Trump Factor: How Political Uncertainty Is Reshaping US Market Dynamics

Politics

2025-04-11 12:12:33Content

Parking your money in America has transformed from a simple financial strategy to a complex decision fraught with challenges and considerations. What was once a straightforward, low-stress approach to managing funds has now become a nuanced landscape requiring careful navigation and strategic thinking.

The traditional notion of parking cash in standard savings accounts or conventional investment vehicles no longer guarantees financial stability or meaningful returns. Investors and everyday savers now face a dynamic environment where traditional parking strategies demand more sophisticated analysis and proactive management.

Economic shifts, fluctuating interest rates, and evolving financial technologies have fundamentally reshaped how Americans approach their monetary reserves. The once-neutral option of parking money now requires a more dynamic, informed approach that balances risk, potential growth, and financial flexibility.

The Shifting Landscape of Financial Parking: Navigating Uncertain Economic Terrain

In an era of unprecedented economic volatility, investors and financial strategists are confronting a complex paradigm where traditional investment strategies are being fundamentally reimagined. The conventional wisdom of parking capital in seemingly stable markets is rapidly evolving, challenging long-held assumptions about financial safety and strategic wealth management.Transforming Capital Strategies in a Volatile Global Economy

The Erosion of Traditional Safe Havens

The American financial landscape has undergone a seismic transformation, rendering traditional parking strategies increasingly precarious. Historically reliable investment mechanisms are now fraught with unprecedented complexity, forcing sophisticated investors to recalibrate their approach. Economic uncertainties, geopolitical tensions, and rapidly shifting market dynamics have fundamentally disrupted conventional financial parking methodologies. Institutional investors are now compelled to adopt more nuanced, adaptive strategies that transcend traditional risk mitigation frameworks. The once-predictable terrain of capital allocation now demands unprecedented agility, strategic foresight, and a willingness to embrace innovative financial instruments.Emerging Alternative Investment Paradigms

Contemporary financial experts are pioneering novel approaches to capital preservation and growth. Cryptocurrency, decentralized finance platforms, and sophisticated algorithmic trading mechanisms are increasingly supplanting traditional parking strategies. These emerging models offer enhanced flexibility, potentially higher returns, and greater resilience against systemic economic disruptions. The technological revolution has democratized investment opportunities, enabling individual investors to access sophisticated financial tools previously reserved for institutional players. Machine learning algorithms, real-time market analysis, and blockchain technologies are reshaping the fundamental architecture of capital management.Geopolitical Influences on Capital Parking Strategies

Global geopolitical tensions are exerting profound influences on investment parking strategies. Trade conflicts, regulatory shifts, and macroeconomic uncertainties are compelling investors to develop more sophisticated, diversified approaches to capital allocation. The traditional notion of geographical financial safety has been fundamentally challenged, necessitating a more holistic, globally integrated perspective. Sophisticated investors are now constructing multi-layered investment portfolios that transcend traditional geographical boundaries. This approach allows for enhanced risk mitigation and provides greater adaptability in an increasingly interconnected global economic ecosystem.Technological Disruption and Financial Innovation

The rapid acceleration of technological innovation is fundamentally restructuring financial parking mechanisms. Artificial intelligence, quantum computing, and advanced predictive analytics are enabling more sophisticated, real-time investment strategies. These technological advancements are dismantling traditional barriers and creating unprecedented opportunities for dynamic capital management. Financial institutions are investing heavily in technological infrastructure, recognizing that technological adaptability is now a critical competitive advantage. The convergence of finance and technology is creating entirely new paradigms of wealth preservation and growth.Regulatory Landscape and Compliance Challenges

The evolving regulatory environment is adding layers of complexity to financial parking strategies. Increasingly stringent compliance requirements, enhanced transparency mandates, and sophisticated monitoring mechanisms are reshaping investment landscapes. Investors must now navigate a labyrinthine regulatory framework that demands unprecedented levels of diligence and strategic planning. Successful financial strategies now require a holistic understanding of regulatory dynamics, technological capabilities, and global economic trends. The ability to anticipate and adapt to regulatory shifts has become a critical competency for modern investors.RELATED NEWS

Politics

Awkward Snapshot Turns Political Triumph: Whitmer Outmaneuvers Trump in Michigan Showdown

2025-04-29 21:07:55

Politics

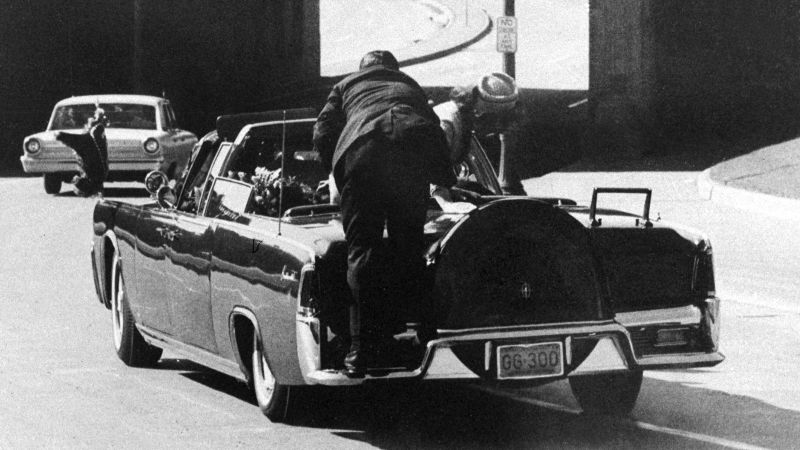

Heroic Secret Service Agent Who Shielded JFK in Fatal Dallas Moment Passes Away at 93

2025-02-24 20:21:02

Politics

Graham Warns: Halting Ukraine Aid Could Spark Geopolitical Catastrophe Worse Than Afghanistan Pullout

2025-03-09 17:51:44