Roadblocks in Justice: Why NY's Child Victims Act Audit Hits a Legal Dead End

Politics

2025-04-11 03:22:00Content

In a revealing assessment, the New York State Comptroller's Office has disclosed significant constraints in its capacity to thoroughly examine the financial liabilities facing local governments. The office's ability to conduct comprehensive financial reviews has been substantially restricted, highlighting potential challenges in fiscal oversight and transparency.

The limitations faced by the Comptroller's Office underscore the complex landscape of municipal financial management, where detailed scrutiny of fiscal obligations can be challenging. These constraints may impact the office's ability to provide comprehensive insights into the financial health and potential risks facing various government entities across New York State.

While the specific details of these limitations remain nuanced, the revelation points to the need for enhanced financial monitoring and reporting mechanisms. Local governments and state officials may need to explore alternative strategies to ensure robust financial accountability and risk assessment in an increasingly complex fiscal environment.

Unveiling the Financial Oversight Maze: New York State Comptroller's Investigative Limitations Exposed

In the intricate landscape of governmental financial accountability, the New York State Comptroller's office finds itself navigating a complex terrain of regulatory constraints and investigative challenges. The delicate balance between fiscal transparency and operational limitations presents a nuanced narrative of public financial oversight that demands closer examination.Unraveling the Complexities of Government Financial Review

The Systemic Constraints of Financial Accountability

The New York State Comptroller's office confronts a multifaceted challenge in its pursuit of comprehensive financial oversight. Unlike popular misconceptions, the agency's investigative capabilities are significantly circumscribed by a labyrinth of legal and procedural restrictions. These limitations create a profound impact on the ability to conduct thorough financial liability assessments across various governmental entities. Experts in public financial management suggest that the constraints stem from a complex interplay of legislative frameworks, bureaucratic protocols, and institutional boundaries. The result is a nuanced landscape where complete financial transparency remains an elusive goal, despite the best intentions of oversight mechanisms.Navigating the Regulatory Landscape

The intricate nature of governmental financial review requires a sophisticated approach that transcends traditional investigative methods. Comptroller officials must carefully maneuver through a maze of legal restrictions, institutional protocols, and jurisdictional limitations that fundamentally restrict their ability to conduct comprehensive financial assessments. Research indicates that these constraints are not merely bureaucratic hurdles but represent a systemic challenge in public financial oversight. The delicate balance between maintaining institutional autonomy and ensuring fiscal accountability creates a complex environment that demands innovative approaches to financial review.Implications for Public Financial Transparency

The limitations faced by the New York State Comptroller's office raise critical questions about the broader mechanisms of governmental financial oversight. These constraints have far-reaching implications for public trust, fiscal accountability, and the fundamental principles of transparent governance. Financial experts argue that the current system creates significant gaps in oversight, potentially leaving critical financial vulnerabilities unaddressed. The intricate web of restrictions effectively creates blind spots in the financial review process, challenging the very essence of public financial management.Technological and Regulatory Innovations

As traditional oversight methods prove increasingly inadequate, there is a growing emphasis on technological and regulatory innovations. Advanced data analytics, artificial intelligence, and more sophisticated review mechanisms are emerging as potential solutions to the current limitations. Cutting-edge approaches promise to revolutionize financial oversight, offering more comprehensive and nuanced methods of investigating governmental financial practices. These innovations represent a potential paradigm shift in how financial accountability is conceptualized and implemented.The Human Element of Financial Oversight

Beyond technological solutions, the human element remains crucial in navigating the complex landscape of financial review. Skilled professionals within the Comptroller's office must continuously adapt to evolving challenges, developing innovative strategies to maximize their investigative capabilities within existing constraints. The intersection of human expertise, technological innovation, and regulatory frameworks presents a dynamic and complex approach to financial oversight that continues to evolve in response to increasingly sophisticated governmental financial practices.RELATED NEWS

Politics

Family's Desperate Pleas: Inside the Tragic Days Before Shapiro Arson Tragedy

2025-04-15 20:43:39

Politics

Pop Star Perks: Rachel Reeves Reveals Backstage Pass to Sabrina Carpenter Concert

2025-03-23 10:38:08

Politics

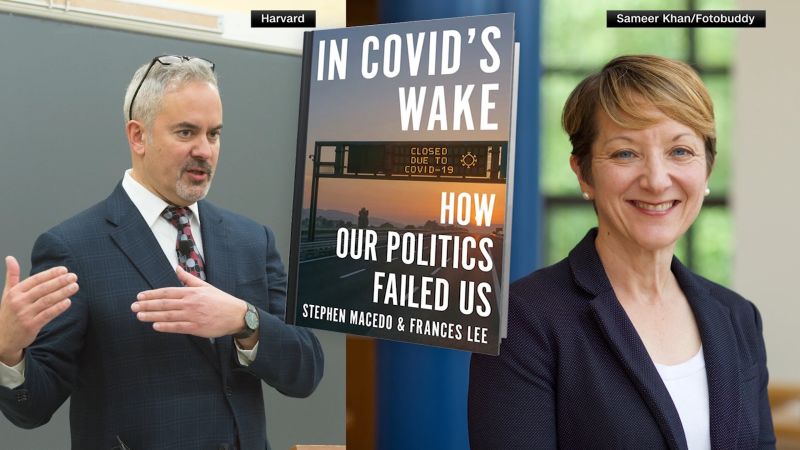

Navigating the Next Pandemic: What COVID-19 Taught Us About Global Crisis Management

2025-03-23 17:26:26