Regulatory Shakeup: Sweden Dismisses Finance Watchdog Amid Conflict of Interest Scandal

Finance

2025-04-10 14:57:17Content

In a decisive move to restore public confidence, Sweden has reshuffled leadership at its financial regulatory agency following a brewing controversy over potential conflicts of interest. The government's swift action aims to quell mounting concerns and reaffirm the integrity of the country's financial oversight mechanisms.

By reassigning the head of the financial watchdog, Swedish authorities are sending a clear message about their commitment to transparency and ethical governance. The leadership change comes in response to growing public and professional scrutiny that threatened to undermine the regulator's credibility.

This strategic personnel shift is designed to rebuild trust and demonstrate that no individual is above the principles of impartiality and accountability. The government's proactive approach underscores Sweden's reputation for maintaining high standards of public administration and financial regulation.

As the new leadership takes the helm, stakeholders will be watching closely to ensure that the financial watchdog continues to operate with the utmost professionalism and independence that Sweden is known for.

Swedish Financial Oversight: A Delicate Balance of Trust and Accountability

In the intricate world of financial regulation, maintaining public confidence is paramount. When the foundations of trust begin to crumble, swift and decisive action becomes not just a choice, but a necessity. The Swedish financial landscape finds itself at a critical juncture, where institutional integrity hangs in the delicate balance of perception and reality.Navigating the Treacherous Waters of Regulatory Credibility

The Roots of Institutional Uncertainty

The Swedish government's recent maneuver to reassign the leadership of its financial watchdog reveals a complex narrative of institutional governance. Beneath the surface of this administrative shift lies a profound commitment to maintaining the highest standards of regulatory oversight. Financial institutions are the backbone of economic stability, and any hint of compromise can send ripples of uncertainty through the entire economic ecosystem. The intricate dance of regulatory management requires an unprecedented level of transparency and accountability. When conflicts of interest emerge, they threaten not just the immediate institution but the entire framework of financial trust. Sweden, known for its robust governance and transparent institutional practices, finds itself confronting a challenge that tests the very principles of its regulatory framework.Institutional Recalibration and Public Trust

The decision to reassign the head of the financial watchdog is more than an administrative reshuffling. It represents a strategic response to mounting concerns about potential conflicts of interest that could undermine the credibility of financial oversight. Such moves are not taken lightly, especially in a country renowned for its meticulous approach to institutional management. Public trust is a fragile construct, easily damaged but challenging to rebuild. By taking proactive steps to address potential vulnerabilities, the Swedish government demonstrates a commitment to maintaining the highest standards of regulatory integrity. This approach sends a powerful message to both domestic and international stakeholders about the nation's unwavering dedication to transparent financial governance.The Broader Implications of Regulatory Transparency

The current situation transcends the immediate context of a single institutional leadership change. It represents a broader conversation about the evolving nature of financial regulation in an increasingly complex global economic landscape. Modern regulatory bodies must navigate intricate challenges, balancing the need for effective oversight with the imperative of maintaining public confidence. Financial watchdogs play a critical role in protecting economic ecosystems from potential systemic risks. Their effectiveness depends not just on technical competence but on the perception of impartiality and commitment to the public interest. The Swedish case illustrates the delicate balance required to maintain this perception in an era of increasing scrutiny and rapid information dissemination.Lessons in Institutional Resilience

Sweden's approach offers valuable insights into effective institutional management. By addressing potential conflicts of interest proactively, the government demonstrates a model of responsive and responsible governance. This strategy goes beyond mere damage control, representing a forward-looking approach to maintaining institutional credibility. The reassignment of leadership serves as a powerful signal of an institution's ability to self-correct and adapt. It reinforces the principle that no individual is above the systemic integrity of the institution. Such actions build long-term trust, showing that the commitment to transparency and accountability supersedes individual interests.RELATED NEWS

Finance

Trade War Tremors: How Trump's Tariff Rollercoaster Is Derailing Stock Picking Strategies

2025-04-06 12:30:33

Finance

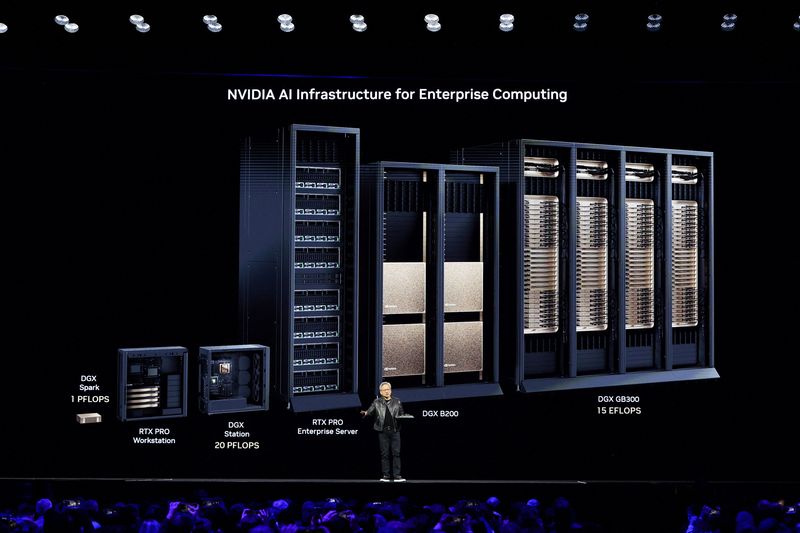

Chip Revolution: Nvidia Pledges Massive US Manufacturing Boost in Multi-Billion Dollar Expansion

2025-03-20 03:22:32

Finance

Breaking: Lincoln Financial Unveils Game-Changing Indexed Universal Life Insurance Product

2025-03-24 13:00:00