Global Markets Reel: Trump's Tariff Tsunami Threatens Economic Stability

Business

2025-04-07 10:11:40Content

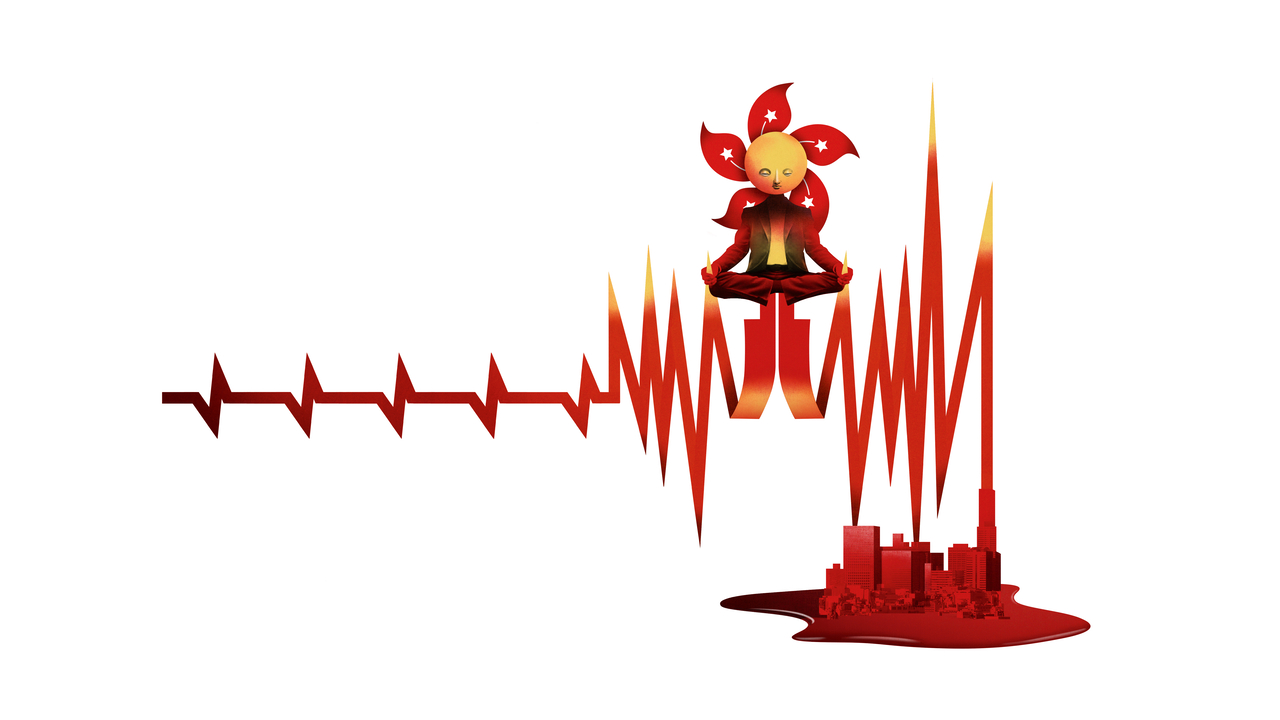

Asian financial markets experienced a dramatic downturn on Monday, with investors reeling from the latest escalation in trade tensions triggered by US President Donald Trump's aggressive tariff policies. The Hong Kong Hang Seng index suffered its most catastrophic single-day decline since the tumultuous Asian financial crisis of 1997, sending shockwaves through regional markets.

The sharp sell-off reflected growing investor anxiety about the potential long-term economic consequences of the ongoing trade dispute between the United States and China. Traders and market analysts watched in dismay as stock values plummeted, underscoring the fragility of international market sentiment in an increasingly unpredictable global economic landscape.

While the full impact of these market movements continues to unfold, the dramatic drop serves as a stark reminder of the interconnected nature of global financial markets and the far-reaching implications of international trade tensions.

Global Markets Reel: Unprecedented Economic Turbulence Sparks Investor Panic

In an extraordinary economic landscape marked by escalating geopolitical tensions and unprecedented market volatility, financial markets worldwide are experiencing seismic shifts that challenge traditional investment paradigms and signal potential long-term structural transformations in global economic dynamics.When Trade Wars Trigger Market Meltdowns: A Deep Dive into Financial Tremors

The Ripple Effect of Protectionist Policies

The implementation of aggressive trade tariffs has unleashed a cascade of economic repercussions that extend far beyond immediate market reactions. Investors and economic analysts are witnessing an intricate web of interconnected market responses that reveal the fragile nature of global financial ecosystems. The sudden implementation of punitive trade measures has created unprecedented uncertainty, causing institutional investors to rapidly reassess their strategic portfolios and risk management approaches. Financial experts argue that these protectionist policies represent more than mere economic maneuvers; they symbolize a fundamental restructuring of international trade relationships. The immediate market reactions demonstrate the profound sensitivity of global financial systems to geopolitical interventions, with stock exchanges experiencing dramatic fluctuations that reflect deeper systemic anxieties.Asian Markets: Epicenter of Economic Disruption

The Asian financial landscape has emerged as the most visibly impacted region, with stock exchanges experiencing unprecedented volatility. The Hong Kong Hang Seng index, in particular, has become a critical barometer of market sentiment, registering performance levels that evoke memories of historical economic crises. Institutional investors are closely monitoring these developments, recognizing that the current market dynamics represent more than a temporary aberration. Sophisticated economic analysis reveals that these market movements are not merely reactive but indicative of complex underlying economic transformations. The interconnectedness of global financial systems means that localized disruptions can rapidly propagate across international markets, creating a domino effect of economic uncertainty.Geopolitical Tensions and Market Psychology

Beyond numerical metrics, the current economic environment is profoundly influenced by market psychology and investor sentiment. The implementation of aggressive trade policies has created an atmosphere of uncertainty that transcends traditional economic forecasting models. Investors are grappling with a landscape where conventional wisdom and established economic theories seem increasingly inadequate. The psychological dimension of market behavior becomes paramount in understanding these complex dynamics. Fear, speculation, and strategic repositioning become as influential as tangible economic indicators. Financial institutions are forced to develop more nuanced, adaptive strategies that can respond to rapidly evolving geopolitical scenarios.Long-Term Implications and Strategic Adaptations

The current market turbulence is not merely a transient phenomenon but potentially represents a fundamental recalibration of global economic relationships. Multinational corporations, investment firms, and national economic policymakers are being compelled to reimagine their strategic frameworks, recognizing that traditional models of international trade and investment are undergoing radical transformation. Emerging economic powers are simultaneously presenting both challenges and opportunities. The redistribution of economic influence suggests that future market dynamics will be characterized by increased multipolarity, with traditional economic hegemonies facing significant challenges from rapidly developing economies.Technological Innovation and Economic Resilience

Amidst the economic uncertainty, technological innovation emerges as a potential stabilizing force. Digital transformation, artificial intelligence, and advanced computational models are providing sophisticated tools for economic analysis and risk management. These technological capabilities offer unprecedented insights into complex market behaviors, enabling more responsive and adaptive economic strategies. Financial technology firms are developing increasingly sophisticated algorithms capable of processing vast quantities of geopolitical and economic data, providing investors with more nuanced predictive capabilities. This technological evolution represents a critical mechanism for navigating the complex and volatile economic landscape.RELATED NEWS

Business

Global Horizons: TAMIU Scholars Set to Spark Innovation at Colombian Business Summit

2025-03-22 13:00:00

Business

Shop Smarter, Not Harder: Amazon's AI-Powered 'Interests' Feature Revolutionizes Online Shopping

2025-03-26 19:53:53