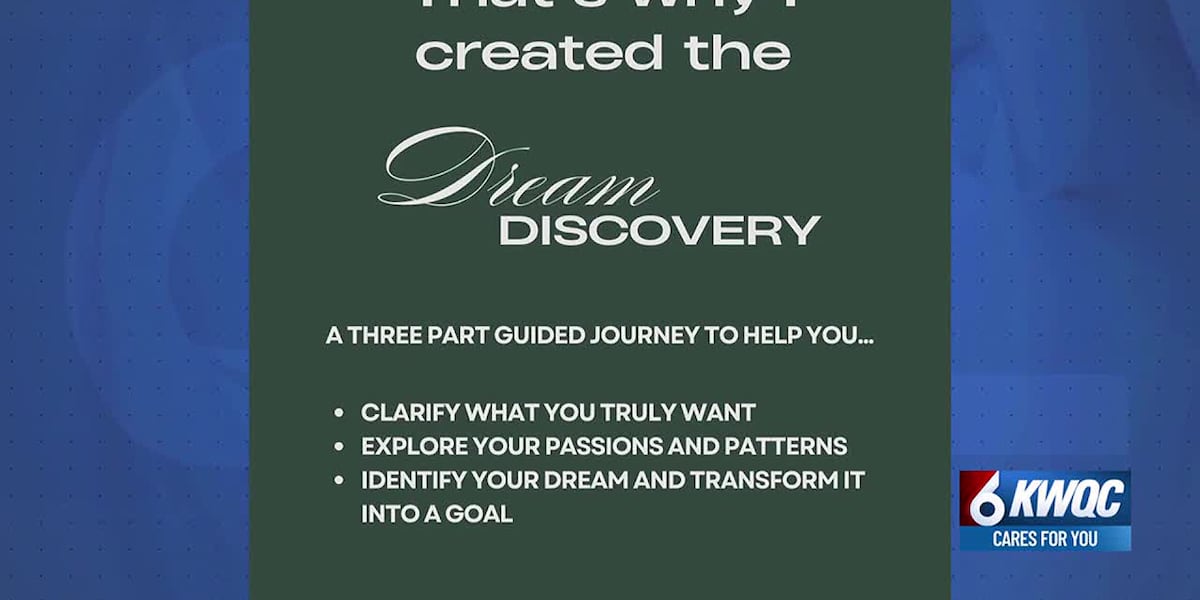

Breaking Barriers: Entrepreneur Unveils Groundbreaking 'Dream Discovery Series' for Women Trailblazers

2025-04-15 05:00:39

Business

Breaking: SBA Slashes Workforce, Absorbs Education Dept's Student Loan Portfolio in Radical Restructuring

2025-03-21 19:00:00

Business

Wisdom Warriors: Top CEOs Reveal Career-Changing Secrets for Ambitious Millennials and Gen Z

2025-05-05 19:00:00