Inside Asia's Corporate Powerhouses: When Founders Hold the Keys

Companies

2025-04-10 04:35:28Content

In the midst of a turbulent global economic landscape, Asian markets are experiencing unprecedented challenges as trade tensions continue to simmer and economic uncertainties loom large. The intricate dance of international commerce is being dramatically reshaped by evolving U.S. tariff policies, creating a complex and unpredictable environment for investors and businesses alike.

Amidst this volatility, a fascinating trend has emerged: growth companies with significant insider ownership are becoming beacons of potential stability. These organizations offer a unique window into market confidence, as company insiders typically possess unparalleled insights into their firm's strategic direction and future potential. Their substantial financial stake signals a profound belief in the company's trajectory, providing investors with a nuanced perspective beyond traditional market indicators.

The interplay between geopolitical tensions and corporate strategy has never been more critical. As markets fluctuate and global economic dynamics shift, companies with strong insider commitment may well represent a strategic refuge for discerning investors seeking resilience in an increasingly unpredictable world.

Navigating Market Turbulence: Insider Ownership as a Strategic Compass in Global Economic Uncertainty

In the intricate landscape of global financial markets, investors and analysts are constantly seeking reliable indicators of potential resilience and strategic opportunity. The intersection of geopolitical tensions, trade dynamics, and corporate governance has emerged as a critical focal point for understanding market behavior and potential growth trajectories.Decoding Market Confidence Through Insider Perspectives

The Geopolitical Chessboard of International Trade

The contemporary economic environment resembles a complex strategic game where nations maneuver economic policies like chess pieces. Asian markets, in particular, find themselves at the epicenter of this intricate global economic reconfiguration. The ongoing trade tensions between major economic powers have created a volatile ecosystem where traditional investment strategies are being fundamentally challenged. Multinational corporations are increasingly required to develop adaptive strategies that can withstand rapid geopolitical shifts. The ability to pivot quickly, understand nuanced market signals, and maintain operational flexibility has become paramount for sustainable growth. Investors are now looking beyond traditional financial metrics, seeking deeper insights into corporate resilience and strategic positioning.Insider Ownership: A Window into Corporate Confidence

Insider ownership represents more than just a financial statistic; it's a profound indicator of internal organizational sentiment and strategic outlook. When company executives and board members maintain significant equity stakes, it signals a robust confidence in the organization's future potential. These insider investments transcend mere financial transactions. They represent a tangible commitment to the company's vision, strategic direction, and long-term value creation. Sophisticated investors recognize that substantial insider ownership can mitigate risks associated with short-term market fluctuations and provide a more stable investment landscape.Economic Resilience in Uncertain Times

The current global economic paradigm demands a nuanced approach to understanding market dynamics. Companies with high insider ownership often demonstrate remarkable adaptability and strategic foresight. These organizations tend to make more calculated decisions, prioritizing sustainable growth over short-term gains. By maintaining significant personal financial stakes, insiders are inherently motivated to drive organizational performance. This alignment of personal and corporate interests creates a powerful mechanism for strategic decision-making that can potentially outperform market expectations during periods of economic uncertainty.Strategic Implications for Investors

Investors seeking to navigate the complex global economic landscape must develop sophisticated analytical frameworks. Insider ownership provides a unique lens through which to evaluate corporate potential, offering insights that traditional financial analysis might overlook. The correlation between insider investment and organizational performance suggests that companies with meaningful insider stakes are more likely to maintain strategic discipline, invest in long-term growth initiatives, and demonstrate greater resilience during market turbulence. This approach represents a more holistic investment strategy that goes beyond quarterly financial reporting.Technological and Regulatory Considerations

The evolving regulatory environment and technological disruptions further complicate the global economic landscape. Companies with strong insider ownership are often better positioned to anticipate and adapt to these transformative changes. Their deep institutional knowledge and strategic commitment enable more agile responses to emerging challenges and opportunities. Advanced data analytics and real-time monitoring technologies are increasingly enabling more sophisticated tracking of insider transactions, providing investors with unprecedented transparency and insights into corporate strategic thinking.RELATED NEWS

Companies

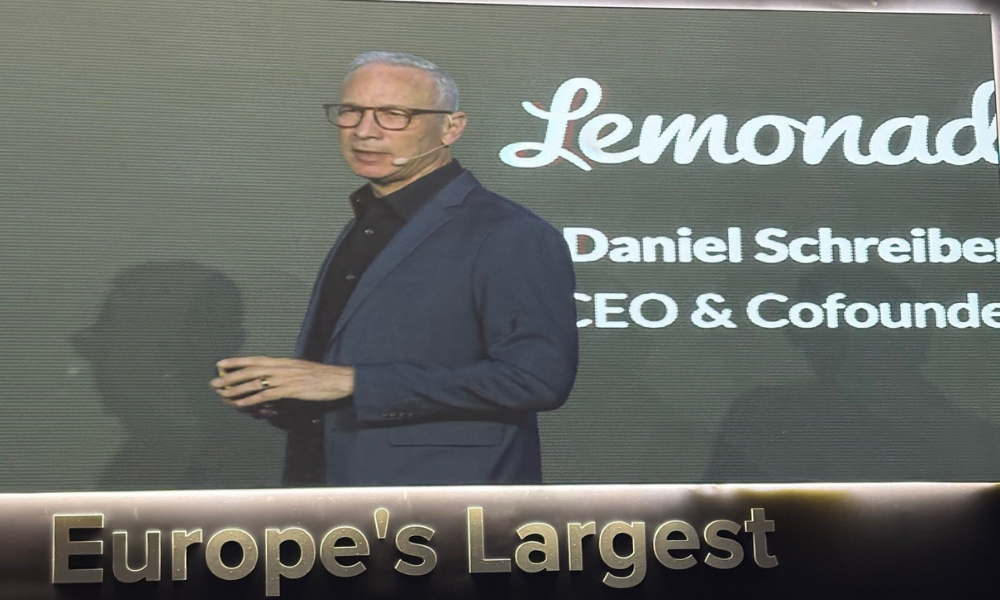

AI Revolution: Lemonade CEO Predicts Massive Insurance Industry Meltdown

2025-03-20 15:17:31

Companies

Ethics Champions: Clarios Clinches Global Recognition for Third Straight Year

2025-03-11 08:02:00

Companies

Rocket Fuel: The 50 Companies Supercharging New England's Economic Engine

2025-03-20 09:30:00