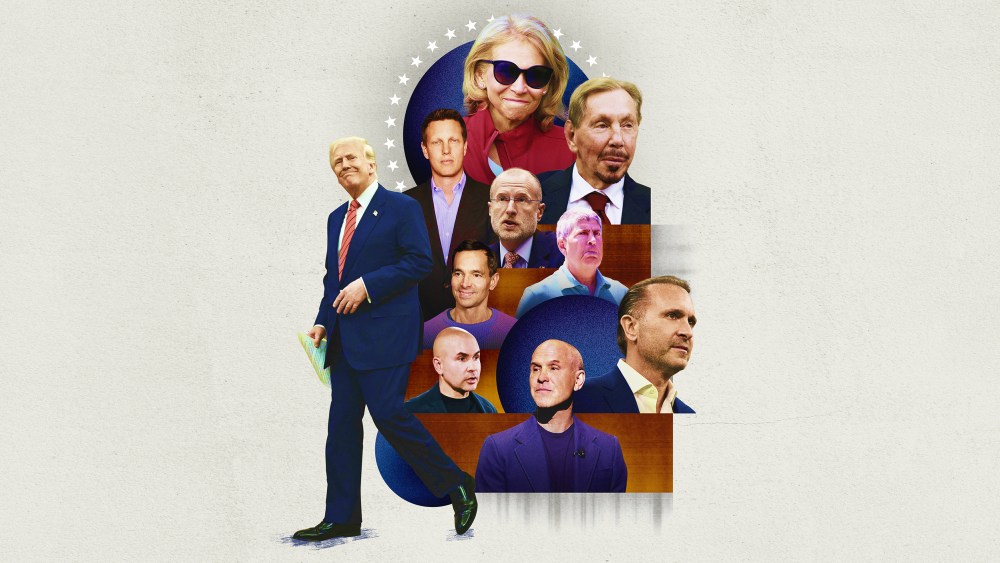

Paramount's High-Stakes Showdown: Trump Drama, Investor Revolt, and the Skydance Deal Hanging by a Thread

Politics

2025-02-19 20:44:34Content

As 2025 unfolds, Paramount Global finds itself navigating a turbulent landscape of legal challenges and corporate drama. The potential sale to Skydance Media hangs in a delicate balance, with mounting political controversies and investor lawsuits casting long shadows over the potential merger.

The entertainment giant is currently embroiled in a complex web of legal and strategic challenges that threaten to derail what was once considered a promising acquisition. Investors have raised significant concerns, filing multiple lawsuits that challenge the proposed transaction and scrutinize every aspect of the potential deal.

Political pressures are adding additional complexity to an already intricate situation. Regulatory bodies and stakeholders are closely examining the proposed merger, raising questions about market competition and corporate governance.

With tensions mounting and uncertainty growing, the future of the Paramount Global and Skydance Media deal remains uncertain. Industry observers are watching closely, wondering whether this high-stakes corporate drama will result in a successful merger or a dramatic collapse.

As the situation continues to evolve, one thing remains clear: the path forward for Paramount Global is fraught with challenges that will test the company's resilience and strategic acumen.

Hollywood's High-Stakes Drama: Paramount's Turbulent Journey Towards an Uncertain Future

In the ever-evolving landscape of media conglomerates, Paramount Global finds itself at a critical crossroads, navigating treacherous political waters and investor scrutiny that threaten to reshape the entertainment industry's fundamental power dynamics. The potential sale to Skydance Media has become a focal point of intense speculation and strategic maneuvering, with implications far beyond traditional corporate transactions.Unraveling the Complex Tapestry of Media Transformation

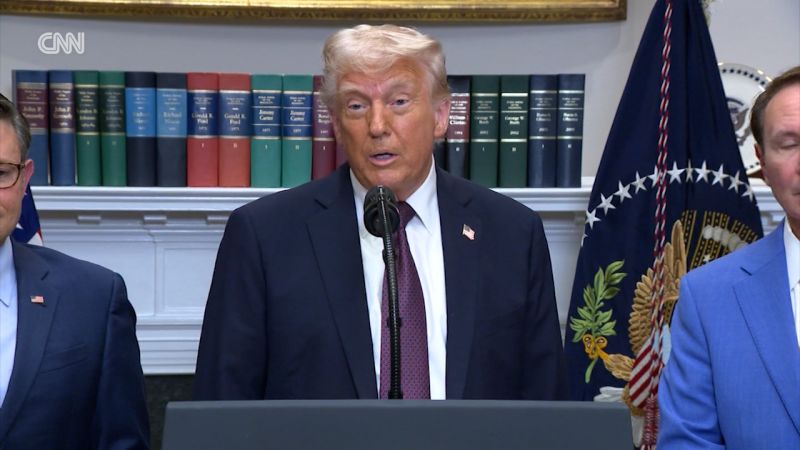

The Political Battlefield of Corporate Restructuring

The entertainment industry has long been a arena of complex negotiations, but Paramount's current situation transcends typical business challenges. Political interference and investor activism have created a perfect storm of uncertainty, challenging the traditional boundaries of media ownership and corporate governance. Stakeholders are watching closely as each strategic move could potentially redefine the studio's trajectory. Insider sources suggest that the potential sale to Skydance Media is far more nuanced than a simple financial transaction. The negotiations involve intricate legal frameworks, strategic alignments, and potential regulatory hurdles that could dramatically alter the proposed deal's landscape.Investor Dynamics and Corporate Governance

Shareholder lawsuits have emerged as a critical factor in Paramount's current predicament. These legal challenges reflect deeper tensions within the corporate structure, highlighting systemic issues of transparency, accountability, and strategic vision. The mounting pressure from institutional investors demands a comprehensive reevaluation of the studio's operational strategies. Financial analysts argue that the potential sale represents more than a mere ownership transfer—it symbolizes a potential paradigm shift in how media companies conceptualize their long-term sustainability and growth models. The intricate dance between Paramount and Skydance Media reveals the complex ecosystem of modern entertainment corporate strategies.Strategic Implications for the Media Landscape

The potential acquisition goes beyond traditional business metrics. It represents a potential recalibration of power dynamics within the entertainment industry, challenging established narratives about media consolidation and strategic positioning. Technological disruption, changing consumer preferences, and global market dynamics are converging to create an unprecedented environment of uncertainty. Paramount's current challenges reflect broader industry transformations, where adaptability and strategic foresight become critical survival mechanisms.The Human Element in Corporate Transformation

Behind the financial figures and legal negotiations, real human stories are unfolding. Employees, creative professionals, and industry stakeholders are experiencing significant emotional and professional uncertainty. The potential sale represents more than a corporate transaction—it's a moment of profound organizational transition. Leadership experts suggest that the success of such a complex transition depends not just on financial calculations but on maintaining organizational culture, preserving creative ecosystems, and managing human capital with empathy and strategic intelligence.Future Horizons and Potential Scenarios

While the outcome remains uncertain, multiple potential scenarios are emerging. The sale to Skydance Media could represent a strategic reinvention, a defensive maneuver, or a complex negotiation strategy designed to maximize value and minimize risk. Industry observers are closely monitoring every development, understanding that this moment could potentially redefine media industry dynamics for years to come. The intricate interplay of political, financial, and strategic factors makes Paramount's current journey a fascinating case study in corporate transformation.RELATED NEWS

Politics

Leaked: Inside the Trump Team's Yemen Strike Strategy - Explosive Group Chat Reveals All

2025-03-25 00:25:19

Politics

Political Showdown: Abbott Calls Special Election in Democratic Stronghold

2025-04-07 22:31:46

Politics

Deadline Diplomacy: Senator Vows Direct Action for Detained Salvadoran Activist

2025-04-15 17:07:46