Wall Street's Wild Ride: Cramer Decodes the Economic Crosscurrents Shaking Markets

Business

2025-02-19 23:58:27Content

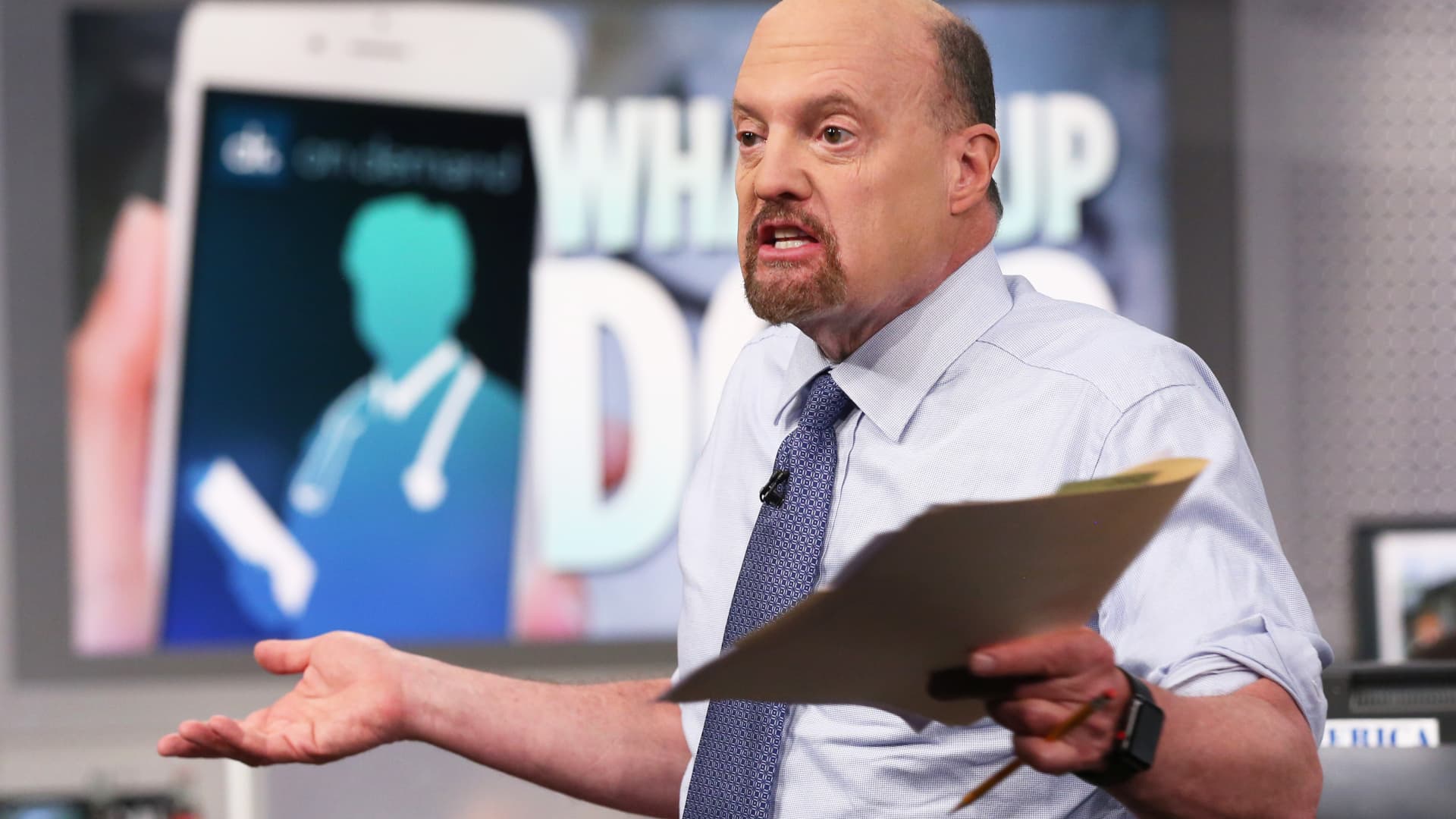

In a bold market commentary, CNBC's Jim Cramer threw down the gauntlet on Wednesday, challenging the conventional wisdom about today's economic landscape. Breaking from traditional analysis, Cramer argued that the current market defies the typical, predictable patterns of a standard business cycle.

Cramer's provocative stance suggests that investors and analysts need to rethink their traditional approaches to market dynamics. Instead of relying on familiar economic rhythms, he emphasizes the need for a more nuanced and adaptive understanding of today's complex financial environment.

The veteran market commentator's insights highlight the unprecedented nature of recent economic conditions, where traditional forecasting models may fall short. His commentary serves as a wake-up call for investors to remain flexible and critically examine long-held assumptions about market behavior.

By questioning the cohesive business cycle narrative, Cramer invites a more dynamic and forward-thinking approach to market analysis, urging financial professionals and individual investors alike to stay alert and innovative in their investment strategies.

Market Dynamics Unraveled: Challenging the Traditional Business Cycle Paradigm

In the ever-evolving landscape of financial markets, traditional economic theories are constantly being challenged and reimagined. The conventional understanding of business cycles has long been a cornerstone of economic analysis, providing investors and analysts with a framework to interpret market movements and economic trends.Breaking Boundaries: A Revolutionary Perspective on Market Behavior

The Shifting Economic Landscape

The contemporary financial ecosystem defies traditional categorization, presenting a complex tapestry of interconnected economic forces that resist simplistic linear interpretations. Modern markets have become increasingly sophisticated, driven by technological innovations, global interconnectedness, and unprecedented levels of real-time information flow. Investors and economists are now confronting a reality where predictive models based on historical patterns may no longer provide comprehensive insights. Financial experts are witnessing a fundamental transformation in how economic cycles manifest. The traditional sequential progression of expansion, peak, contraction, and trough has become increasingly blurred, with rapid technological disruptions and global economic interdependencies creating a more nuanced and unpredictable environment.Technological Disruption and Market Dynamics

The digital revolution has fundamentally altered the way economic systems operate, introducing unprecedented levels of complexity and volatility. Artificial intelligence, blockchain technologies, and instantaneous global communication networks have created new mechanisms of value generation that transcend traditional economic frameworks. These technological advancements have effectively decoupled many economic indicators from their historical correlations. Companies can now scale exponentially without following traditional growth trajectories, and entire industries can be transformed or rendered obsolete within remarkably short timeframes. This dynamic challenges long-standing assumptions about market behavior and economic progression.Global Interconnectedness and Economic Complexity

Contemporary economic systems are characterized by intricate global networks that defy simplistic linear analysis. Geopolitical events, technological innovations, and instantaneous information exchange have created a multidimensional economic landscape where cause-and-effect relationships are increasingly difficult to predict. The interconnected nature of modern markets means that localized economic events can have rapid and profound global implications. Traditional business cycle models struggle to capture the nuanced interactions between different economic sectors, technological platforms, and international markets.Reimagining Economic Analysis

Financial professionals are now required to develop more sophisticated analytical frameworks that can accommodate unprecedented levels of complexity and rapid change. This necessitates a more holistic approach that integrates multiple disciplines, including technology, sociology, and global political dynamics. The emerging paradigm demands adaptive thinking, where economic models are viewed as dynamic, fluid constructs rather than rigid, predictive frameworks. Successful analysts and investors must cultivate intellectual flexibility and a willingness to challenge established economic narratives.The Human Factor in Economic Interpretation

Despite technological advancements, human intuition and contextual understanding remain crucial in interpreting complex market dynamics. The most effective economic analysis combines sophisticated data analytics with nuanced human insight, recognizing that markets are ultimately driven by human behavior and perception. Emotional intelligence, cultural understanding, and the ability to synthesize diverse information streams have become increasingly valuable skills in navigating the contemporary economic landscape. The most successful financial strategists are those who can blend quantitative analysis with qualitative interpretation.RELATED NEWS

Business

Retail Shakeup: How TikTok is Disrupting Traditional E-Commerce Hierarchies

2025-04-23 21:21:58

Business

Vascular Intervention Shake-up: Teleflex Seals $791M Biotronik Deal in Strategic Medical Merger

2025-02-27 22:23:48

Business

AI Revolution: How EXL Turns Algorithmic Potential into Profit-Driving Strategies

2025-03-05 20:36:59