Putin's Pivot: Trump's Charm Offensive Could Reopen Doors for Western Business

Companies

2025-02-19 18:12:41Content

As diplomatic channels between Moscow and Washington continue to explore potential pathways to peace in Ukraine, global investors are closely watching a critical question: Could the massive corporate exodus from Russia—triggered by the country's invasion in February 2022—potentially be reversed?

The unprecedented wave of international companies withdrawing from the Russian market in protest of the military aggression created a seismic shift in the global economic landscape. Now, with ongoing negotiations and potential diplomatic breakthroughs, businesses are cautiously assessing the possibility of re-entering the Russian market.

The corporate retreat was swift and comprehensive, with multinational giants from technology, finance, retail, and energy sectors quickly distancing themselves from Russian operations. However, the evolving geopolitical dynamics and potential resolution of the conflict might signal a gradual recalibration of corporate strategies.

Investors are keenly monitoring diplomatic discussions, sanctions developments, and potential signs of de-escalation that could pave the way for a strategic corporate re-engagement with the Russian market. The outcome remains uncertain, but the potential for economic reconciliation continues to intrigue global business leaders.

Corporate Exodus from Russia: A Geopolitical Chess Game of Economic Sanctions and Strategic Withdrawal

In the complex landscape of international relations, the corporate response to Russia's invasion of Ukraine has emerged as a pivotal moment in modern economic diplomacy. The unprecedented mass exodus of multinational corporations has created a seismic shift in global business dynamics, challenging traditional notions of economic engagement and political neutrality.Unraveling the Economic Consequences of Principled Corporate Withdrawal

The Anatomy of Corporate Disengagement

The corporate exodus from Russia represents more than a mere business decision; it is a profound statement of global economic solidarity. Hundreds of multinational corporations, ranging from technology giants to consumer brands, have voluntarily suspended operations, sacrificing billions in potential revenue. This unprecedented mass withdrawal demonstrates a collective commitment to international norms and human rights that transcends traditional profit-driven motivations. Companies like Apple, McDonald's, and Microsoft have not only ceased operations but have also written off substantial investments, signaling a transformative approach to corporate social responsibility. The financial implications are staggering, with estimates suggesting that corporate withdrawals have cost international businesses over $100 billion in direct and indirect losses.Geopolitical Implications and Strategic Recalibration

The corporate exodus has emerged as a powerful non-military instrument of diplomatic pressure. By creating significant economic strain, these corporate actions complement governmental sanctions, potentially influencing Russia's strategic calculus. The withdrawal goes beyond symbolic gesture, creating tangible economic consequences that challenge Russia's geopolitical ambitions. International businesses are now reassessing global investment strategies, recognizing the potential risks associated with operating in politically volatile regions. This shift represents a fundamental reevaluation of risk management, where ethical considerations and geopolitical stability are becoming as crucial as traditional financial metrics.Long-Term Economic Repercussions and Global Business Landscape

The Russian corporate exodus is likely to have lasting implications for international business practices. Emerging markets and potential investment destinations will now be scrutinized through a more complex lens, considering not just economic potential but also political stability and ethical considerations. Multinational corporations are developing more sophisticated risk assessment frameworks that integrate geopolitical analysis, human rights considerations, and potential reputational risks. This evolution suggests a more nuanced approach to global business strategy, where economic interests are increasingly aligned with broader ethical and social responsibilities.The Future of Corporate Diplomacy

As negotiations between Moscow and Washington continue, the corporate world stands at a critical juncture. The potential for corporate re-engagement remains uncertain, contingent upon complex diplomatic negotiations and potential resolution of the ongoing conflict. The current situation underscores a transformative moment in global business, where corporations are no longer passive economic entities but active participants in international diplomacy. The decisions made in the coming months will likely set precedents for how businesses navigate complex geopolitical landscapes in the future.RELATED NEWS

Companies

Local Business Boost: UMD's Charlton College Launches Strategic Support for SouthCoast Entrepreneurs

2025-04-06 18:01:57

Companies

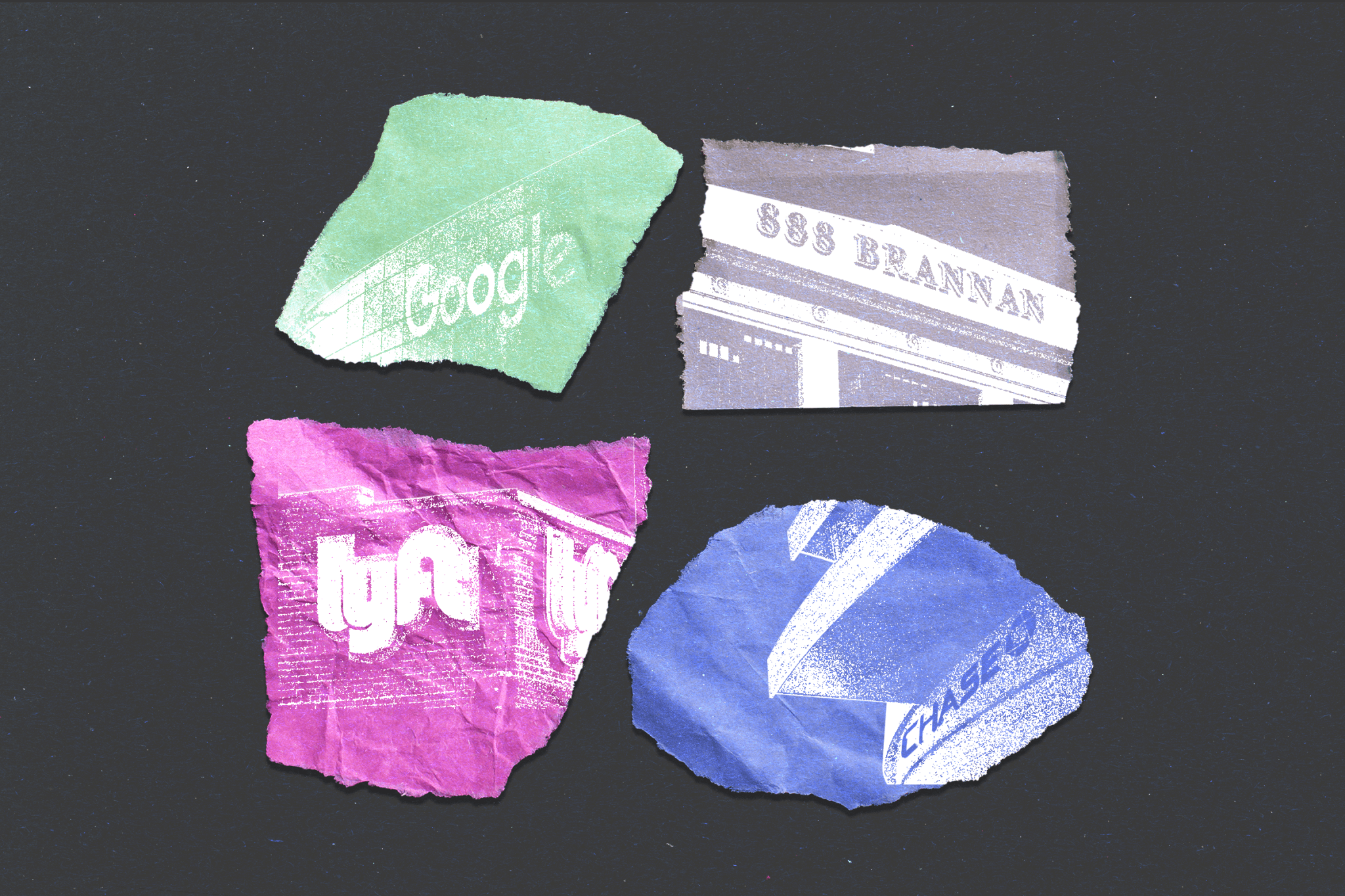

San Francisco's Corporate Comeback: Why Tech Giants Are Reclaiming Their Office Spaces

2025-02-18 19:00:00

Companies

Hunger Crisis Looms: Lender Claims Iowa Firms Threaten 110,000 Pigs with Potential Starvation

2025-04-09 17:06:49