Health Insurance Stocks Soar: Medicare Rates Spark Unexpected Wall Street Rally

Health

2025-04-07 21:22:58Content

In a significant boost for Medicare Advantage plans, the U.S. government has unveiled a substantial financial update that will reshape healthcare coverage for millions of Americans. The Centers for Medicare & Medicaid Services (CMS) announced a robust 5.06% average increase in reimbursement rates for private insurers' Medicare Advantage health plans in 2026, dramatically surpassing the modest 2% increase initially proposed earlier this year.

This unexpected and generous rate adjustment represents a game-changing moment for healthcare providers and insurers, signaling a strong commitment to supporting Medicare Advantage programs. The substantial bump in reimbursement rates is likely to have far-reaching implications for healthcare accessibility and plan offerings across the country.

The dramatic jump from the original January proposal to the current 5.06% increase underscores the government's responsiveness to industry feedback and its dedication to maintaining a robust and competitive Medicare Advantage marketplace. Insurers and healthcare stakeholders are expected to welcome this development, which could potentially lead to enhanced benefits and more comprehensive coverage options for seniors and eligible participants.

Medicare Advantage Rates Surge: A Landmark Shift in Healthcare Reimbursement for 2026

In the ever-evolving landscape of healthcare financing, the United States government has made a groundbreaking announcement that promises to reshape the Medicare Advantage ecosystem. This pivotal decision signals a significant transformation in how private insurers will be compensated, potentially impacting millions of Americans who rely on these critical health plans.Navigating the Complex Terrain of Healthcare Economics

The Unprecedented Reimbursement Rate Adjustment

The recent proclamation by federal authorities reveals a substantial 5.06% increase in Medicare Advantage reimbursement rates for 2026, a figure that dramatically eclipses the initial proposed increment. This substantial adjustment represents more than a mere numerical change; it embodies a strategic recalibration of healthcare economic policies that could have far-reaching implications for insurers, healthcare providers, and beneficiaries alike. The magnitude of this rate increase suggests a nuanced understanding of the complex challenges facing the healthcare system. By providing a more robust financial framework, the government aims to incentivize private insurers to maintain and enhance the quality of Medicare Advantage plans, ultimately benefiting the millions of seniors and individuals with disabilities who depend on these programs.Economic Implications and Market Dynamics

Delving deeper into the economic landscape, this rate adjustment represents a sophisticated balancing act. Private insurers must now recalibrate their strategic approaches, considering how this increased reimbursement will translate into improved healthcare services, expanded coverage options, and potentially more competitive plan structures. The 5.06% increase is not merely a numerical figure but a potential catalyst for innovation within the Medicare Advantage market. Insurers will likely need to reassess their operational models, investment strategies, and service delivery mechanisms to optimize the newfound financial flexibility.Potential Ripple Effects on Healthcare Accessibility

Beyond the immediate financial implications, this rate adjustment could significantly impact healthcare accessibility. The increased reimbursement might encourage insurers to expand their network of healthcare providers, introduce more comprehensive coverage options, and potentially reduce out-of-pocket expenses for beneficiaries. Moreover, the decision reflects a broader governmental commitment to supporting a robust, adaptable healthcare ecosystem that can meet the evolving needs of an aging population. By providing a more sustainable financial model, the government signals its recognition of the critical role private insurers play in delivering high-quality healthcare services.Technological and Innovative Considerations

The rate increase may also serve as a catalyst for technological innovation within Medicare Advantage plans. With enhanced financial resources, insurers might invest more heavily in telehealth infrastructure, advanced diagnostic technologies, and personalized healthcare solutions that can improve patient outcomes and operational efficiency. This strategic approach demonstrates a forward-thinking perspective that goes beyond immediate financial considerations, potentially setting the stage for a more integrated, technology-driven healthcare delivery model.Navigating Regulatory and Compliance Landscapes

For private insurers, this rate adjustment necessitates a comprehensive review of regulatory compliance and strategic alignment. The increased reimbursement comes with implicit expectations of enhanced service quality, transparency, and patient-centric approaches. Insurers will need to develop sophisticated strategies that not only capitalize on the financial opportunity but also demonstrate a commitment to delivering exceptional healthcare experiences that meet and exceed regulatory standards.RELATED NEWS

Health

Massive Staff Shake-Up: CDC Dangles $25K Incentive for Mass Employee Exit

2025-03-09 19:02:57

Health

Alert: Measles Breach at Hobby Airport - Houston's First Confirmed Case Sparks Health Concerns

2025-04-05 21:51:16

Health

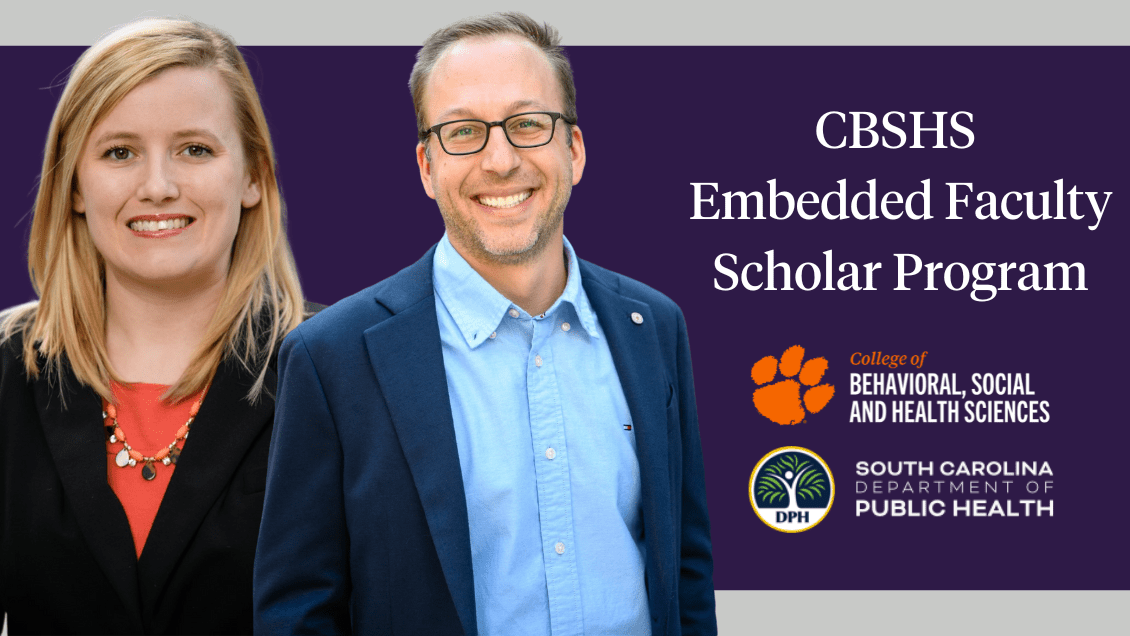

Breaking Barriers: Clemson's Bold New Initiative Bridges Academic Research and Public Health

2025-02-27 16:56:58