Wall Street's Hidden Crisis: Regional Banks Caught in a Financial Crossfire

Finance

2025-04-01 17:00:10Content

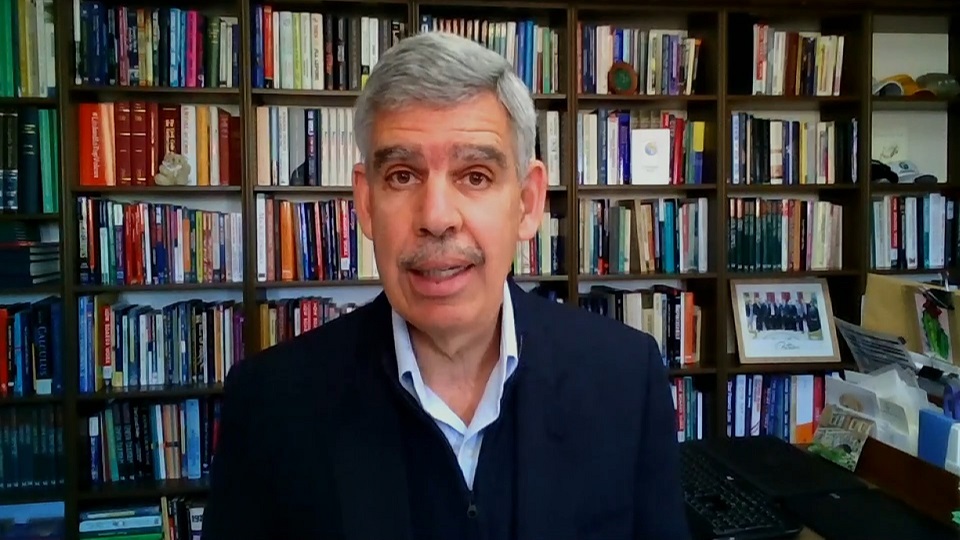

The financial sector experienced a mixed performance in the first quarter of 2025, with major financial institutions showing strength while regional banks struggled to maintain momentum. In an exclusive interview, Anton Schutz, senior portfolio manager at Mendon Capital, shed light on the underlying challenges facing the banking landscape.

Schutz highlighted two critical factors dampening the regional banking sector's performance: a noticeable slowdown in mergers and acquisitions (M&A) activity and persistent economic uncertainty. These challenges have created a climate of caution among investors and banking executives alike.

While the broader Financial Select Sector SPDR Fund (XLF) demonstrated resilience, regional banks found themselves navigating increasingly complex market conditions. The lack of anticipated consolidation and strategic partnerships has left many smaller financial institutions searching for growth opportunities in a challenging economic environment.

Investors and market watchers are closely monitoring how regional banks will adapt to these headwinds and potentially reposition themselves in the evolving financial ecosystem. For more in-depth market insights and expert analysis, tune into Wealth's latest market coverage.

Financial Sector's Rollercoaster Ride: Unveiling the Q1 2025 Market Dynamics

In the ever-evolving landscape of financial markets, the first quarter of 2025 has emerged as a pivotal period of transformation and challenge. Investors and market analysts find themselves navigating a complex terrain of economic uncertainties, sector-specific challenges, and emerging trends that are reshaping the financial ecosystem.Decoding the Financial Sector's Intricate Performance Puzzle

The Broader Financial Landscape: Triumphs and Tribulations

The financial sector in 2025 presents a nuanced narrative of resilience and vulnerability. While major financial institutions have demonstrated remarkable adaptability, regional banks are grappling with unprecedented challenges that threaten their traditional business models. The macroeconomic environment has become increasingly complex, with geopolitical tensions, technological disruptions, and regulatory shifts creating a multifaceted operational landscape. Institutional investors are closely monitoring the sector's dynamics, recognizing that the current market conditions represent more than just a temporary fluctuation. The interplay between technological innovation, regulatory frameworks, and economic uncertainties has created a perfect storm that demands strategic recalibration from financial institutions.Mergers and Acquisitions: The Unexpected Slowdown

Contrary to previous market expectations, the anticipated wave of mergers and acquisitions has unexpectedly stalled. This phenomenon has sent ripples of concern through the financial ecosystem, challenging long-standing assumptions about sector consolidation and growth strategies. The hesitation among financial institutions reflects a broader sentiment of caution, driven by economic unpredictability and stringent regulatory environments. Experts like Anton Schutz from Mendon Capital suggest that this M&A slowdown is not merely a temporary pause but potentially indicative of deeper structural changes in the financial services landscape. The traditional pathways of corporate expansion are being reevaluated, with institutions prioritizing strategic resilience over aggressive growth.Economic Uncertainty: A Catalyst for Strategic Transformation

The current economic climate has emerged as a powerful catalyst for strategic transformation within the financial sector. Regional banks, in particular, are being compelled to reimagine their operational models, leveraging technology, diversifying revenue streams, and developing more agile risk management frameworks. The uncertainty is not just a challenge but an opportunity for innovation. Financial institutions are increasingly investing in digital infrastructure, artificial intelligence, and data analytics to create more robust and adaptive business models. This technological pivot represents a fundamental reshaping of how financial services are conceptualized and delivered.Investor Perspectives and Market Sentiment

Investor sentiment remains cautiously optimistic, with a keen focus on institutions demonstrating adaptability and strategic foresight. The traditional metrics of financial performance are being supplemented by more holistic assessments that consider technological capability, regulatory compliance, and potential for innovation. The market is witnessing a subtle but significant shift towards valuing institutional resilience over short-term financial metrics. This evolving perspective suggests a more mature and nuanced approach to financial sector investment, one that recognizes the complex interdependencies of modern economic systems.Future Outlook: Navigating Uncharted Territories

As the financial landscape continues to evolve, institutions that can successfully balance technological innovation, regulatory compliance, and strategic flexibility will likely emerge as the frontrunners. The first quarter of 2025 serves as a critical inflection point, signaling the need for continuous adaptation and forward-thinking strategies. The financial sector stands at a crossroads, with unprecedented opportunities and challenges converging to create a dynamic and unpredictable environment. Only those institutions capable of embracing complexity and transforming uncertainty into strategic advantage will thrive in this new economic paradigm.RELATED NEWS

Finance

Wall Street's Financial Leaders Double Down on Sustainable Investing Despite Market Headwinds

2025-02-21 09:00:00