Equipment Investment Hits Brakes: Business Spending Downshifts in February

Business

2025-03-26 15:17:40Content

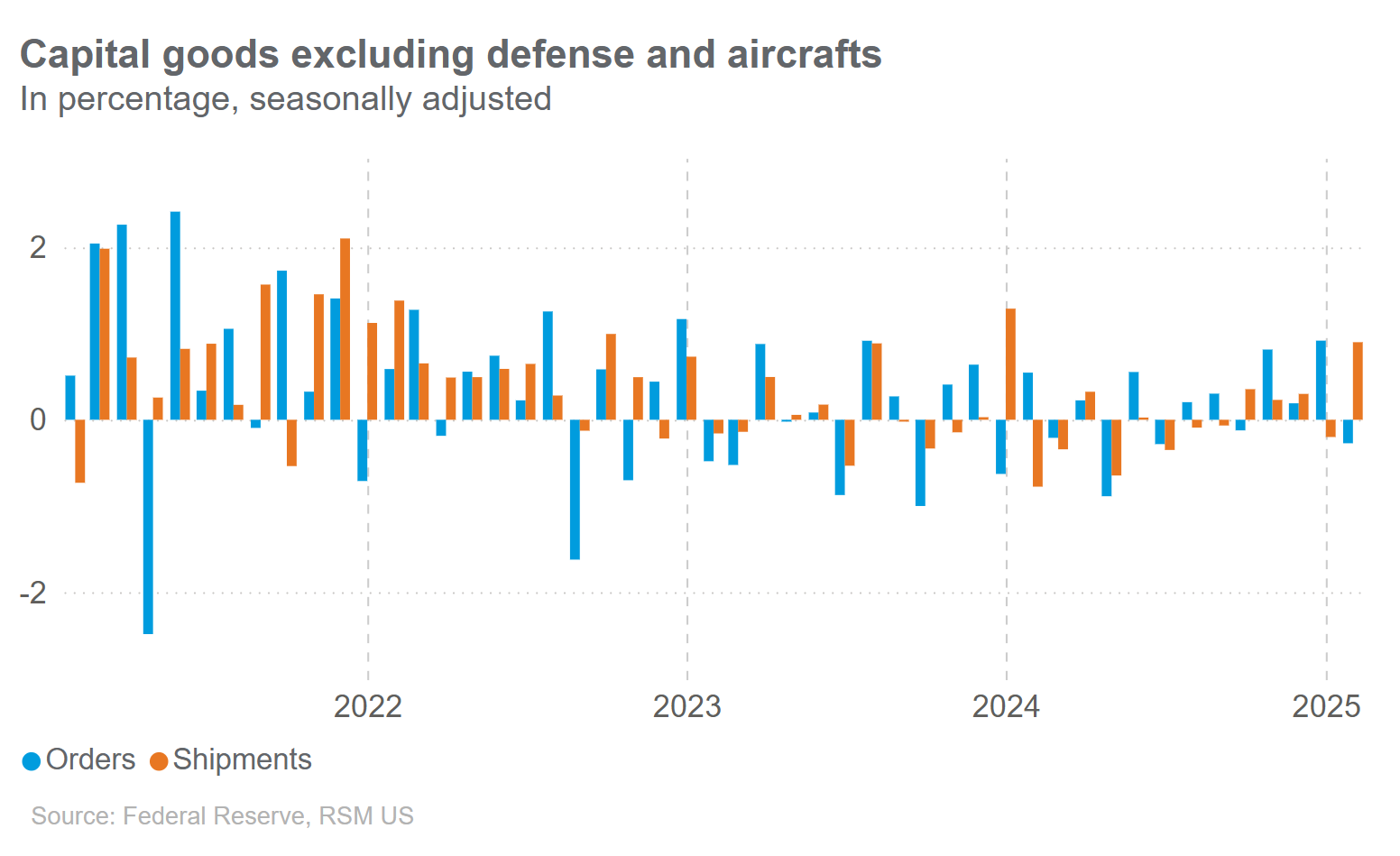

In a potential sign of economic hesitation, core business capital goods orders experienced a modest decline in February. The key indicator of private investment spending, which tracks durable goods expected to serve businesses for more than three years, dropped by 0.3%. This slight pullback suggests businesses might be exercising caution in their long-term equipment and infrastructure investments.

The marginal decrease could reflect growing economic uncertainties, including factors such as interest rate fluctuations, supply chain challenges, or broader market sentiment. Economists and investors will likely be closely monitoring future reports to determine whether this represents a temporary pause or a more significant trend in business investment strategies.

While a 0.3% decline might seem minimal, it could signal important shifts in corporate spending patterns and overall economic momentum. Investors and policymakers will be keen to analyze subsequent data to understand the underlying dynamics driving this subtle but noteworthy change in capital goods orders.

Capital Goods Conundrum: Decoding the Subtle Shifts in Business Investment Landscape

In the intricate world of economic indicators, subtle fluctuations can signal profound transformations in business strategy and market dynamics. The recent decline in core business capital goods orders unveils a complex narrative of economic adaptation, technological evolution, and strategic recalibration that demands comprehensive exploration.Navigating Uncertainty: When Investment Signals Whisper Economic Nuances

The Macroeconomic Tapestry of Capital Goods Investment

The contemporary business ecosystem is experiencing a remarkable metamorphosis, where traditional investment paradigms are being systematically reimagined. Core business capital goods, traditionally viewed as robust indicators of economic vitality, are now revealing intricate layers of strategic decision-making that transcend simplistic numerical interpretations. Enterprises are increasingly adopting a more nuanced approach to capital expenditure, balancing immediate operational requirements with long-term technological sustainability. The 0.3% decline in new orders represents more than a statistical fluctuation; it embodies a sophisticated recalibration of corporate investment strategies in response to rapidly evolving market conditions.Technological Disruption and Investment Dynamics

Modern businesses are navigating an unprecedented technological landscape where investment decisions are increasingly influenced by digital transformation imperatives. The traditional three-year durability metric for capital goods is being fundamentally challenged by accelerating technological obsolescence and the need for continuous innovation. Companies are no longer making linear investment decisions but are instead adopting agile, adaptive strategies that prioritize flexibility and scalability. This shift manifests in more measured, strategic capital goods acquisitions that align with emerging technological trends and potential future disruptions.Economic Resilience and Strategic Adaptation

The marginal decline in capital goods orders should not be interpreted as a sign of economic weakness, but rather as a sophisticated strategic recalibration. Businesses are demonstrating remarkable resilience by implementing more targeted, efficient investment approaches that maximize technological leverage while maintaining fiscal prudence. Sophisticated organizations are increasingly viewing capital goods investments through a multidimensional lens, considering factors such as technological integration potential, long-term operational efficiency, and alignment with broader digital transformation strategies. This approach represents a profound evolution from traditional linear investment models.Global Economic Contextual Analysis

The current capital goods investment landscape is deeply intertwined with complex global economic dynamics. Geopolitical uncertainties, supply chain reconfiguration, and emerging technological paradigms are creating a multifaceted environment that demands unprecedented strategic agility from businesses. Enterprises are developing more sophisticated risk assessment frameworks that enable them to make nuanced investment decisions. The 0.3% decline in new orders reflects not a contraction, but a strategic pause—a moment of careful evaluation and recalibration in response to rapidly shifting global economic conditions.Future-Proofing Investment Strategies

As businesses confront an increasingly complex economic landscape, the approach to capital goods investment is undergoing a fundamental transformation. Organizations are developing more holistic, forward-looking investment strategies that prioritize adaptability, technological integration, and long-term value creation. The current investment trends signal a profound shift towards more intelligent, data-driven capital allocation models that transcend traditional metrics and embrace a more comprehensive understanding of technological and economic potential.RELATED NEWS

Business

Back to Base: The Corporate Comeback - Are You Prepared for the Office Resurrection?

2025-04-29 05:30:00

Business

Beauty Biz Battleground: How China Tariffs Are Threatening South Florida's Cosmetic Entrepreneurs

2025-04-17 03:24:56