Wall Street Whiplash: Bond Markets Reel in Trump's Unexpected Political Resurgence

Finance

2025-04-08 19:20:16Content

The recent dramatic spike in long-term Treasury yields has emerged as yet another striking illustration of the unusual market dynamics following what some are calling Trump's tariff-driven "Liberation Day". Financial markets have been experiencing unprecedented volatility, with investors scrambling to interpret the complex economic signals triggered by recent trade policy shifts.

The surge in Treasury yields reflects growing uncertainty and potential reshaping of global investment strategies in response to escalating trade tensions. Traders and economists are closely monitoring these movements, recognizing them as potential harbingers of broader economic transformations that could ripple through global financial systems.

As markets continue to digest the implications of recent policy changes, the Treasury yield landscape serves as a critical barometer of investor sentiment and economic expectations. The unprecedented nature of these market reactions underscores the profound impact of geopolitical and trade policy decisions on financial markets.

Financial Tremors: Unraveling the Unprecedented Treasury Yield Surge in Post-Tariff America

In the complex landscape of global financial markets, recent developments have sent shockwaves through economic corridors, challenging traditional understanding of market dynamics and investor sentiment. The unprecedented movement in long-term Treasury yields represents more than a mere statistical fluctuation—it signals a profound transformation in economic perception and strategic positioning.Navigating Unprecedented Market Turbulence: A Deep Dive into Treasury Yield Dynamics

The Geopolitical Catalyst: Understanding Tariff-Induced Market Shifts

The implementation of tariffs has historically been a potent instrument of economic policy, capable of triggering cascading effects across financial ecosystems. In the current economic climate, these trade interventions have precipitated a remarkable recalibration of investor strategies, particularly within the bond market. Sophisticated investors are now meticulously reassessing risk profiles, with long-term Treasury yields emerging as a critical barometer of underlying economic tensions. Institutional analysts have observed nuanced shifts in market sentiment, where traditional hedging mechanisms are being rapidly reevaluated. The interplay between geopolitical decisions and financial market responses has never been more intricate, suggesting a complex web of interconnected economic variables.Decoding the Treasury Yield Phenomenon: Economic Implications and Investor Psychology

The surge in long-term Treasury yields transcends mere numerical movement—it represents a profound psychological recalibration within financial markets. Investors are simultaneously navigating uncertainty and seeking strategic positioning, creating a dynamic environment characterized by heightened volatility and strategic repositioning. Economic indicators suggest that this yield surge is not an isolated incident but part of a broader narrative of economic transformation. The intricate dance between monetary policy, geopolitical tensions, and investor sentiment has created a uniquely complex market landscape that demands sophisticated analytical approaches.Market Resilience and Adaptive Strategies in Turbulent Times

Financial markets have consistently demonstrated remarkable adaptability, and the current scenario is no exception. Institutional investors are developing nuanced strategies that incorporate multiple contingency frameworks, recognizing that traditional risk management models may prove insufficient in this unprecedented environment. The Treasury yield movement serves as a critical signal, offering insights into broader economic expectations and potential future trajectories. Sophisticated market participants are leveraging advanced analytical tools to decode these signals, seeking competitive advantages in an increasingly complex global economic ecosystem.Global Economic Interconnectedness: Beyond Domestic Market Dynamics

The current financial landscape cannot be understood through a purely domestic lens. Global economic interconnectedness means that seemingly localized events can trigger widespread reverberations. The Treasury yield surge is symptomatic of broader international economic recalibrations, reflecting complex interactions between trade policies, monetary strategies, and investor perceptions. Emerging market dynamics, technological disruptions, and evolving geopolitical relationships are all contributing to this intricate economic tapestry. The Treasury yield movement represents just one visible manifestation of these profound underlying transformations.Technological Innovation and Financial Market Evolution

Advanced algorithmic trading, real-time data analytics, and machine learning are revolutionizing how financial markets interpret and respond to economic signals. The Treasury yield surge demonstrates the increasing sophistication of market mechanisms, where traditional human intuition is complemented—and sometimes supplanted—by computational analysis. Investors and policymakers must now navigate a landscape where technological innovation and economic strategy are inextricably linked, requiring continuous adaptation and learning.RELATED NEWS

Finance

Green Energy Giant: Power Finance Corp Backs Adani's $1B Renewable Lifeline

2025-03-03 12:54:45

Finance

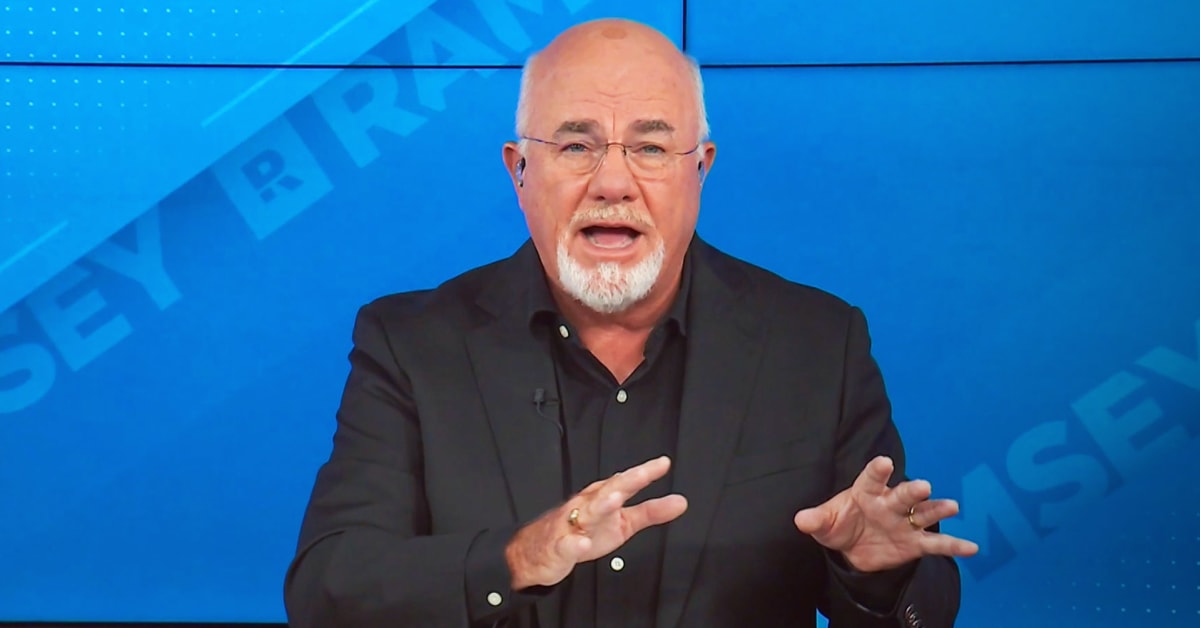

Homebuying Pitfall: Dave Ramsey Reveals the Critical Error Draining Your Wallet

2025-05-03 15:17:00

Finance

Trade Tensions Escalate: Trump-Xi Summit Unlikely as Ackman Suggests China Tariff Timeout

2025-05-05 15:53:33