Brace for Impact: Dimon Signals Economic Storm Ahead

Business

2025-04-11 11:29:10Content

In a candid assessment of the current economic landscape, JPMorgan Chase CEO Jamie Dimon highlighted the complex challenges facing the United States economy while simultaneously celebrating the bank's impressive financial performance. Despite potential headwinds, the banking giant reported robust growth in both revenue and profits for the last quarter, demonstrating remarkable resilience in an uncertain economic environment.

Dimon, known for his strategic insights and frank economic commentary, painted a nuanced picture of the economic challenges ahead. His remarks suggest that while the US economy shows signs of strength, it is navigating through a series of intricate and potentially disruptive economic crosscurrents.

The bank's strong financial results underscore JPMorgan's ability to maintain solid performance even amid economic uncertainties. This performance not only reflects the institution's strategic management but also provides a glimpse into the broader economic dynamics at play in the current financial landscape.

Investors and economic observers are closely watching Dimon's commentary, as his perspectives are often considered a bellwether for understanding the complex interplay of economic forces shaping the nation's financial future.

Economic Turbulence: Jamie Dimon's Candid Insights into America's Financial Landscape

In the ever-evolving world of global finance, few voices carry as much weight as Jamie Dimon's. As the helm of JPMorgan Chase, one of the world's most influential financial institutions, Dimon's perspectives offer a critical lens into the complex economic dynamics shaping the United States' financial future.Navigating Uncertain Economic Waters: A Comprehensive Analysis of Banking and Market Challenges

The Macroeconomic Crosswinds Challenging Financial Stability

The contemporary economic environment presents a labyrinth of interconnected challenges that demand nuanced understanding and strategic navigation. JPMorgan's recent financial performance reveals a compelling narrative of resilience amidst uncertainty. Dimon's strategic leadership has positioned the banking giant to not just survive, but potentially thrive, in a landscape marked by unprecedented volatility. Economic indicators suggest a multifaceted scenario where traditional predictive models struggle to capture the full complexity of market dynamics. Inflation pressures, geopolitical tensions, and shifting monetary policies create a perfect storm of economic unpredictability that requires sophisticated financial maneuvering.Institutional Performance and Strategic Adaptability

JPMorgan's robust financial results underscore the organization's remarkable ability to generate substantial revenue and profits even in challenging economic conditions. This performance is not merely a testament to the bank's financial engineering but reflects a deeper strategic approach that anticipates and mitigates potential market disruptions. The bank's diversified portfolio and risk management strategies have proven instrumental in maintaining financial stability. By leveraging advanced technological infrastructure and maintaining a forward-looking perspective, JPMorgan demonstrates how financial institutions can transform potential challenges into opportunities for growth and innovation.Technological Innovation and Financial Services Transformation

Digital transformation has become a critical component of modern banking strategies. JPMorgan's investments in cutting-edge technologies like artificial intelligence, blockchain, and advanced data analytics represent a proactive approach to reimagining financial services. These technological investments are not merely cosmetic improvements but fundamental restructuring of how financial institutions interact with customers, manage risk, and create value. By embracing innovation, JPMorgan signals a commitment to staying ahead of emerging market trends and customer expectations.Global Economic Interdependencies and Risk Management

The contemporary financial ecosystem is characterized by intricate global interdependencies that require sophisticated risk assessment and management strategies. Dimon's insights reveal a nuanced understanding of how international economic dynamics influence domestic market conditions. Geopolitical tensions, trade relationships, and emerging market developments create a complex web of potential risks and opportunities. JPMorgan's approach demonstrates the importance of maintaining flexibility and developing robust predictive models that can adapt to rapidly changing global economic landscapes.Future Outlook and Strategic Positioning

While economic uncertainties persist, JPMorgan's performance suggests a cautiously optimistic perspective. The bank's ability to generate strong financial results amid challenging conditions reflects a strategic approach that balances risk mitigation with growth-oriented initiatives. Dimon's leadership emphasizes the importance of maintaining financial resilience, investing in technological capabilities, and developing adaptive strategies that can respond effectively to emerging economic challenges. This approach provides valuable insights for financial professionals, investors, and policymakers seeking to navigate the complex economic terrain.RELATED NEWS

Business

From Hoodie Hero to Trade Battleground: How One American Sweatshirt Exposes the Deeper Economic Divide

2025-04-21 10:00:02

Business

Desperate Plea: Local Businessman's Family Battles ICE Detention in High-Stakes Immigration Showdown

2025-03-04 00:50:35

Business

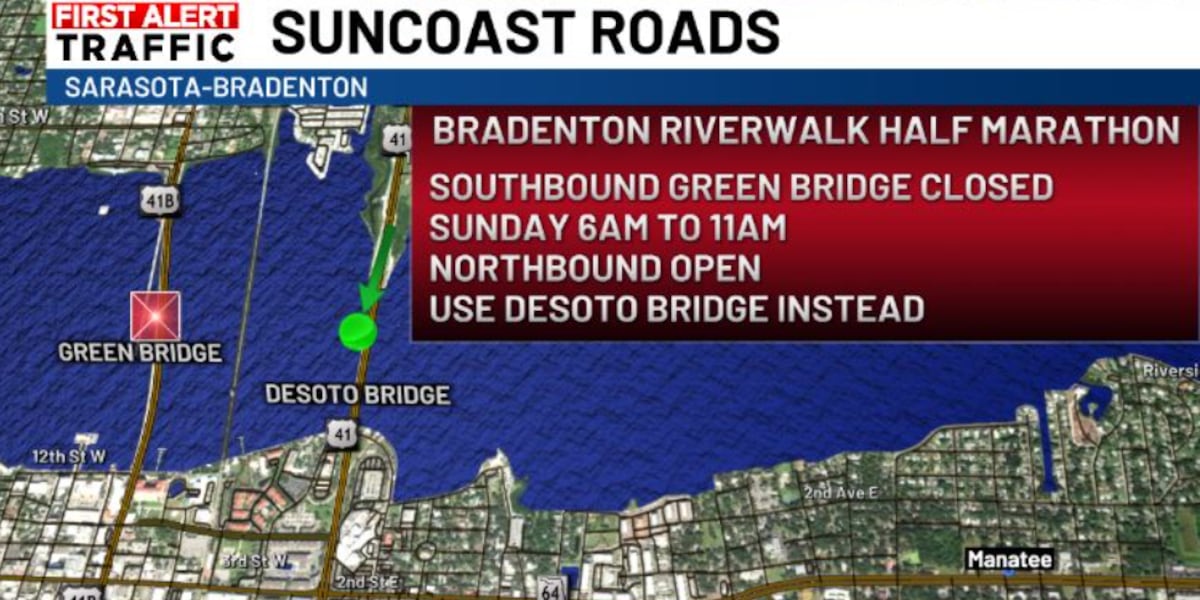

Rail Project Sparks Legal Showdown: Local Entrepreneur Challenges City's Development Plans

2025-02-22 04:23:19