Economic Storm Brewing: Recession Odds Climb as Experts Sound Alarm

Politics

2025-04-06 22:03:39Content

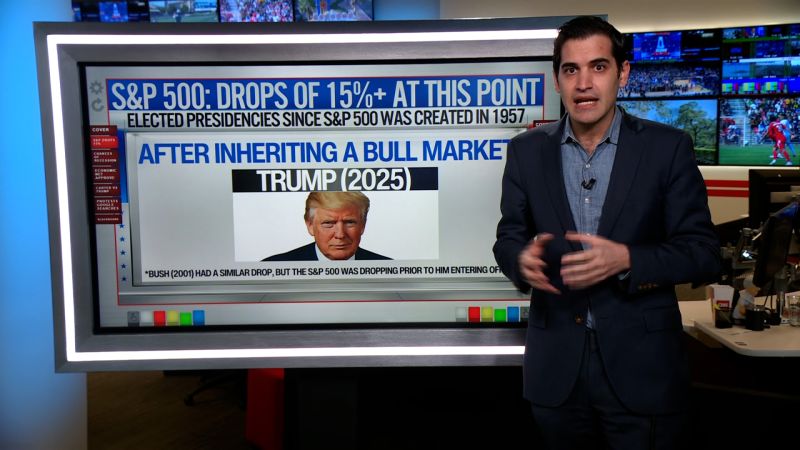

In the wake of recent turbulence in the financial markets, CNN's chief data analyst Harry Enten offers a nuanced perspective on the looming possibility of a recession. As US stocks experience a significant downturn, investors and economic experts are closely monitoring the potential economic implications.

Enten's analysis delves deep into the complex economic indicators that signal potential economic challenges. Drawing from comprehensive data and sophisticated statistical models, he breaks down the probability of a recession with remarkable clarity and insight.

The recent stock market plunge has sparked widespread concern, with many wondering whether this signals the beginning of a broader economic downturn. Enten's expert interpretation provides a measured and data-driven assessment of the current economic landscape, helping to demystify the complex interplay of financial factors.

By examining historical trends, current market conditions, and key economic indicators, Enten offers a balanced view of the potential economic trajectory. His analysis goes beyond simple speculation, providing viewers and readers with a substantive understanding of the economic risks and opportunities ahead.

While uncertainty remains, Enten's expert insights offer a beacon of understanding in these turbulent financial times, helping people navigate the complex world of economic forecasting with greater confidence and knowledge.

Economic Tremors: Decoding the Potential Recession Landscape in the United States

In the ever-shifting terrain of global economics, the United States finds itself at a critical crossroads, where financial indicators are sending complex and sometimes contradictory signals about the potential for an imminent economic downturn. The intricate dance between stock market volatility, monetary policy, and broader economic indicators has economists and financial experts closely monitoring the pulse of the nation's economic health.Navigating Uncertain Economic Waters: A Critical Analysis of Recession Risks

The Stock Market's Volatile Symphony

The recent plunge in US stock markets has triggered a cascade of speculation and concern among financial analysts and investors. Unlike previous economic downturns, the current landscape presents a multifaceted and nuanced picture of potential economic challenges. Market volatility is not merely a numerical fluctuation but a complex ecosystem of interconnected financial dynamics that demand sophisticated interpretation. Institutional investors and economic strategists are meticulously analyzing every subtle shift in market trends, recognizing that contemporary economic indicators are far more intricate than traditional predictive models. The volatility represents more than statistical data; it reflects deeper structural transformations within the American economic framework.Macroeconomic Indicators and Predictive Modeling

Contemporary economic forecasting transcends simplistic binary predictions of recession. Advanced predictive models now incorporate sophisticated machine learning algorithms and real-time data streams to generate more nuanced economic projections. These models consider multiple variables simultaneously, including employment rates, consumer spending patterns, technological disruption, and global geopolitical tensions. The complexity of modern economic systems means that traditional recession indicators no longer provide a comprehensive understanding. Economists are developing more holistic approaches that account for the rapid technological transformations and unprecedented global interconnectedness that characterize the 21st-century economic landscape.Technological Disruption and Economic Resilience

The emergence of digital economies and technological innovation introduces unprecedented variables into economic forecasting. Sectors like artificial intelligence, renewable energy, and digital infrastructure are creating new economic paradigms that challenge conventional recession models. Technological resilience has become a critical factor in economic sustainability. Companies and industries that demonstrate adaptive capabilities and technological agility are more likely to withstand potential economic contractions. This shift represents a fundamental reimagining of economic robustness beyond traditional metrics.Global Economic Interdependencies

The United States' economic trajectory is increasingly influenced by complex global interdependencies. International trade relationships, geopolitical tensions, and transnational economic policies create a multidimensional framework that defies simplistic economic predictions. Emerging markets, technological innovations, and shifting global power dynamics contribute to an increasingly complex economic ecosystem. The potential for recession is no longer a localized phenomenon but a global interconnected experience that requires sophisticated, nuanced analysis.Policy Responses and Economic Mitigation

Government and financial institutions are developing increasingly sophisticated strategies to anticipate and mitigate potential economic challenges. Monetary policy has evolved from reactive approaches to more proactive, data-driven interventions that seek to stabilize economic systems before significant disruptions occur. The Federal Reserve and other economic policymakers are leveraging advanced predictive technologies and comprehensive data analysis to create more responsive and adaptive economic strategies. These approaches represent a fundamental transformation in economic management, moving beyond traditional reactive models.Consumer Behavior and Economic Sentiment

Consumer confidence and spending patterns have emerged as critical indicators of potential economic shifts. The psychological dimensions of economic expectations play an increasingly significant role in shaping economic realities. Digital platforms and real-time sentiment analysis provide unprecedented insights into consumer behavior, allowing economists to develop more nuanced understandings of potential economic trajectories. The intersection of psychological factors and economic indicators creates a more holistic approach to economic forecasting.RELATED NEWS

Politics

Breaking: McEnany Unveils Explosive Biden Revelations That Transcend Political Boundaries

2025-05-05 15:18:46

Politics

Breaking: Local Politician Reveals How Autism Transforms Political Perspective

2025-03-16 07:07:01