Money Mavens Reveal: The Shocking Financial Wisdom That Defies Common Sense

Finance

2025-04-08 11:00:00Content

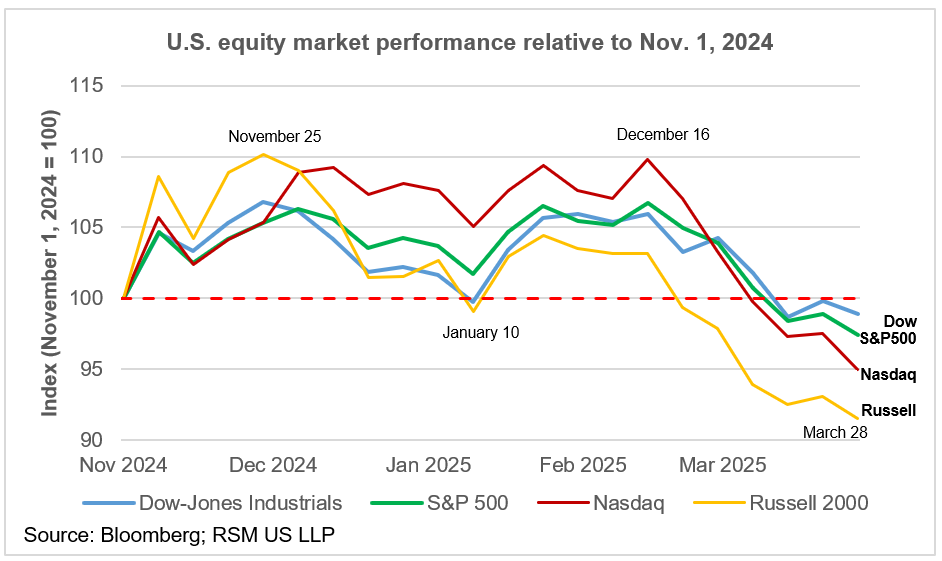

When markets plummet, the instinct to panic and make hasty investment decisions can be overwhelming. Your heart races, palms sweat, and every financial news alert feels like a personal attack on your portfolio. Yet, paradoxically, doing nothing is often the most strategic response during market turbulence.

Seasoned investors understand that market volatility is not a signal to abandon ship, but an opportunity to demonstrate emotional discipline. Knee-jerk reactions like selling in a panic or making impulsive trades can lock in losses and derail long-term financial strategies. Instead, maintaining a calm, rational approach allows you to weather the storm and potentially benefit from market recovery.

This doesn't mean being passive. It means being purposeful. Review your investment strategy, ensure your asset allocation remains aligned with your goals, and remember that historically, markets have always rebounded after downturns. Your patience and composure can be your greatest financial assets during challenging economic times.

The key is perspective: short-term market fluctuations are noise, while your long-term investment strategy is the signal. Stay focused, stay disciplined, and trust in your carefully crafted financial plan.

Navigating Market Volatility: The Counterintuitive Power of Patience in Investing

In the tumultuous world of financial markets, investors often find themselves gripped by an overwhelming impulse to take immediate action when confronted with dramatic market downturns. The psychological pressure to do something—anything—can be intense, driving even seasoned investors to make rash decisions that could potentially undermine their long-term financial strategies.Mastering Your Emotions: The Ultimate Investment Strategy

The Psychological Battlefield of Investment Decision-Making

The human brain is hardwired to respond to perceived threats with immediate action. When stock markets plummet, our instinctive fight-or-flight response kicks into overdrive, compelling us to protect our financial assets through hasty maneuvers. However, this visceral reaction often contradicts the most fundamental principles of sound investment strategy. Professional investors and financial experts consistently emphasize that emotional decision-making is the most significant risk to long-term wealth accumulation. Neuroscientific research reveals that market panic triggers the same neural pathways as physical danger, flooding our system with stress hormones that cloud rational judgment. This biochemical cocktail can transform rational investors into reactive participants, potentially sacrificing years of carefully constructed investment portfolios in moments of panic-driven impulse.Understanding Market Cycles: The Invisible Rhythms of Financial Ecosystems

Financial markets operate like complex, adaptive systems with inherent cyclical patterns that transcend momentary fluctuations. Historical data consistently demonstrates that markets have consistently recovered and expanded following significant downturns. The most successful investors view market volatility not as a threat, but as an opportunity for strategic repositioning and long-term value acquisition. Sophisticated investors understand that attempting to time market movements precisely is a futile endeavor. The cumulative evidence from decades of financial research suggests that maintaining a disciplined, diversified investment approach yields substantially better results than reactive trading strategies.Risk Mitigation Through Strategic Inaction

Counterintuitively, doing nothing during market turbulence can be the most proactive strategy available. By resisting the urge to liquidate investments or make dramatic portfolio adjustments, investors protect themselves from several critical risks: transaction costs, potential tax implications, and the near-impossible challenge of perfectly timing market re-entry. Professional portfolio managers often emphasize the importance of maintaining a long-term perspective. Short-term market fluctuations represent mere ripples in the broader economic ocean, and knee-jerk reactions can transform temporary volatility into permanent capital loss.Psychological Resilience: The Invisible Investment Superpower

Developing emotional discipline represents a critical yet often overlooked investment skill. The ability to remain calm and rational during market turbulence distinguishes successful investors from those perpetually caught in cycles of financial anxiety. This psychological resilience requires continuous self-awareness, ongoing financial education, and a commitment to strategic thinking. Meditation practices, financial literacy programs, and working with professional financial advisors can help investors cultivate the mental fortitude necessary to navigate complex market landscapes without succumbing to emotional impulses.Building a Robust Investment Philosophy

Creating a robust investment philosophy transcends mere technical knowledge. It involves developing a holistic approach that integrates personal financial goals, risk tolerance, and a nuanced understanding of market dynamics. This approach requires continuous learning, adaptability, and a willingness to challenge existing assumptions about investment strategies. By embracing patience, maintaining diversification, and viewing market volatility as an inherent feature rather than an anomaly, investors can transform potential financial stress into opportunities for strategic growth and long-term wealth accumulation.RELATED NEWS

Finance

Trailblazers Unveiled: Capturing the Moments of Latin America's Finance Queens

2025-03-12 18:26:58

Finance

Profits Surge: New Mountain Finance Reveals Stellar Year-End Performance for 2024

2025-02-26 21:23:00