Broke and Struggling: America's Top 10 Urban Financial Pressure Cookers

Finance

2025-02-20 10:00:00Content

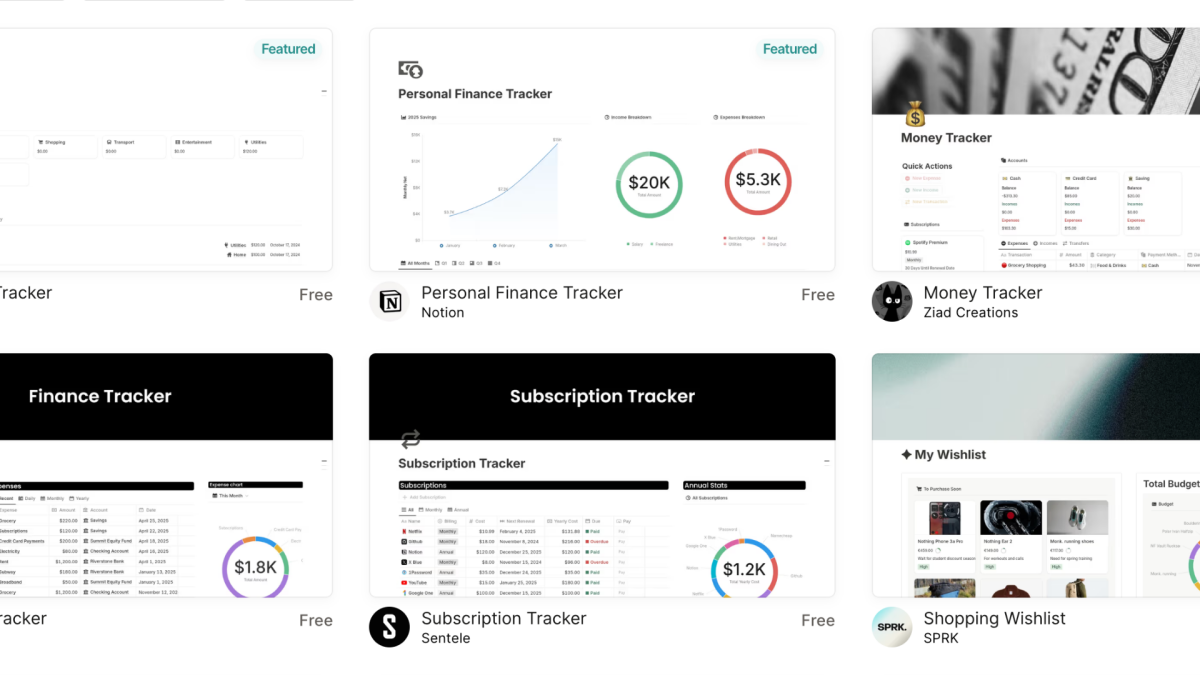

In a groundbreaking financial analysis, researchers have delved deep into the economic health of consumers by examining key financial indicators. The comprehensive study shed light on critical financial metrics, including credit scores, financial distress signals, bankruptcy trends, and consumer financial search behaviors.

By meticulously tracking average credit scores and analyzing patterns of accounts experiencing financial challenges, the research provides unprecedented insights into the current economic landscape. The investigation went beyond surface-level data, exploring bankruptcy filing rates and the growing online interest in debt management and loan opportunities.

These findings offer a nuanced understanding of consumer financial wellness, revealing intricate connections between credit performance, economic stress, and individuals' financial decision-making processes. The study serves as a valuable resource for economists, financial advisors, and policymakers seeking to comprehend the complex dynamics of personal financial health.

Financial Distress Decoded: Unraveling the Hidden Signals of Economic Strain

In an era of economic uncertainty, understanding the subtle indicators of financial health has become more critical than ever. Researchers have embarked on a groundbreaking investigation that delves deep into the intricate landscape of economic vulnerability, revealing unprecedented insights into how individuals and communities navigate financial challenges.Deciphering the Economic Pulse: A Comprehensive Financial Health Analysis

The Anatomy of Financial Vulnerability

Modern economic landscapes are increasingly complex, with multiple interconnected factors signaling potential financial distress. Credit scores, once considered a simple numerical representation of financial reliability, now serve as a sophisticated diagnostic tool for understanding broader economic trends. Researchers have discovered that these scores are far more than mere numbers – they are intricate narratives of individual and collective economic resilience. The investigation reveals a nuanced approach to measuring financial strain, moving beyond traditional metrics. By examining multiple dimensions of economic health, researchers have uncovered patterns that provide unprecedented insights into how financial challenges manifest across different demographic groups and economic environments.Credit Scores: More Than Just Numbers

Contrary to popular belief, credit scores are not static indicators but dynamic reflections of economic adaptability. The study meticulously analyzed how these scores fluctuate in response to broader economic pressures, revealing intricate relationships between individual financial behaviors and systemic economic challenges. Sophisticated algorithms now allow researchers to track subtle shifts in credit patterns, identifying early warning signs of potential financial distress. These advanced analytical techniques provide a more comprehensive understanding of economic vulnerability, going far beyond traditional risk assessment methods.Bankruptcy: The Ultimate Economic Stress Test

Bankruptcy filings represent more than just individual financial failures – they are critical indicators of broader economic systemic pressures. The research uncovered compelling patterns that demonstrate how these filings reflect deeper economic challenges facing communities and regions. By examining the contextual factors surrounding bankruptcy declarations, researchers have developed a more holistic understanding of economic resilience. These insights challenge traditional narratives about financial failure, presenting a more nuanced perspective on economic survival and adaptation.Digital Footprints of Financial Anxiety

In the digital age, online search behaviors have emerged as powerful indicators of economic sentiment. The study meticulously tracked search patterns related to debt, loans, and financial assistance, revealing fascinating correlations between digital interactions and real-world economic challenges. These digital breadcrumbs provide unprecedented insights into collective financial anxieties, offering researchers a real-time window into economic psychological landscapes. The analysis demonstrates how online search behaviors can serve as early warning systems for emerging economic trends.Interconnected Economic Ecosystems

The research emphasizes the interconnected nature of modern economic systems. Individual financial challenges are no longer isolated incidents but part of complex, dynamic networks of economic interactions. By understanding these intricate relationships, policymakers and financial professionals can develop more responsive and adaptive strategies. The study's findings challenge traditional linear models of economic analysis, presenting a more holistic, interconnected approach to understanding financial health and resilience.RELATED NEWS

Finance

Carney in Crosshairs: Freeland's Bold Leadership Bid Signals Potential Cabinet Shake-Up

2025-03-05 17:36:19