Market Pulse: European Stocks Hiding Untapped Potential in 2025

Companies

2025-04-08 05:07:46Content

Navigating Market Turbulence: European Stocks Face Challenging Landscape

European financial markets are experiencing significant turbulence as unprecedented U.S. trade tariffs send shockwaves through investment landscapes. The STOXX Europe 600 index has plummeted, marking its most substantial decline in half a decade, signaling profound economic uncertainty and mounting inflationary challenges.

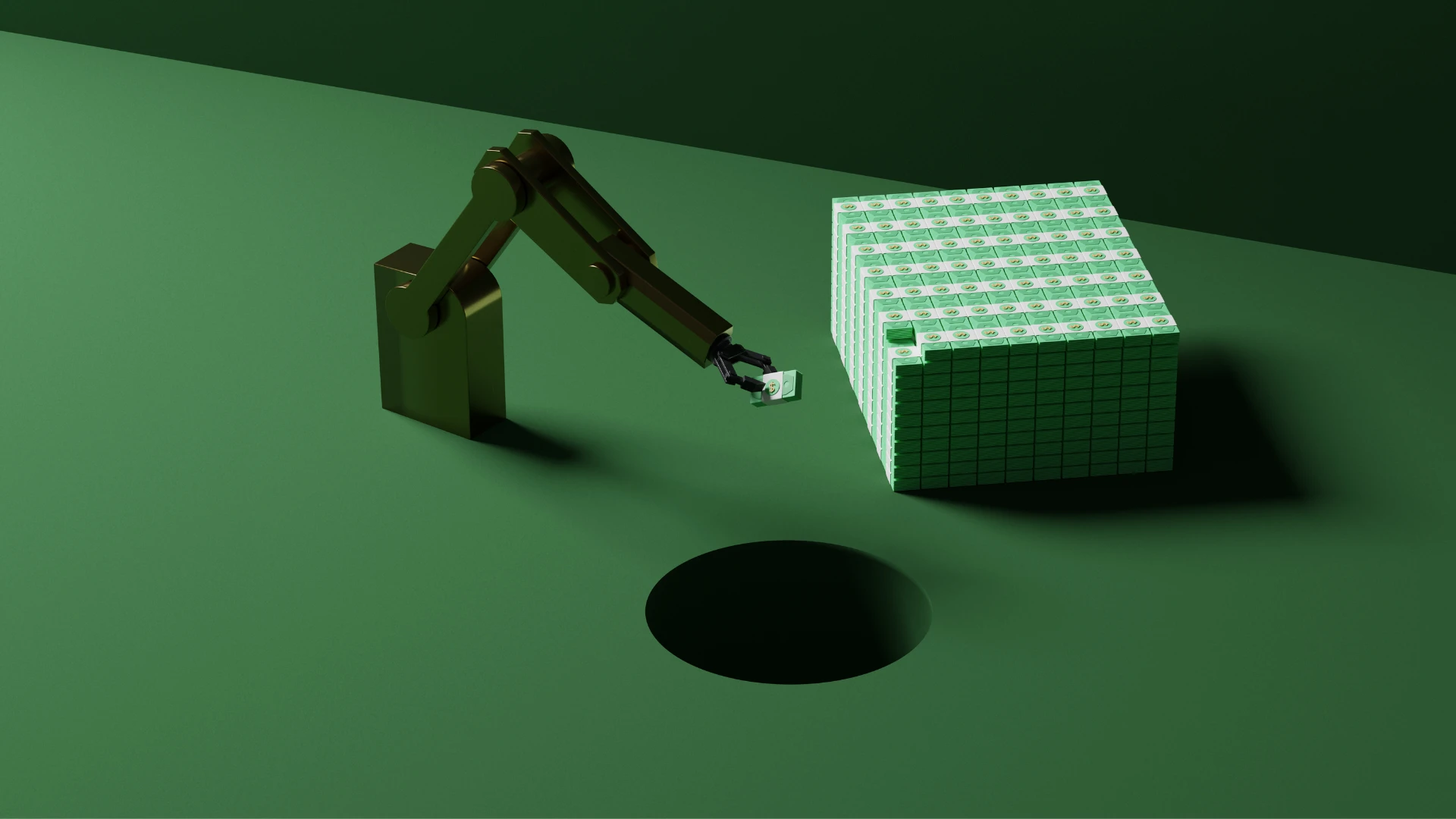

Amid this complex market environment, savvy investors are seeking strategic opportunities hidden within the volatility. Identifying potentially undervalued stocks becomes crucial, with discerning investors focusing on companies demonstrating robust fundamental strengths and promising growth trajectories that have yet to be fully recognized by broader market sentiment.

The current economic climate demands a nuanced approach, where careful analysis and strategic positioning can transform market challenges into potential investment advantages. Sophisticated investors are closely examining companies with resilient business models, strong balance sheets, and innovative capabilities that might offer attractive entry points during this turbulent period.

As global trade dynamics continue to evolve and market pressures intensify, understanding the intricate interplay between geopolitical factors, economic indicators, and corporate performance becomes paramount for making informed investment decisions.

Market Tremors: Navigating the Turbulent Landscape of Global Trade and Investment Opportunities

In an era of unprecedented economic volatility, investors find themselves standing at a critical crossroads, where traditional market wisdom collides with emerging global dynamics. The intricate dance of international trade, geopolitical tensions, and economic uncertainties creates a complex landscape that demands strategic insight and nuanced understanding.Unraveling Market Complexities: Your Guide to Strategic Investment in Uncertain Times

The Shifting Tectonic Plates of Global Economic Dynamics

The contemporary financial ecosystem is experiencing seismic shifts that challenge conventional investment paradigms. European markets are witnessing unprecedented transformations, driven by multifaceted pressures that extend far beyond traditional economic indicators. Trade tariffs, once considered mundane regulatory mechanisms, have emerged as powerful instruments reshaping global economic interactions. Sophisticated investors recognize that these disruptions are not mere temporary fluctuations but fundamental restructurings of international economic relationships. The cascading effects of trade policies ripple through complex global supply chains, creating both unprecedented challenges and hidden opportunities for those prepared to navigate these turbulent waters.Decoding Market Signals: Beyond Surface-Level Economic Indicators

Beneath the surface of headline-grabbing market indices lies a nuanced narrative of economic resilience and strategic repositioning. The STOXX Europe 600's recent performance is not just a statistical anomaly but a profound reflection of deeper systemic transformations occurring across international markets. Investors who can decode these subtle market signals stand to gain significant strategic advantages. By understanding the intricate interplay between geopolitical tensions, trade policies, and market sentiments, sophisticated market participants can identify undervalued assets that possess robust fundamental strengths and exceptional growth potential.Strategic Investment Approaches in a Volatile Landscape

Navigating the current economic environment requires a multidimensional approach that transcends traditional investment methodologies. Successful strategies demand a holistic understanding of global economic ecosystems, combining rigorous analytical frameworks with adaptive thinking. Institutional investors and individual market participants must develop sophisticated risk management techniques that account for the increasing complexity of international trade dynamics. This involves not just monitoring economic indicators but developing predictive models that can anticipate potential market disruptions and identify emerging opportunities.The Human Element: Psychological Dimensions of Market Adaptation

Beyond quantitative analysis, successful market navigation requires a profound understanding of the psychological dimensions of economic behavior. The current market environment demands emotional intelligence, strategic patience, and the ability to maintain composure amid seemingly chaotic economic landscapes. Investors who can cultivate a balanced perspective, combining analytical rigor with psychological resilience, are better positioned to transform market uncertainties into strategic advantages. This approach requires continuous learning, adaptability, and a willingness to challenge existing investment paradigms.RELATED NEWS

Companies

Corporate Royalty: Georgia's Business Titans Top the 'Most Envied' Leadership Chart

2025-04-11 10:50:44

Companies

Toy Titan Mattel Sounds Alarm: Tariff Tensions Could Squeeze Playtime Prices

2025-05-05 22:57:51

:max_bytes(150000):strip_icc()/DentalInsurance-Roundups-BestDentalInsuranceCompaniesforOlderAdults1-a656f23966da4f559faf38674512f3da.png)