Govoni Empire Crumbles: Bankruptcy Court Sets Stage for Massive 7-Company Liquidation Auction

Companies

2025-04-10 16:58:17Content

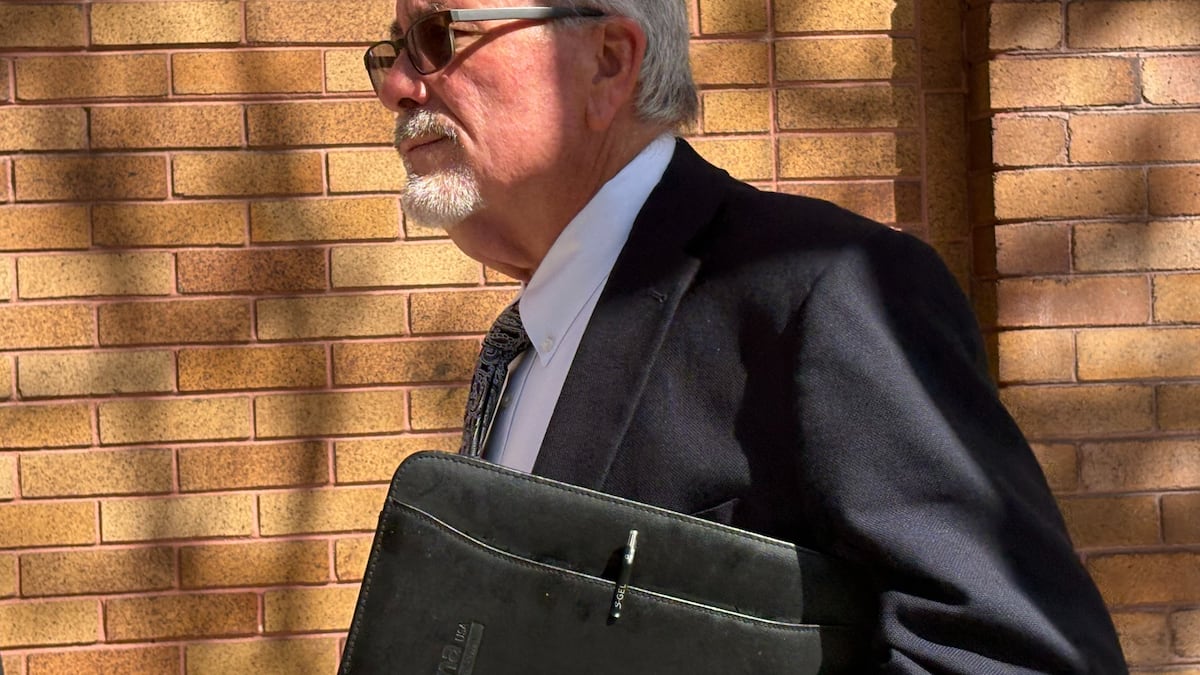

In a significant legal development, a Clearwater businessman is now facing the first asset sale amid an ongoing FBI investigation into allegations of missing trust funds. The action marks a critical turning point in what has become a complex financial saga.

The sale, which comes as federal authorities continue to scrutinize the businessman's financial activities, signals potential legal and financial consequences for the individual at the center of the probe. Investigators are meticulously examining the circumstances surrounding the alleged misappropriation of trust funds, with this asset liquidation representing an initial step in what could be a broader legal process.

Sources close to the investigation suggest that the sale is part of a strategic effort to potentially recover funds and provide transparency into the financial irregularities under examination. The businessman, whose reputation is now under intense scrutiny, faces mounting pressure from both legal authorities and potentially affected stakeholders.

While specific details remain limited, the asset sale underscores the serious nature of the FBI's ongoing investigation and the potential financial and legal ramifications for the Clearwater businessman. Authorities are expected to continue their thorough examination of the financial records and circumstances surrounding the missing trust funds.

The community and financial sector are watching closely as this case unfolds, with many anticipating further developments in the coming weeks.

Trust Fund Turmoil: Clearwater Businessman's Assets Seized in High-Stakes Financial Investigation

In the shadowy world of financial intrigue, a Clearwater businessman finds himself at the center of a dramatic unfolding narrative that threatens to expose a complex web of financial misconduct and potential legal consequences. The recent asset seizure marks a critical turning point in an ongoing investigation that has captured the attention of federal authorities and local business communities alike.Unraveling a Financial Mystery: When Trust Meets Suspicion

The Initial Probe: FBI Investigative Dynamics

The Federal Bureau of Investigation has been meticulously building a case that suggests significant irregularities in the management of trust funds. Preliminary investigations indicate a pattern of financial discrepancies that raise serious questions about the businessman's fiduciary responsibilities. Forensic financial experts have been combing through intricate financial records, tracing potential misappropriations and identifying potential systemic vulnerabilities in the trust management process. Investigators are particularly focused on understanding the mechanisms through which funds may have been diverted or misused. The complexity of financial forensics requires a multi-layered approach, involving detailed transaction analysis, cross-referencing of financial statements, and extensive interviews with potential witnesses and financial associates.Asset Seizure: Legal Mechanisms and Implications

The decision to initiate asset seizure represents a significant escalation in the investigative process. Federal authorities have strategically moved to prevent potential further financial obfuscation by immobilizing the businessman's assets. This legal maneuver serves multiple purposes: preserving potential evidence, preventing potential asset concealment, and sending a clear message about the seriousness of the ongoing investigation. Legal experts suggest that such actions are typically undertaken when investigators have accumulated substantial evidence suggesting financial impropriety. The seizure process involves complex legal protocols, requiring extensive documentation and judicial oversight to ensure that the rights of the investigated individual are simultaneously respected and scrutinized.Broader Context of Financial Trust Violations

This case is not occurring in isolation but represents part of a broader landscape of financial accountability and regulatory enforcement. Trust fund management requires an extraordinary level of ethical commitment and professional integrity. When these fundamental principles are compromised, it can have far-reaching consequences that extend beyond individual actors. The investigation highlights systemic challenges within financial oversight mechanisms. It raises critical questions about the robustness of current regulatory frameworks and the potential gaps that allow financial misconduct to emerge and potentially persist undetected for extended periods.Community and Economic Ramifications

For Clearwater's business ecosystem, this investigation represents more than a singular legal proceeding. It potentially signals deeper structural challenges within local financial practices. The ripple effects of such an investigation can impact investor confidence, institutional credibility, and the broader economic perception of the region's financial reliability. Local business leaders and community stakeholders are closely monitoring the developments, understanding that the outcome could have significant implications for future regulatory approaches and professional standards in financial management.Potential Legal Trajectories

As the investigation continues, multiple potential legal scenarios remain possible. The range of outcomes could vary from negotiated settlements to more severe criminal prosecutions, depending on the evidence accumulated and the specific nature of the financial irregularities discovered. Legal proceedings in such complex financial cases often involve intricate negotiations, potential plea bargains, and extensive documentation review. The ultimate resolution will likely depend on the comprehensiveness of the FBI's investigative work and the ability to establish clear patterns of financial misconduct.RELATED NEWS

Companies

Waynesboro Facility Gets Major Boost: McClung Companies Unveils $4.6M Expansion Plan

2025-03-28 08:30:38