Fiscal Alarm: Japan's Kato Signals Potential Financial Pressure from Rising Bond Yields

Finance

2025-02-21 00:57:02Content

Japan's financial landscape is facing mounting pressure as government bond yields continue to climb, signaling potential challenges for the country's already strained fiscal situation. Finance Minister Shunichi Suzuki raised concerns about the escalating bond yields, which recently reached a 15-year peak for the 10-year benchmark.

The surge in bond yields represents a significant shift in Japan's long-standing low-interest environment, potentially threatening the government's delicate financial balance. With yields climbing to levels not seen since 2008, policymakers are closely monitoring the potential ripple effects on public spending, debt management, and overall economic stability.

This development comes at a critical time for Japan, which has traditionally maintained an ultra-loose monetary policy. The rising yields could force the government to reassess its financial strategies and potentially implement more conservative fiscal approaches to mitigate potential economic risks.

As investors and economists watch these developments closely, the finance minister's warning underscores the complexity of Japan's economic challenges and the delicate balance required to maintain fiscal health in an increasingly volatile global financial landscape.

Japan's Financial Tightrope: Bond Yields Spark Economic Anxiety

In the intricate landscape of global financial markets, Japan finds itself navigating a precarious economic terrain. The nation's financial stability hangs in the balance as government bond yields surge to unprecedented levels, sending ripples of concern through economic corridors and raising critical questions about the country's fiscal resilience.Navigating Uncertain Economic Waters: A Critical Financial Crossroads

The Rising Tide of Bond Market Volatility

Japan's financial ecosystem is experiencing unprecedented turbulence as government bond yields climb to their highest point in over a decade and a half. This dramatic shift represents more than just a numerical change; it signals a profound transformation in the country's economic landscape. Financial experts are closely monitoring these developments, recognizing that each percentage point represents potential systemic challenges that could reshape Japan's economic strategy. The bond market's current trajectory suggests a complex interplay of multiple economic factors. Institutional investors, central bank policies, and global economic trends are converging to create a uniquely challenging environment. The 10-year benchmark yield's ascent is not merely a statistical anomaly but a potential harbinger of significant structural changes in Japan's financial infrastructure.Fiscal Pressures and Structural Challenges

Finance Minister Shunichi Suzuki's warning resonates with deep-seated concerns about Japan's fiscal sustainability. The nation's already strained financial framework faces mounting pressure from these escalating bond yields. Decades of economic stagnation, coupled with massive public debt and an aging population, have created a perfect storm of fiscal complexity. The potential implications extend far beyond immediate market reactions. Japan's economic policy must now navigate a delicate balance between maintaining economic stimulus and preventing unsustainable debt accumulation. This requires unprecedented levels of strategic financial management and potentially radical policy interventions.Global Economic Context and Comparative Analysis

Japan's current financial scenario cannot be understood in isolation. The global economic landscape is experiencing significant transformations, with central banks worldwide reassessing monetary policies. Comparative analysis reveals that Japan's challenges are both unique and emblematic of broader international economic trends. Emerging market dynamics, geopolitical tensions, and technological disruptions are creating an increasingly unpredictable economic environment. Japan's response to these bond yield challenges could potentially serve as a critical case study for other nations facing similar fiscal pressures.Technological Innovation and Economic Resilience

Beyond traditional economic metrics, Japan's renowned technological innovation might offer unexpected solutions to its financial challenges. The nation's robust technological ecosystem could provide novel approaches to economic management, potentially transforming fiscal constraints into opportunities for strategic reinvention. Artificial intelligence, advanced financial modeling, and innovative economic strategies could help Japan navigate its current financial complexities. The intersection of technological prowess and economic policy might reveal unprecedented pathways to fiscal stability and growth.Long-term Implications and Strategic Considerations

The current bond yield scenario represents more than a momentary economic fluctuation. It signals a potential fundamental restructuring of Japan's economic framework. Policymakers, financial institutions, and global investors are closely analyzing every nuance of this developing situation. Strategic adaptability will be crucial. Japan must leverage its historical economic resilience, technological innovation, and global economic relationships to chart a sustainable path forward. The coming months and years will be critical in determining whether the nation can transform these challenges into opportunities for economic revitalization.RELATED NEWS

Finance

Brexit Fallout: UK Treasury Chief Signals Potential EU Rapprochement, Flags Devastating Trade Tariff Risks

2025-04-12 21:09:04

Finance

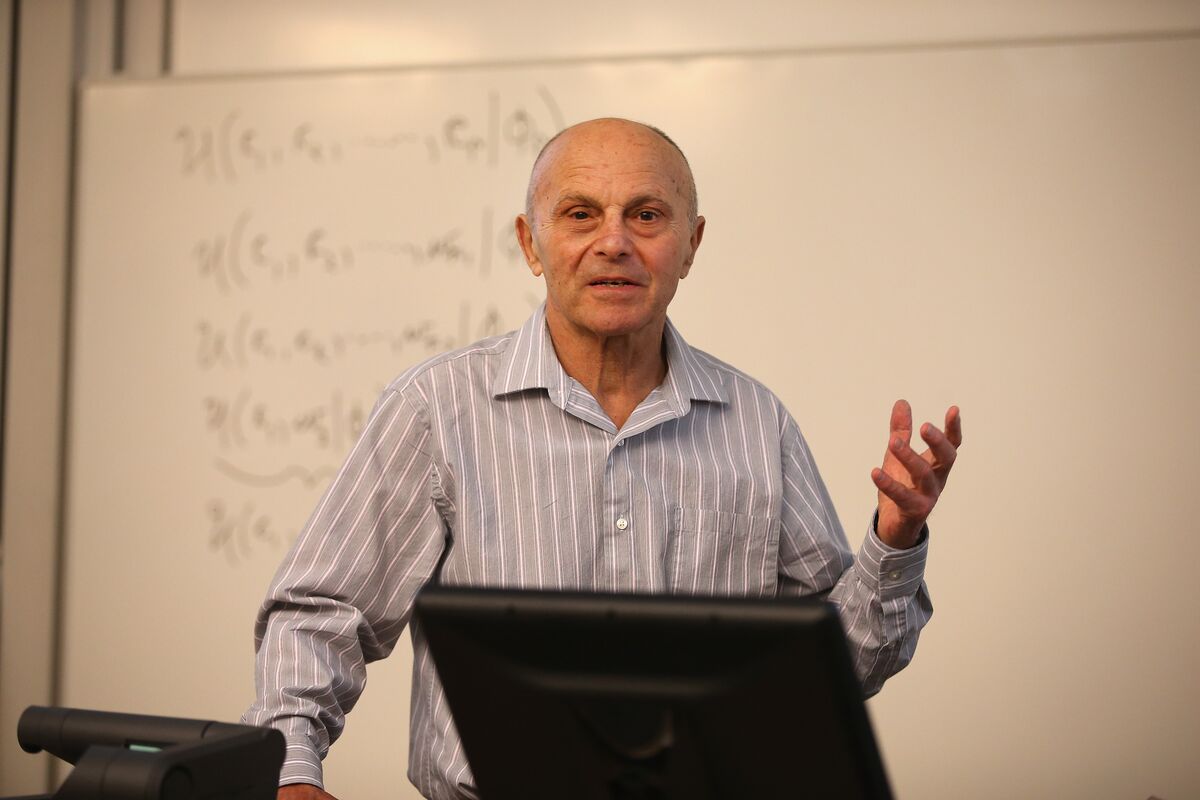

From Theory to Triumph: How Fama and Booth Revolutionized Financial Thinking

2025-03-06 09:00:01