Breaking: Fixed Income's Secret Weapon Could Unlock DeFi's Mass Market, Treehouse CEO Reveals

Finance

2025-02-21 07:36:30Content

In a recent industry insight, Brandon Goh, CEO of Treehouse, shed light on a transformative potential within decentralized finance (DeFi): the promising landscape of fixed income investments. Goh emphasized that fixed income could be the critical catalyst driving institutional investors toward broader DeFi adoption.

By highlighting the strategic importance of stable, predictable returns in the volatile crypto ecosystem, Goh underscores how fixed income mechanisms can bridge the gap between traditional financial expectations and the innovative world of blockchain-based investments. His perspective suggests that as DeFi matures, sophisticated fixed income products could provide the reliability and risk management institutional investors typically seek.

The commentary signals a pivotal moment for DeFi, indicating that the sector is evolving beyond speculative trading towards more structured, sustainable financial models. With fixed income emerging as a potential game-changer, the path to mainstream institutional engagement appears increasingly promising.

Revolutionizing Financial Horizons: The Transformative Potential of Fixed Income in Decentralized Finance

In the rapidly evolving landscape of digital finance, a groundbreaking shift is emerging that promises to reshape how institutional investors perceive and engage with decentralized financial ecosystems. The intersection of traditional financial principles and cutting-edge blockchain technology is creating unprecedented opportunities for innovation, transparency, and financial democratization.Unlocking Institutional Potential: The Future of Decentralized Financial Strategies

The Paradigm Shift in Financial Infrastructure

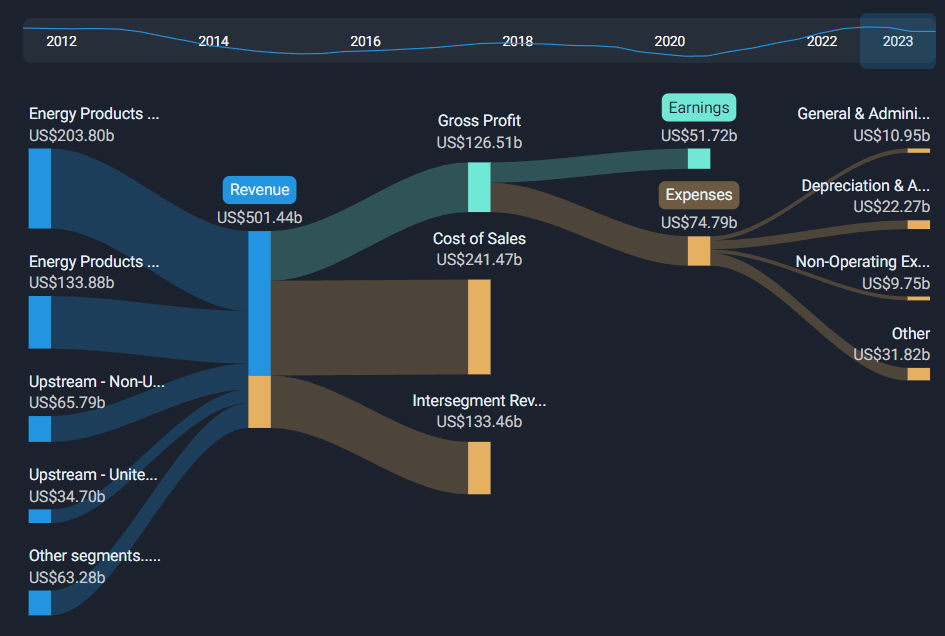

The decentralized finance (DeFi) sector stands at a critical juncture, with fixed income mechanisms emerging as a potential game-changer for institutional adoption. Traditional financial institutions have long been hesitant to fully embrace blockchain-based financial systems, primarily due to concerns about volatility, regulatory uncertainty, and technological complexity. However, the introduction of sophisticated fixed income products is rapidly changing this narrative. Fixed income instruments in the DeFi ecosystem represent a revolutionary approach to generating stable returns. Unlike traditional cryptocurrency investments characterized by extreme volatility, these mechanisms offer a more predictable and structured investment framework. By implementing advanced risk management protocols and creating sophisticated yield-generating strategies, DeFi platforms are demonstrating their ability to compete with and potentially outperform traditional financial instruments.Technological Innovation Driving Institutional Confidence

The emergence of robust fixed income solutions is not merely a technological novelty but a fundamental reimagining of financial infrastructure. Advanced smart contract technologies enable unprecedented levels of transparency, automated compliance, and real-time settlement mechanisms that traditional financial systems cannot match. These technological capabilities are increasingly attracting sophisticated institutional investors who seek more efficient and transparent investment vehicles. Blockchain's inherent characteristics of immutability, decentralization, and programmability provide a unique value proposition for fixed income products. Smart contracts can automatically manage complex financial agreements, reducing counterparty risks and eliminating intermediary costs. This technological innovation represents a significant leap forward in creating more accessible and efficient financial systems.Economic Implications and Market Transformation

The integration of fixed income strategies within decentralized finance signals a profound economic transformation. By providing stable, predictable returns in a traditionally volatile cryptocurrency market, these mechanisms are bridging the gap between traditional finance and blockchain-based ecosystems. Institutional investors are recognizing the potential for diversification, risk mitigation, and enhanced yield generation. Moreover, the global accessibility of these financial instruments democratizes investment opportunities. Individuals and institutions from diverse geographical backgrounds can now participate in sophisticated financial strategies that were previously restricted to elite financial circles. This unprecedented level of financial inclusion represents a fundamental shift in how we conceptualize investment and wealth generation.Regulatory Landscape and Future Outlook

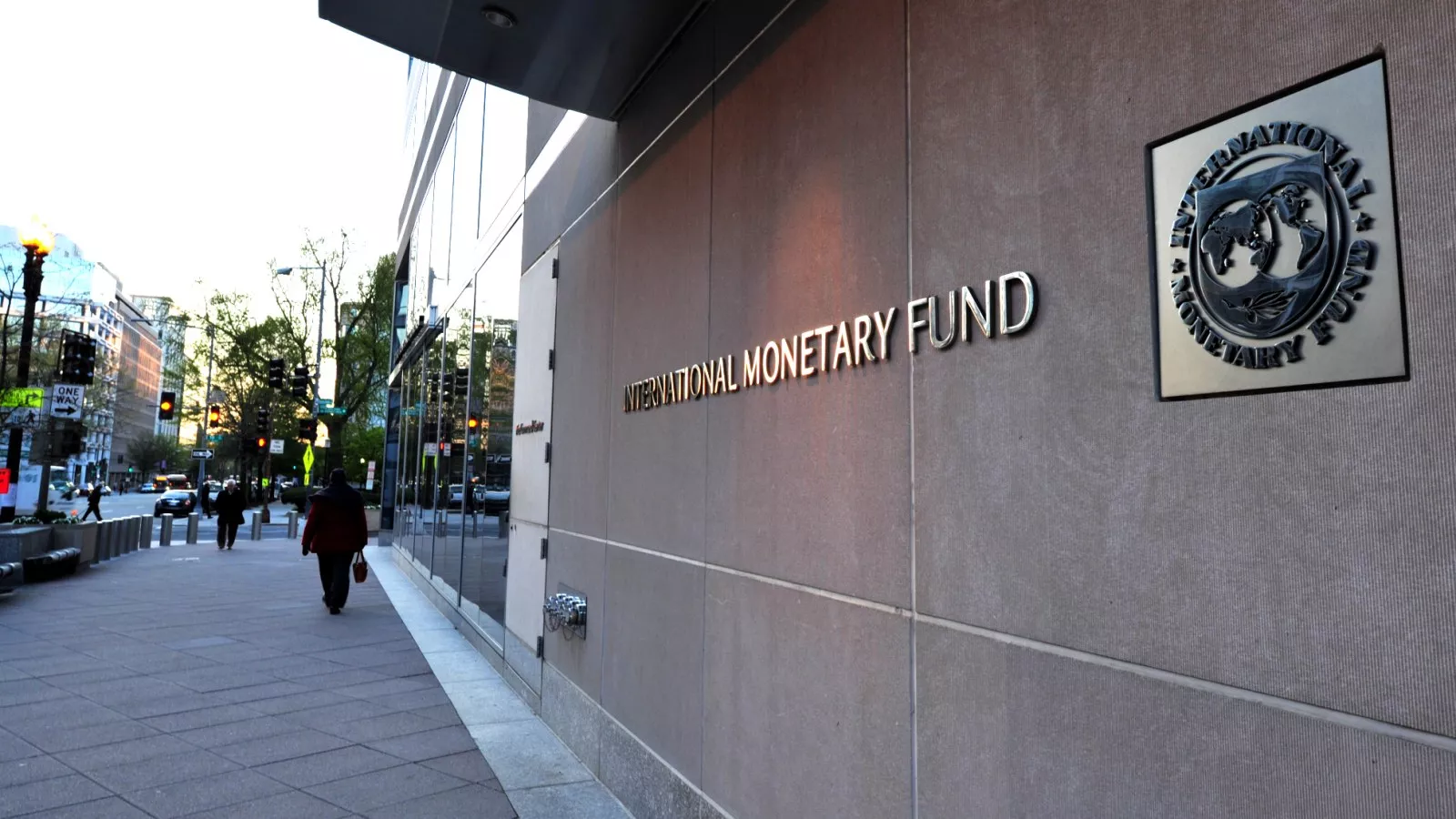

As fixed income mechanisms in DeFi continue to mature, regulatory frameworks are evolving to accommodate these innovative financial products. Governments and financial regulators worldwide are increasingly engaging with blockchain technologies, recognizing their potential to create more transparent and efficient financial systems. The ongoing development of comprehensive regulatory guidelines will be crucial in determining the long-term trajectory of fixed income in decentralized finance. Institutional investors are closely monitoring these developments, understanding that clear regulatory frameworks will be essential for widespread adoption and mainstream integration.Strategic Implications for Financial Institutions

Financial institutions that proactively explore and integrate DeFi fixed income strategies will likely gain significant competitive advantages. By understanding and leveraging these emerging technologies, organizations can position themselves at the forefront of financial innovation. The ability to offer sophisticated, blockchain-based investment products will become an increasingly important differentiator in the global financial marketplace. The journey of fixed income in decentralized finance represents more than a technological trend—it is a fundamental reimagining of financial infrastructure, promising greater efficiency, transparency, and accessibility for investors worldwide.RELATED NEWS

Finance

Campaign Finance Board Delivers Unexpected Ruling on NYC Political Funding

2025-04-16 00:25:13

Finance

Galantas Gold Unveils Stellar Financial Performance: A Year of Triumph in 2024

2025-04-30 06:00:00

Finance

Wall Street Trembles: Tech Stocks Drag Indexes Down in Dramatic Market Meltdown

2025-03-10 13:30:40