Earnings Growth Goldmine: How Time Finance Crushed the Market Expectations

Finance

2025-03-19 07:38:16Content

Navigating the Investment Landscape: Beyond the Compelling Narrative

In the dynamic world of investing, many newcomers fall into a common trap: becoming captivated by an enticing corporate story and rushing to invest without deeper analysis. While a compelling narrative can be seductive, successful investors understand that a great story alone is not a guarantee of financial success.

Experienced investors know that behind every attractive company pitch lies a complex web of financial metrics, market conditions, and strategic performance. The most prudent approach involves looking beyond the surface-level storytelling and conducting thorough due diligence.

Key considerations should include:

• Comprehensive financial health

• Sustainable business model

• Competitive market positioning

• Management team's track record

• Long-term growth potential

By moving past the initial allure of a persuasive corporate narrative and diving into substantive research, investors can make more informed decisions that align with their financial goals and risk tolerance. Remember, in the investment world, substance trumps style every time.

Navigating the Investment Maze: Unraveling the Secrets of Smart Stock Selection

In the complex world of financial markets, investors face an intricate landscape of opportunities and pitfalls that can make or break their financial futures. The journey of investment is fraught with challenges, requiring a nuanced approach that goes beyond surface-level analysis and emotional decision-making.Unlock the Hidden Strategies of Successful Investors: Your Ultimate Guide to Intelligent Stock Picking

The Psychology of Investment Decision-Making

Investing is far more than a mathematical equation; it's a profound psychological journey that tests an individual's emotional intelligence and rational thinking. Many novice investors fall into the trap of being seduced by compelling narratives and attractive stories surrounding potential investments. The human brain is wired to seek patterns and compelling storylines, which can lead to significant cognitive biases that cloud rational judgment. Successful investors understand that emotional detachment is crucial. They develop a systematic approach that transcends the allure of captivating corporate narratives, focusing instead on fundamental financial metrics, long-term growth potential, and comprehensive market analysis. This requires cultivating a disciplined mindset that can objectively evaluate investment opportunities without being swayed by temporary market sentiments or sensationalized corporate communications.Decoding Financial Fundamentals: Beyond Surface-Level Analysis

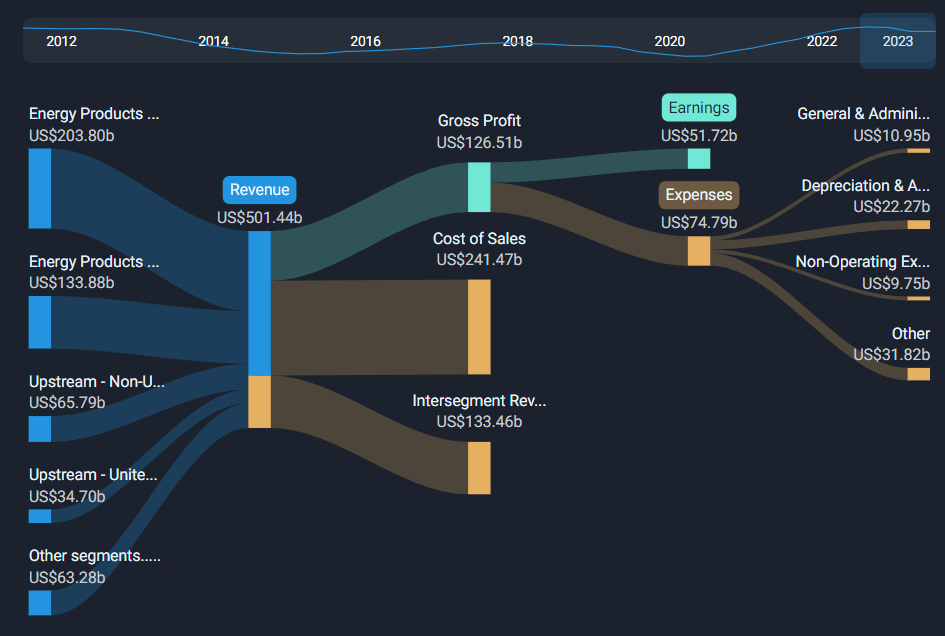

Truly sophisticated investors dig deeper than superficial financial reports. They meticulously examine a company's financial health through multiple lenses, including revenue streams, debt structures, competitive positioning, and potential future growth trajectories. This comprehensive approach involves understanding not just current performance but also potential disruptive technologies, market trends, and macroeconomic factors that could impact long-term value. Financial statements are more than just numbers; they're intricate narratives that reveal a company's strategic direction, operational efficiency, and potential vulnerabilities. Investors must develop the skill to read between the lines, identifying subtle indicators of future performance that aren't immediately apparent to casual observers.Risk Management: The Cornerstone of Intelligent Investing

Risk is an inherent component of any investment strategy, but intelligent investors don't shy away from it—they manage it strategically. Diversification isn't merely about spreading investments across different sectors; it's about creating a robust portfolio that can withstand market volatilities while maintaining potential for growth. Advanced risk management involves continuous monitoring, adaptive strategies, and a willingness to make calculated adjustments. This means understanding correlation between different asset classes, maintaining liquidity, and having a clear exit strategy for each investment. Successful investors treat their portfolios like dynamic ecosystems, constantly evolving and responding to changing market conditions.Technology and Data: The Modern Investor's Competitive Edge

In today's digital age, technology has transformed investment strategies. Sophisticated data analytics, artificial intelligence, and machine learning algorithms provide unprecedented insights into market dynamics. Investors who leverage these technological tools gain a significant competitive advantage, able to process complex information and identify potential opportunities faster than traditional methods. However, technology is a tool, not a replacement for critical thinking. The most successful investors combine technological insights with deep domain knowledge, creating a synergistic approach that balances algorithmic precision with human intuition.Continuous Learning: The Ultimate Investment Strategy

The most valuable asset an investor can develop is not a specific stock or portfolio, but the commitment to continuous learning. Markets evolve, technologies disrupt industries, and global economic landscapes shift rapidly. Investors who remain curious, adaptable, and committed to expanding their knowledge will always have a competitive edge. This means staying informed through diverse sources, attending workshops, engaging with professional networks, and maintaining a humble approach that acknowledges the complexity of financial markets. True mastery in investing comes from recognizing that there's always more to learn and understanding that wisdom is gained through experience, reflection, and an open mind.RELATED NEWS

Finance

Profits Surge: New Mountain Finance Reveals Stellar Year-End Performance for 2024

2025-02-26 21:23:00

Finance

Wall Street Cheers: CVS Health Taps Seasoned Executive to Steer Financial Strategy

2025-04-08 12:24:11

Finance

Market Resilience: Wall Street Brushes Off Setbacks with Surprising Confidence

2025-02-24 20:04:51