Wall Street's Hidden Gems: Uncovering Finance Stocks Primed to Shock Investors

Finance

2025-03-28 13:00:01Content

Unlock Earnings Potential: Mastering Stock Selection with Zacks Earnings ESP

Navigating the complex world of stock investments just got simpler. The Zacks Earnings ESP (Estimated Surprise Prediction) is your secret weapon for identifying stocks with the highest probability of outperforming quarterly earnings expectations.

Imagine having a powerful tool that cuts through market noise and helps you pinpoint potentially lucrative investment opportunities. The Zacks Earnings ESP does exactly that by combining sophisticated predictive analytics with real-time financial data.

Here's how it works: By analyzing earnings estimate revisions and other critical financial indicators, the Zacks Earnings ESP provides investors with a strategic edge. It calculates the likelihood of a stock surprising investors with better-than-expected earnings, giving you insights that traditional research methods might miss.

Whether you're a seasoned investor or just starting your financial journey, the Zacks Earnings ESP empowers you to make more informed investment decisions. Stop guessing and start strategizing with a tool designed to help you stay ahead of market trends.

Take control of your investment portfolio and discover stocks with genuine growth potential. With Zacks Earnings ESP, beating the market isn't just a possibility—it's a strategic advantage.

Unlocking Investment Success: The Revolutionary Approach to Earnings Prediction

In the fast-paced world of financial markets, investors are constantly seeking an edge that can transform their investment strategies from guesswork to precision. The quest for identifying potentially lucrative stocks before they make their quarterly earnings announcements has long been a challenging endeavor that separates successful investors from the average market participants.Discover the Game-Changing Strategy That Empowers Investors to Predict Earnings with Unprecedented Accuracy

The Earnings Prediction Landscape: Beyond Traditional Analysis

Modern investment strategies demand more than conventional wisdom. Traditional stock analysis often leaves investors navigating through murky waters of uncertainty, relying on fragmented information and historical performance. The emerging landscape of financial intelligence requires a more sophisticated, data-driven approach that can cut through the noise and provide actionable insights. Sophisticated investors understand that predicting earnings is not about luck, but about leveraging advanced analytical tools that transform raw data into strategic intelligence. The complexity of financial markets demands a nuanced understanding that goes beyond surface-level metrics, diving deep into predictive methodologies that can anticipate market movements with remarkable precision.Decoding the Science of Earnings Estimation

The art and science of earnings prediction have evolved dramatically in recent years. Cutting-edge technologies and sophisticated algorithms now enable investors to parse through massive datasets, identifying subtle patterns and signals that traditional analysis might overlook. These advanced systems can detect micro-trends and potential performance indicators that provide a competitive advantage in investment decision-making. Investors who embrace these innovative approaches gain a significant edge in understanding potential stock performance. By integrating multiple data points, including historical performance, market sentiment, economic indicators, and company-specific metrics, these advanced prediction tools offer a comprehensive view of potential earnings outcomes.Technological Innovation in Financial Forecasting

The emergence of artificial intelligence and machine learning has revolutionized earnings prediction methodologies. These technologies can process vast amounts of information instantaneously, identifying complex correlations that human analysts might miss. The integration of big data analytics with predictive modeling creates a powerful toolkit for investors seeking to make informed decisions. Machine learning algorithms continuously refine their predictive capabilities, learning from historical data and adapting to changing market conditions. This dynamic approach ensures that investors have access to increasingly accurate and responsive earnings estimation tools that can provide real-time insights into potential stock performance.Strategic Implications for Investor Decision-Making

Understanding earnings prediction is more than just a technical exercise; it's a strategic approach to investment management. By leveraging advanced predictive tools, investors can develop more robust, data-driven investment strategies that minimize risk and maximize potential returns. The ability to anticipate earnings performance with greater accuracy allows investors to make more informed decisions, potentially identifying undervalued stocks before they experience significant market movement. This proactive approach transforms investment from a reactive process to a strategic, forward-looking endeavor.The Future of Investment Intelligence

As financial technologies continue to advance, the landscape of earnings prediction will become increasingly sophisticated. Investors who stay ahead of these technological trends will be best positioned to capitalize on emerging opportunities and navigate the complex world of financial markets. The convergence of artificial intelligence, big data, and advanced analytics promises a future where investment decisions are driven by unprecedented levels of insight and precision. Those who embrace these technological innovations will be at the forefront of a new era of intelligent investing.RELATED NEWS

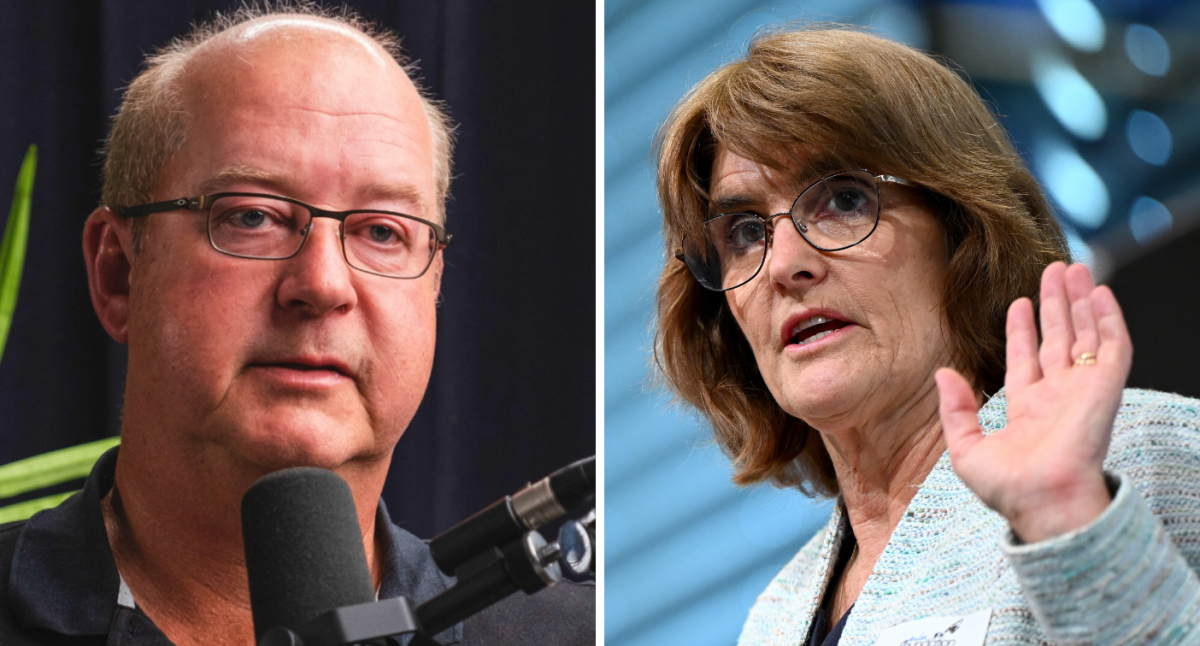

Fed Chief Warns: Tariff Pressures Threaten Economic Stability as Trump Demands Rate Cuts