Wheels of Deception: Local Shipping Mogul Caught in Massive $6.4 Million Tax Evasion Scheme

Business

2025-04-10 19:47:11Content

In a significant legal development, a Michigan businessman has admitted to serious tax violations related to his international vehicle shipping enterprise. The individual pleaded guilty to two critical financial offenses: submitting a fraudulent tax return and deliberately avoiding tax payments on cash wages distributed to his employees.

The case highlights the ongoing efforts of tax authorities to crack down on businesses that attempt to circumvent tax regulations. By concealing income and misrepresenting financial records, the defendant not only violated federal tax laws but also undermined the integrity of legitimate business practices.

This guilty plea serves as a stark reminder that tax evasion carries serious legal consequences, potentially resulting in substantial financial penalties and potential criminal prosecution. The case underscores the importance of transparency and compliance in business financial reporting.

Tax Evasion Scandal: Michigan Businessman's Elaborate Scheme Unravels

In the complex world of international business, where financial regulations intersect with entrepreneurial ambitions, a Michigan-based vehicle shipping entrepreneur found himself entangled in a web of legal complications that would ultimately expose a calculated attempt to circumvent tax obligations.Uncovering the Truth: When Business Practices Cross Legal Boundaries

The International Vehicle Shipping Landscape

The global vehicle transportation industry represents a sophisticated network of logistics, compliance, and intricate financial management. Within this complex ecosystem, businesses must navigate stringent regulatory frameworks that govern international commerce. For many entrepreneurs, the temptation to cut corners can become an irresistible proposition, especially when financial pressures mount and competitive landscapes become increasingly challenging. In this particular case, the Michigan businessman's operation revealed a systematic approach to financial manipulation that extended beyond simple oversight. His business model, which appeared legitimate on the surface, concealed a deliberate strategy of tax avoidance and financial misrepresentation.Wage Reporting and Cash Compensation Strategies

The investigation uncovered a nuanced approach to employee compensation that deliberately circumvented standard reporting protocols. By providing cash wages outside traditional payroll systems, the business owner created a parallel economic structure designed to minimize tax liabilities and obscure true financial transactions. This method of compensation is not merely an administrative oversight but represents a calculated attempt to exploit gaps within financial reporting mechanisms. Such practices undermine the integrity of tax systems and create unfair advantages for businesses willing to operate in ethical gray zones.Legal Implications and Consequences

The legal ramifications of filing false tax returns extend far beyond immediate financial penalties. By pleading guilty, the businessman acknowledged the systematic nature of his financial misconduct, which potentially exposed him to significant criminal and civil consequences. Federal tax laws are designed to ensure equitable economic participation, and deliberate attempts to circumvent these regulations carry substantial risks. The prosecution of such cases serves as a critical deterrent, signaling to other businesses the potential consequences of financial malfeasance.Broader Economic and Ethical Considerations

This case illuminates broader challenges within international business environments where regulatory oversight can be complex and inconsistent. The vehicle shipping industry, in particular, operates within a global framework that demands meticulous financial transparency and ethical conduct. The businessman's actions reflect a broader systemic issue where short-term financial gains are prioritized over long-term legal and ethical sustainability. Such approaches not only risk individual legal consequences but also contribute to erosion of trust within business ecosystems.Lessons for Business Operators

For entrepreneurs and business leaders, this case serves as a compelling reminder of the critical importance of financial integrity. Compliance is not merely a legal obligation but a fundamental aspect of sustainable business practice. Transparent financial reporting, accurate wage documentation, and adherence to tax regulations are not optional considerations but essential components of responsible business management. The potential consequences of circumventing these standards far outweigh any perceived short-term advantages.RELATED NEWS

Business

From Blueprint to Billions: How One Egyptian Entrepreneur Turned Licensing into a Manufacturing Empire

2025-03-04 21:10:24

Business

Pioneering Business Visionary Dr. Lee Bodenhamer Leaves Lasting Legacy at 90

2025-02-22 16:41:52

Business

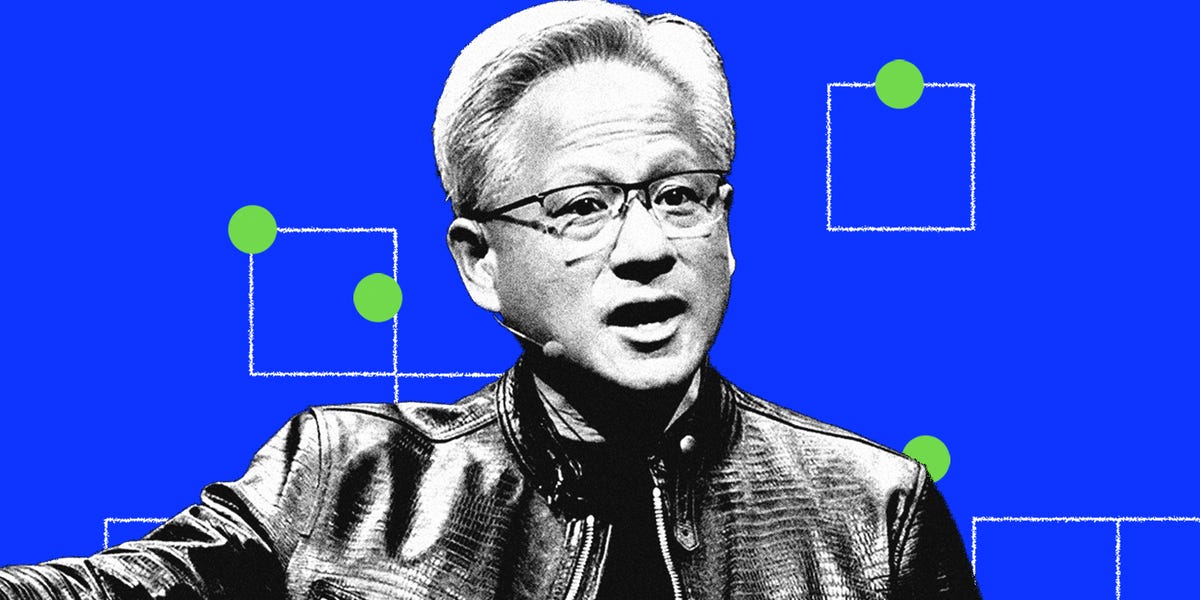

The Silicon Valley Maverick: How Jensen Huang Turned Nvidia into a Tech Titan

2025-03-18 04:30:01