TRTX Surges: Is This Real Estate Finance Stock Poised for a Breakout Rally?

Finance

2025-04-10 14:49:00Content

TPG RE Finance Trust (TRTX) experienced a notable surge in its stock price during the recent trading session, accompanied by heightened trading activity. However, investors should approach this momentum with caution, as the current trajectory of earnings estimate revisions fails to indicate sustained positive performance in the near future.

The real estate investment trust's sudden price jump has caught the attention of market watchers, but the underlying fundamentals suggest that this might be a temporary spike rather than a long-term trend. Analysts are closely monitoring the stock's potential for continued growth, with the current earnings estimates painting a somewhat tepid picture of TRTX's short-term prospects.

Investors are advised to conduct thorough research and carefully evaluate the company's financial health and market positioning before making any investment decisions. While the recent price movement may seem attractive, the underlying earnings estimates recommend a measured and strategic approach to this particular stock.

Navigating the Turbulent Waters of Real Estate Investment: TPG RE Finance Trust's Market Dynamics Unveiled

In the ever-evolving landscape of real estate finance, investors find themselves navigating a complex terrain of market fluctuations, strategic investments, and nuanced financial performance. The recent developments surrounding TPG RE Finance Trust (TRTX) offer a compelling narrative of resilience, challenge, and potential transformation in the real estate investment sector.Decoding Market Movements: When Volatility Meets Opportunity

The Unexpected Share Price Surge

The financial markets are notorious for their unpredictability, and TPG RE Finance Trust recently demonstrated this characteristic with a remarkable share price jump that caught the attention of seasoned investors and market analysts alike. This unexpected movement occurred against a backdrop of above-average trading volume, signaling significant investor interest and potential underlying market dynamics. The surge represents more than a mere numerical fluctuation; it reflects the complex interplay of investor sentiment, market perception, and the intrinsic value of real estate investment trusts. Investors and financial experts are keenly observing the nuanced signals embedded within this price movement, seeking to understand the deeper implications for the company's financial trajectory.Earnings Estimate Revisions: A Cautionary Signal

Despite the initial euphoria surrounding the share price increase, a closer examination reveals a more nuanced narrative. The recent trends in earnings estimate revisions suggest a potential moderation of the current momentum. This divergence between short-term price movement and long-term earnings projections presents a critical juncture for investors to reassess their strategic positioning. The earnings estimate revisions serve as a sophisticated barometer of future financial performance, offering insights that extend beyond surface-level market movements. Sophisticated investors understand that these revisions are not merely statistical adjustments but represent a comprehensive reassessment of the company's fundamental financial health and growth potential.Strategic Implications for Investors

The current market scenario surrounding TPG RE Finance Trust demands a multifaceted approach to investment analysis. While the share price surge might initially appear attractive, the underlying earnings estimate trends suggest a need for cautious optimism. Investors must look beyond immediate market reactions and delve deeper into the company's structural capabilities, market positioning, and long-term strategic vision. This moment represents an opportunity for strategic recalibration. Investors are encouraged to conduct thorough due diligence, examining the company's portfolio composition, risk management strategies, and ability to navigate complex real estate market dynamics. The interplay between short-term market movements and long-term financial projections requires a nuanced, sophisticated approach to investment decision-making.Market Context and Broader Implications

The developments surrounding TPG RE Finance Trust are not occurring in isolation but are part of a broader narrative of transformation in the real estate investment landscape. The current market environment is characterized by unprecedented volatility, technological disruption, and shifting economic paradigms. Investors must recognize that success in this complex ecosystem requires adaptability, strategic insight, and a willingness to challenge conventional wisdom. The recent market movements serve as a microcosm of the larger trends reshaping real estate finance, offering valuable lessons for those prepared to look beyond surface-level indicators.RELATED NEWS

Finance

Aloha Profits: Bank of Hawai'i Rides Wave of Strong Q1 Financial Performance

2025-04-21 10:45:00

Finance

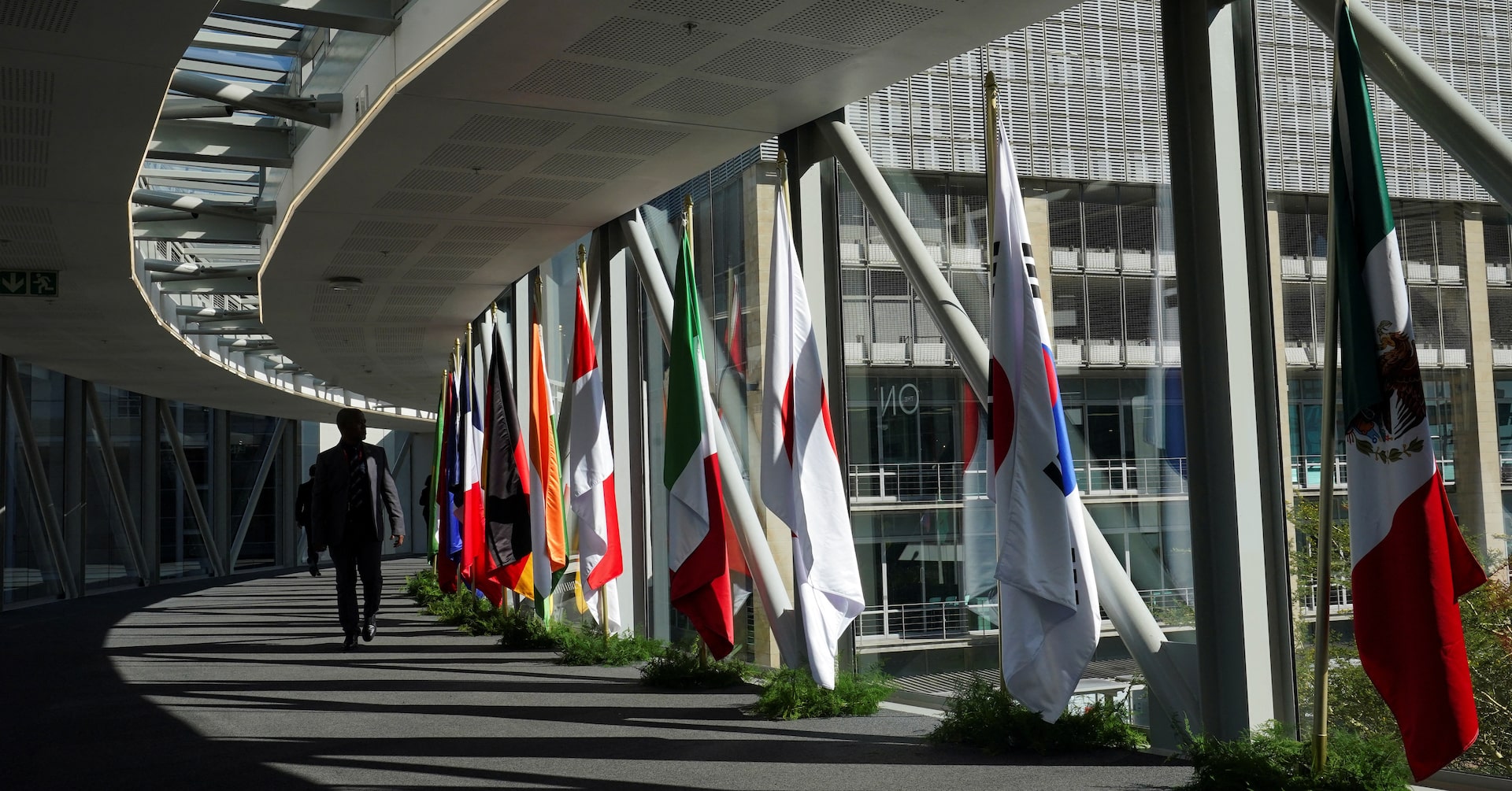

Global Economic Powerhouses Converge: G20 Finance Chiefs Brace for Turbulent Diplomatic Showdown

2025-02-26 01:09:22