CVS Health: Defying Economic Storms with a Blockbuster 50% Surge

Health

2025-04-10 10:49:47Content

CVS Health Defies Market Turbulence with Impressive Performance

CVS Health (CVS) has emerged as a standout performer in the S&P 500 for 2025, delivering remarkable year-to-date returns that have surpassed 50%. The company has demonstrated remarkable resilience, effortlessly navigating through challenging economic landscapes including potential trade tensions and market volatility.

In recent trading, CVS has shown strong momentum, with the stock climbing 3% over the past five days and an impressive 42% surge since the start of the year. This performance stands in stark contrast to the broader market downturn that has been eroding trillions in market capitalization across major stock indices.

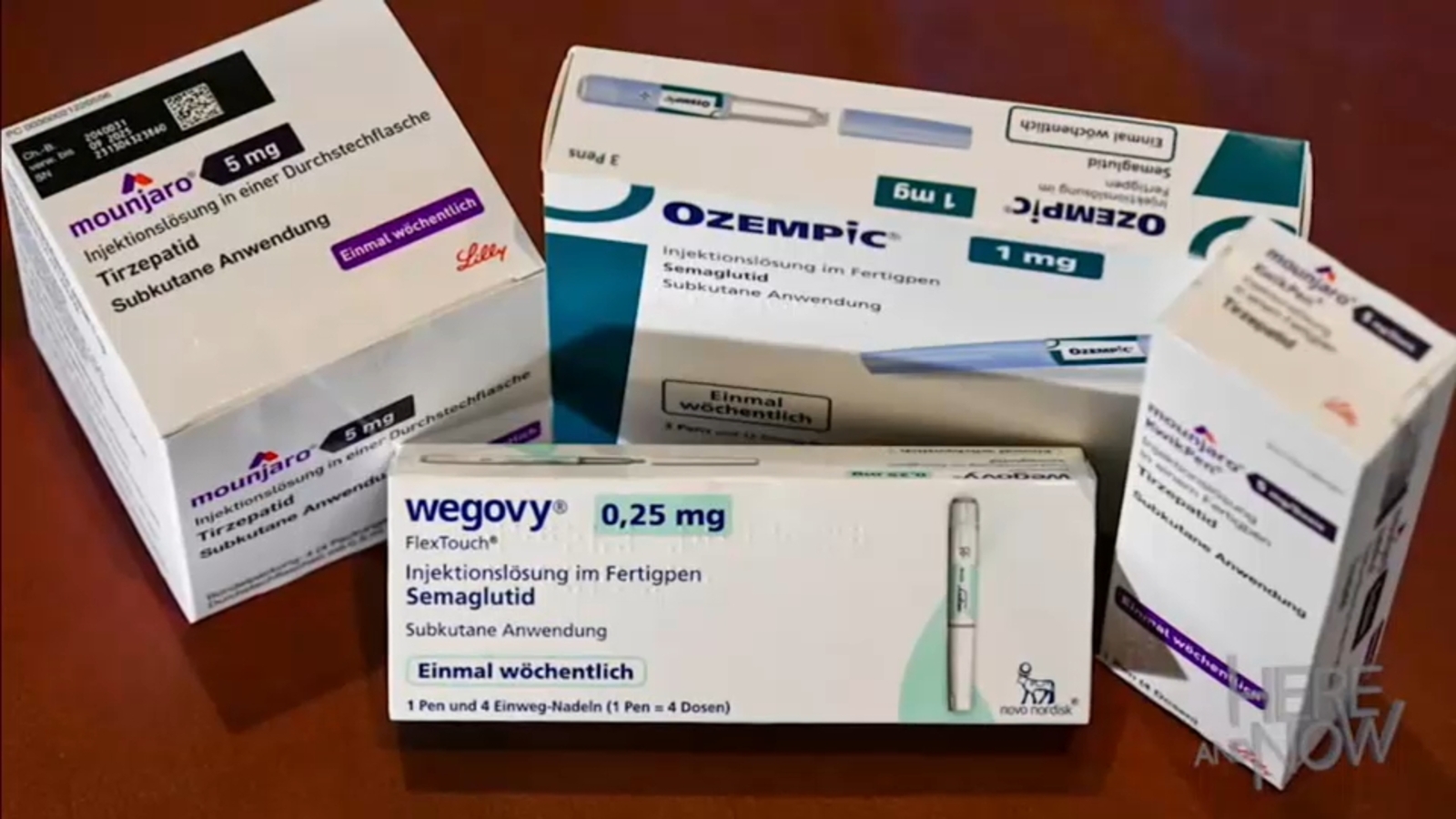

While CVS is widely recognized for its ubiquitous corner drugstores, the company has been strategically transforming its business model. The acquisition of key healthcare assets has positioned CVS as a more integrated and diversified healthcare services provider, potentially contributing to its robust stock performance.

Investors and market analysts are taking note of CVS's ability to maintain strong growth and stability in an increasingly unpredictable economic environment.

CVS Health: A Resilient Titan Defying Market Turbulence and Rewriting Healthcare Investment Strategies

In the volatile landscape of healthcare and financial markets, CVS Health emerges as a beacon of stability and strategic innovation, challenging conventional investment wisdom and demonstrating remarkable resilience amid global economic uncertainties.Navigating Market Challenges with Unprecedented Financial Fortitude

Extraordinary Performance in Challenging Economic Environments

CVS Health has distinguished itself as an extraordinary performer in the S&P 500, showcasing an impressive year-to-date return that dramatically outpaces market expectations. While global financial markets experience significant volatility and substantial index valuations have been dramatically reduced, CVS has maintained an extraordinary trajectory of growth and stability. The company's stock performance represents more than mere numerical success; it embodies a strategic approach to navigating complex economic landscapes. By demonstrating remarkable resilience against potential disruptive forces such as geopolitical tensions, trade uncertainties, and macroeconomic challenges, CVS Health has positioned itself as a robust investment vehicle.Strategic Transformation and Market Adaptation

Beyond its traditional identity as a corner drugstore chain, CVS Health has undergone a profound metamorphosis, strategically expanding its operational scope and diversifying its revenue streams. The company's transformative acquisition strategy has been instrumental in creating a more comprehensive and integrated healthcare ecosystem. By leveraging its extensive network of retail locations and embracing technological innovations, CVS has transcended the conventional pharmacy model. The organization has effectively positioned itself as a holistic healthcare solutions provider, integrating pharmaceutical services, health insurance, and digital health platforms into a cohesive and dynamic business model.Investment Dynamics and Future Potential

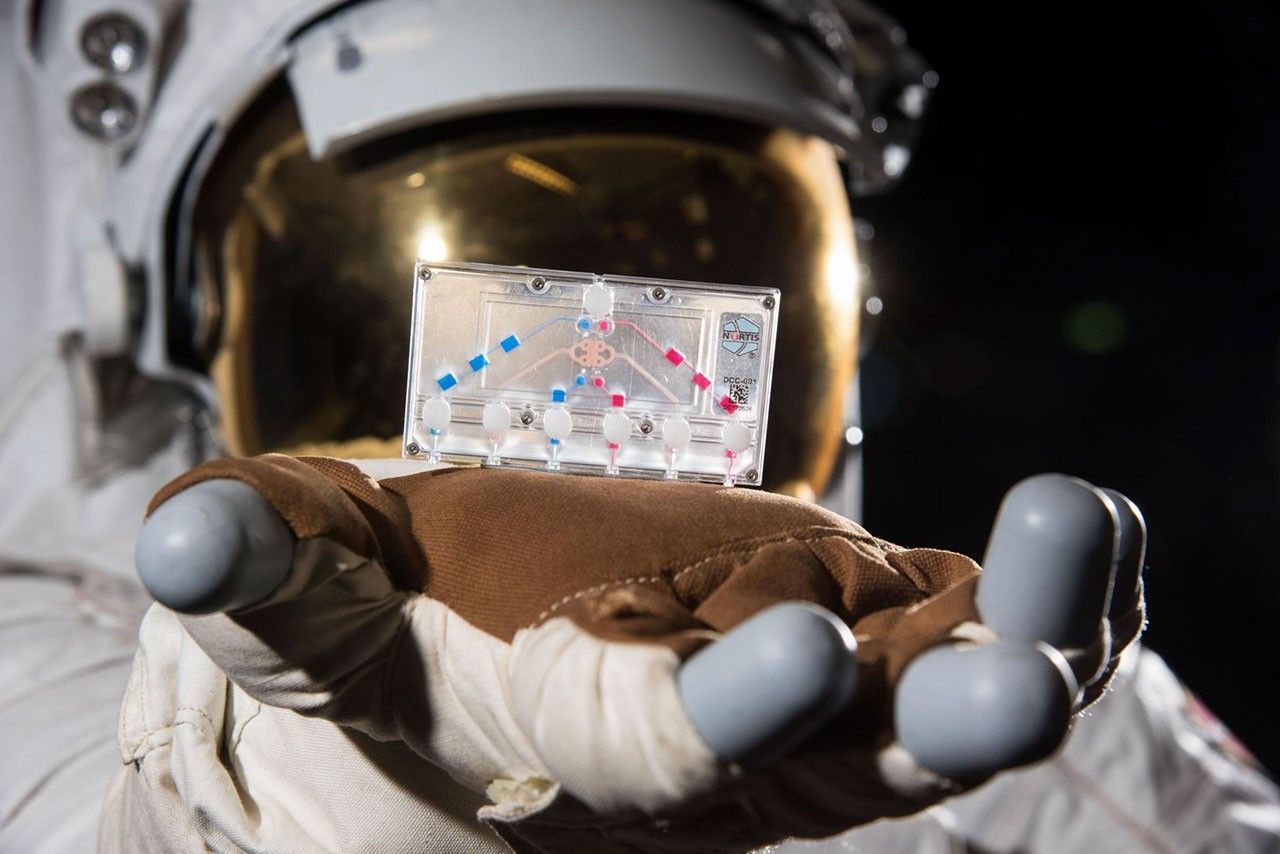

Recent market data underscores CVS Health's exceptional performance, with the stock experiencing a remarkable 42% increase since January. This substantial growth represents a compelling narrative of strategic management, operational efficiency, and adaptability in an increasingly complex healthcare landscape. The company's ability to maintain positive momentum despite global market turbulence suggests a robust underlying business strategy. Investors and market analysts are increasingly recognizing CVS Health's potential as a resilient and forward-thinking organization capable of generating consistent value.Technological Innovation and Healthcare Integration

CVS Health's success is not merely a product of traditional business strategies but also reflects its commitment to technological innovation and comprehensive healthcare integration. By embracing digital transformation and creating seamless patient experiences, the company has differentiated itself in a competitive market. The organization's approach to healthcare delivery represents a sophisticated model of vertical integration, combining pharmaceutical services, retail presence, and advanced technological solutions. This multifaceted strategy enables CVS to create unique value propositions that extend beyond conventional healthcare service models.Market Sentiment and Investor Confidence

The consistent positive performance of CVS Health has significantly bolstered investor confidence. Despite global economic uncertainties and market fluctuations, the company has maintained a strong and attractive investment profile. Institutional and individual investors alike are drawn to CVS Health's demonstrated ability to generate sustainable growth and navigate complex market dynamics. The stock's resilience serves as a testament to the company's strategic vision and operational excellence.RELATED NEWS

Inside the Pope's Health Crisis: A Medical Expert Breaks Down the Pontiff's Ongoing Challenges

:max_bytes(150000):strip_icc()/Health-GettyImages-1280517967-fa019e994f694657bacd194cfbe958e0.jpg)