Global Legal Powerhouse White & Case Guides MMG's Strategic Takeover of Anglo's Nickel Empire

Business

2025-02-20 12:00:00Content

In a strategic move to diversify its portfolio, MMG Limited has secured a landmark deal to acquire Anglo American's nickel business in Brazil, with global law firm White & Case LLP guiding the transaction. The acquisition, valued at up to US$500 million in cash, marks MMG's inaugural investment in Brazil and represents a significant expansion of its base metal commodity exposure.

Leading the deal for White & Case, partner John Tivey highlighted the importance of this transaction, emphasizing how it positions MMG for growth in the competitive nickel market. The agreement signals MMG's commitment to broadening its international footprint and strengthening its position in the global metals and mining sector.

This transformative acquisition not only expands MMG's geographical reach but also demonstrates the company's strategic approach to resource investment, leveraging expert legal guidance to navigate complex international business transactions.

Strategic Metals Acquisition: MMG's Bold Brazilian Nickel Venture Reshapes Global Mining Landscape

In a groundbreaking move that signals significant transformation within the international mining sector, global corporations are witnessing a strategic realignment of metal commodity investments that promises to redefine industrial resource acquisition strategies.Unlocking Potential: A Transformative Cross-Continental Mining Transaction

Global Strategic Positioning

The contemporary mining landscape is experiencing unprecedented dynamism as corporations strategically expand their geographical and commodity portfolios. MMG Limited's recent acquisition represents a calculated maneuver to diversify and strengthen its international market presence, demonstrating sophisticated corporate strategic planning beyond traditional investment paradigms. Multinational mining enterprises increasingly recognize the critical importance of geographical diversification and commodity portfolio expansion. By targeting Anglo American's Brazilian nickel operations, MMG Limited is positioning itself as an agile and forward-thinking organization capable of identifying and executing complex international investment opportunities.Economic and Technological Implications

The transaction's financial magnitude—potentially reaching US$500 million—underscores the substantial economic significance of this strategic investment. Nickel, a critical component in emerging technologies like electric vehicle batteries and renewable energy infrastructure, represents a pivotal resource in the global transition toward sustainable technological development. This acquisition signals MMG's commitment to emerging markets and technological innovation. Brazil's robust mining infrastructure and abundant mineral resources provide an ideal environment for strategic resource development, offering MMG unprecedented opportunities for long-term growth and technological integration.Legal and Transactional Complexity

White & Case LLP's involvement highlights the intricate legal landscape surrounding international corporate transactions. The global law firm's expertise was instrumental in navigating complex cross-border regulatory frameworks, ensuring a seamless and compliant acquisition process. The transaction's complexity extends beyond mere financial considerations, encompassing intricate legal, environmental, and geopolitical dimensions. Sophisticated legal counsel becomes paramount in managing potential risks and facilitating smooth international business negotiations.Market Dynamics and Future Outlook

MMG's Brazilian nickel business entry represents more than a singular transaction—it symbolizes a broader trend of strategic global resource repositioning. As industries worldwide increasingly prioritize sustainable and technologically advanced resource acquisition, such investments become critical for maintaining competitive advantage. The nickel sector's future appears increasingly promising, with growing demand from electric vehicle manufacturers, renewable energy infrastructure, and advanced technological applications. MMG's strategic move positions the company at the forefront of this transformative industrial landscape, potentially setting new standards for international resource investment.Technological and Sustainable Development

Beyond immediate financial considerations, this acquisition reflects a nuanced understanding of emerging technological trends. Nickel's pivotal role in battery technology and sustainable infrastructure makes this investment strategically aligned with global decarbonization objectives. The transaction demonstrates how forward-thinking corporations are integrating sustainability considerations into their core investment strategies, recognizing that long-term success requires holistic approaches that balance economic performance with environmental responsibility.RELATED NEWS

Business

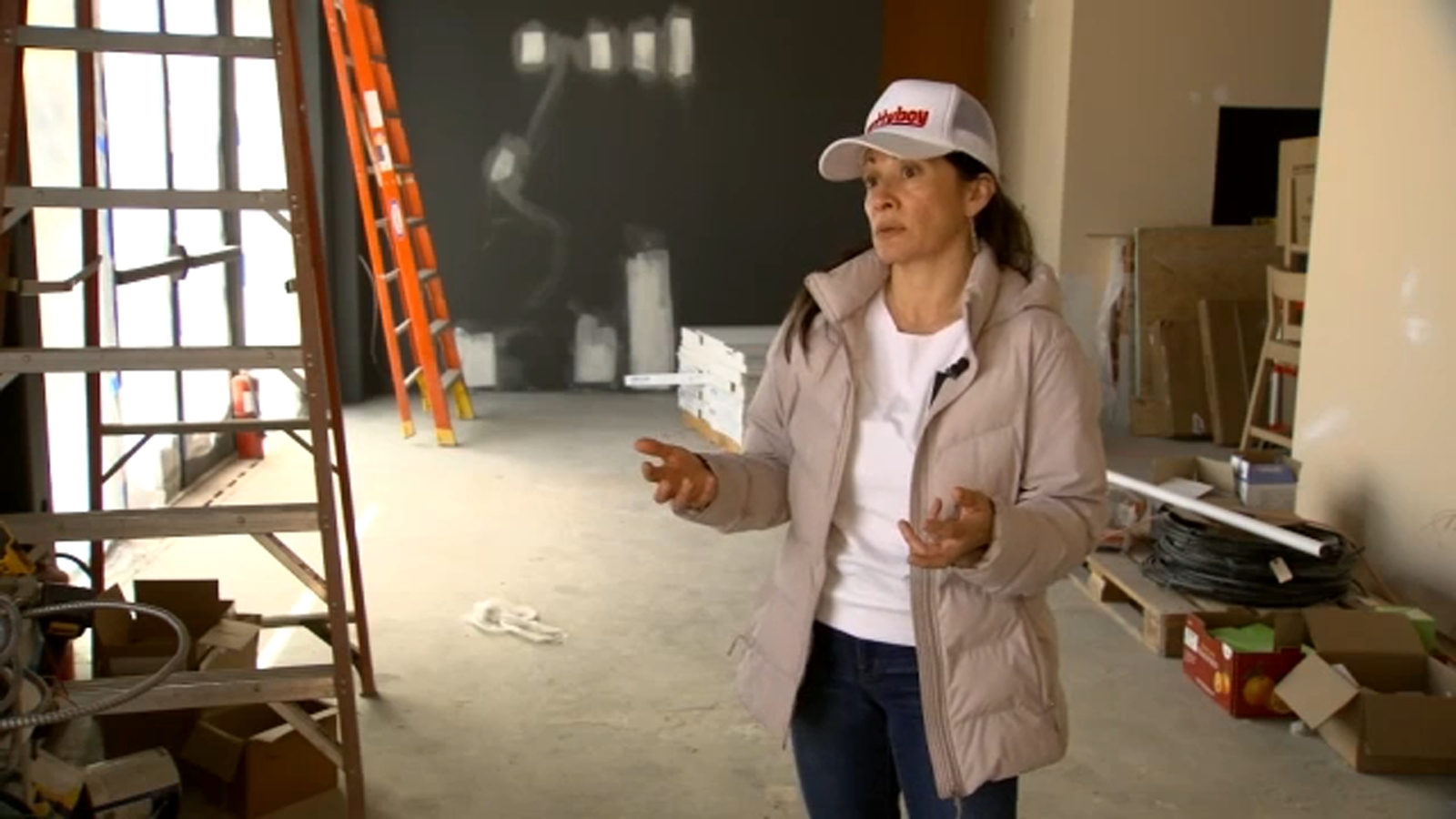

Crafting Catastrophe: Joann Stores Set to Shutter Nationwide, Leaving Hobbyists in Shock

2025-02-24 20:48:37

Business

Craft Retail Giant Joann Slashes Prices: Mass. Stores Set for Dramatic Shutdown

2025-02-20 15:13:36

Business

From Stable to Startup: How One Equestrian Entrepreneur Galloped Past Traditional Business Barriers

2025-02-20 21:29:23