Wallet-Saving Survival: Your Financial Shield Against Nature's Fury

Finance

2025-03-24 21:00:00Content

Natural Disasters Unleash Unprecedented Financial Toll in 2024

The United States experienced a staggering financial blow from natural disasters in 2024, with damages exceeding $182 billion across 27 catastrophic events that each caused over $1 billion in losses, according to the National Oceanic and Atmospheric Administration's (NOAA) National Centers for Environmental Information.

To help Americans navigate these challenging financial landscapes, Rob Williams, managing director of financial planning at the Schwab Center for Financial Research, joined Wealth host Brad Smith to provide critical insights and strategic guidance for managing the economic impact of increasingly frequent and severe natural disasters.

Williams emphasized the importance of proactive financial planning, recommending that individuals and families develop comprehensive emergency preparedness strategies that include robust insurance coverage, emergency funds, and flexible financial contingency plans.

For more expert analysis and in-depth market insights, viewers are encouraged to explore additional content on the Wealth platform, where financial professionals continue to break down complex economic challenges.

Financial Resilience in the Face of Nature's Fury: Navigating the $182 Billion Disaster Landscape of 2024

In an era of unprecedented environmental volatility, the United States faces a critical challenge as natural disasters continue to reshape economic landscapes and test the financial resilience of communities nationwide. The escalating frequency and intensity of catastrophic events demand a comprehensive understanding of risk management, financial preparedness, and strategic adaptation.Unleash Your Financial Defense: Protecting Wealth When Disaster Strikes

The Economic Tsunami of Natural Disasters

The year 2024 has emerged as a watershed moment in the annals of environmental and economic history, with natural disasters inflicting a staggering $182 billion in damages across the United States. This unprecedented financial toll represents more than just numbers on a balance sheet—it's a stark testament to the increasing vulnerability of our infrastructure, communities, and personal financial ecosystems. Experts like Rob Williams from the Schwab Center for Financial Research are sounding the alarm, emphasizing the critical need for proactive financial strategies. The landscape of risk has fundamentally transformed, requiring individuals and businesses to develop sophisticated approaches to economic resilience.Decoding the Disaster Economics

The 27 billion-dollar events that punctuated 2024 reveal a complex narrative of environmental and economic interdependence. Each catastrophic event—whether hurricanes ravaging coastal regions, wildfires consuming western landscapes, or unprecedented flooding disrupting midwestern communities—carries profound financial implications that extend far beyond immediate damage. Insurance models are being radically reimagined, with risk assessment algorithms struggling to keep pace with the new normal of climate-induced volatility. Financial institutions are developing increasingly nuanced strategies to help clients navigate this treacherous economic terrain.Personal Financial Preparedness Strategies

Developing a robust financial defense mechanism requires a multifaceted approach. Comprehensive emergency funds, adaptive insurance coverage, and strategic investment diversification have transformed from optional considerations to absolute necessities. Individuals must now view financial planning through the lens of potential environmental disruption. This means creating liquid asset reserves, understanding comprehensive insurance coverage, and developing flexible income streams that can withstand sudden economic shocks.Technological Innovation in Disaster Financial Management

Cutting-edge technologies are emerging as powerful tools in mitigating financial risks associated with natural disasters. Advanced predictive modeling, real-time risk assessment platforms, and AI-driven financial planning solutions are revolutionizing how we approach economic resilience. Financial technology firms are developing sophisticated algorithms that can instantaneously assess potential risks, recommend adaptive strategies, and provide real-time guidance during environmental crises. These innovations represent a quantum leap in our ability to protect personal and collective economic interests.Community and Institutional Resilience

The $182 billion disaster landscape of 2024 underscores the critical importance of collective financial preparedness. Local governments, financial institutions, and community organizations are increasingly collaborating to develop comprehensive disaster response and recovery frameworks. This holistic approach recognizes that financial resilience is not merely an individual pursuit but a complex ecosystem requiring coordinated efforts across multiple sectors. From innovative public-private partnerships to community-based financial support networks, new models of economic protection are rapidly emerging.Looking Beyond the Horizon

As we confront the economic challenges posed by increasingly unpredictable environmental conditions, adaptability becomes our most valuable asset. The financial strategies of tomorrow will be defined by flexibility, technological integration, and a profound understanding of interconnected risk landscapes. The $182 billion disaster narrative of 2024 is more than a statistical report—it's a clarion call for reimagining our approach to financial security in an age of environmental uncertainty.RELATED NEWS

Financial Shakeup: Bank of England Halts Investments and Dividends Amid Fiscal Pressure

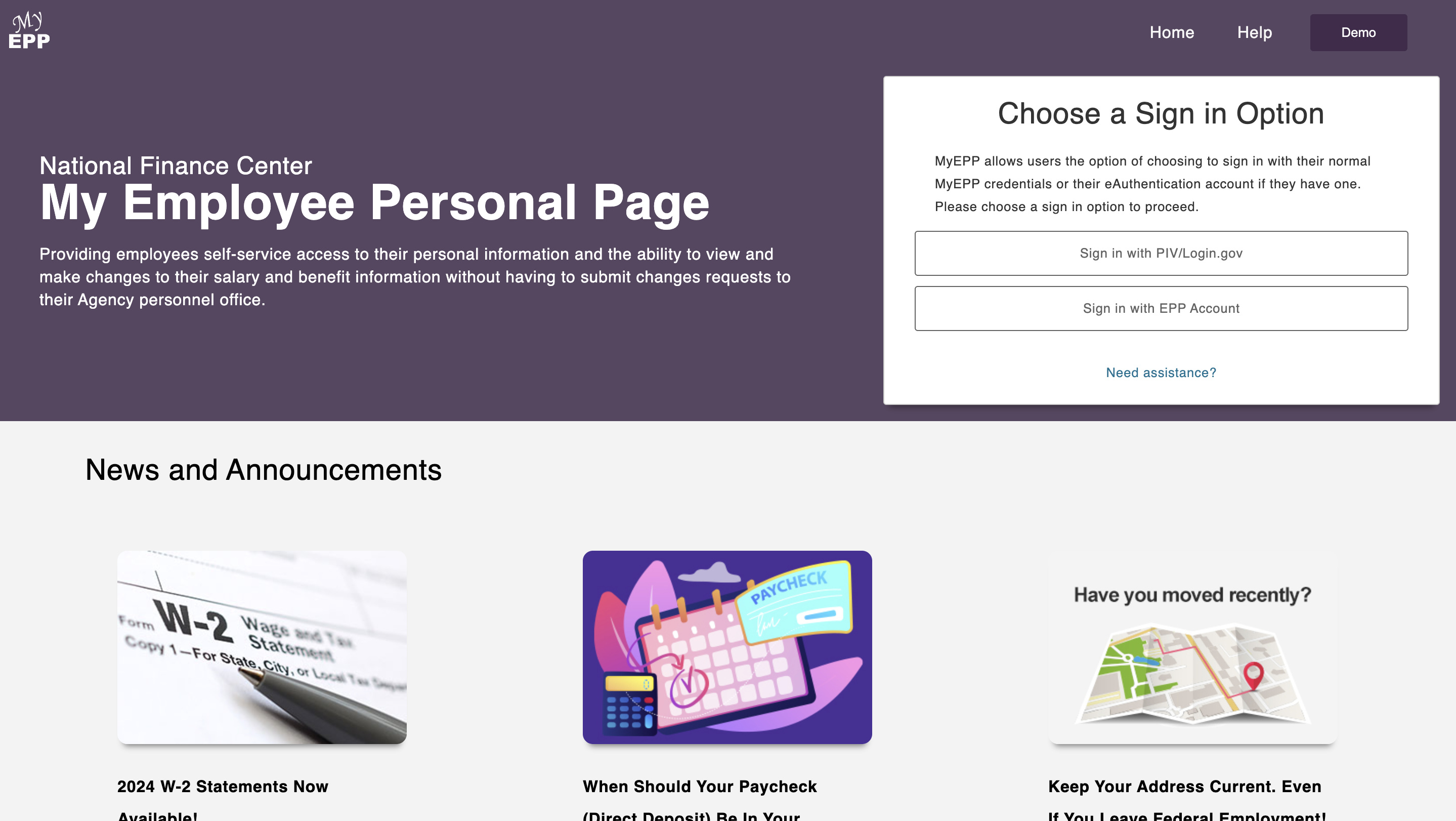

Phishing Scheme Exposes Massive Federal Employee Data Breach at National Finance Center